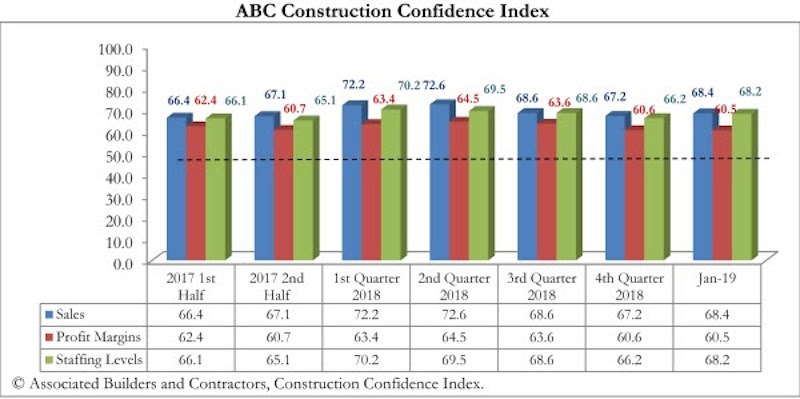

Construction industry leaders remained confident regarding the nonresidential construction sector’s prospects during January 2019, according to the latest Construction Confidence Index recently released by Associated Builders and Contractors.

Expectations for sales during the coming six-month period remained especially upbeat in January, with nearly 70% of respondents anticipating an increase in sales levels. A similar level of confidence characterizes contractors expectations on future staffing levels, with fewer than 7% of contractors indicating expectations of shrinking workforces.

While contractors became fractionally less confident regarding profit margins, more than half of respondents still expect their margins to increase in coming months, while less than 13% expect margins to shrink. All three principal components measured by the survey—sales, profit margins, and staffing levels—remain well above the diffusion index threshold of 50, signaling ongoing expansion in construction activity.

– The CCI for sales expectations increased from 67.2 to 68.4 in January.

– The CCI for profit margin expectations fell from 60.6 to 60.5.

– The CCI for staffing levels increased from 66.2 to 68.2.

“Indications of ongoing confidence in the construction sector have become more important," said ABC Chief Economist Anirban Basu. “Recent dips in consumer and small-business confidence have become a source of concern, as have weak reports regarding employment growth and retail sales. Thankfully, contractors continue to exhibit elevated levels of confidence regarding the near-term trajectory of the economy despite ongoing workforce shortages. Not only do contractors expect to further expand staffing levels, many continue to expect rising profit margins despite rapidly expanding payroll expenses.

“One source of relief has been a recent moderation in construction materials prices,” said Basu. “With the global economy continuing to soften, materials prices should remain well-behaved over the months to come. Investors continue to aggressively seek ways to deploy capital, including on new commercial construction. This helps explain a recent surge in the Architecture Billings Index, another leading indicator that, along with CCI, suggests ongoing economic momentum throughout the first half of 2019.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

[Editor’s note: ABC’s Construction Confidence Index will be reported monthly beginning with January 2019 data. This is the first monthly CCI release.]

Related Stories

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).

Contractors | Mar 12, 2024

The average U.S. contractor has 8.1 months worth of construction work in the pipeline, as of February 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.1 months in February, according to an ABC member survey conducted Feb. 20 to March 5. The reading is down 1.1 months from February 2023.

Market Data | Mar 6, 2024

Nonresidential construction spending slips 0.4% in January

National nonresidential construction spending decreased 0.4% in January, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.190 trillion.

Multifamily Housing | Mar 4, 2024

Single-family rentals continue to grow in BTR communities

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

MFPRO+ News | Mar 2, 2024

Job gains boost Yardi Matrix National Rent Forecast for 2024

Multifamily asking rents broke the five-month streak of sequential average declines in January, rising 0.07 percent, shows a new special report from Yardi Matrix.

K-12 Schools | Feb 29, 2024

Average age of U.S. school buildings is just under 50 years

The average age of a main instructional school building in the United States is 49 years, according to a survey by the National Center for Education Statistics (NCES). About 38% of schools were built before 1970. Roughly half of the schools surveyed have undergone a major building renovation or addition.

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

Student Housing | Feb 21, 2024

Student housing preleasing continues to grow at record pace

Student housing preleasing continues to be robust even as rent growth has decelerated, according to the latest Yardi Matrix National Student Housing Report.

Architects | Feb 21, 2024

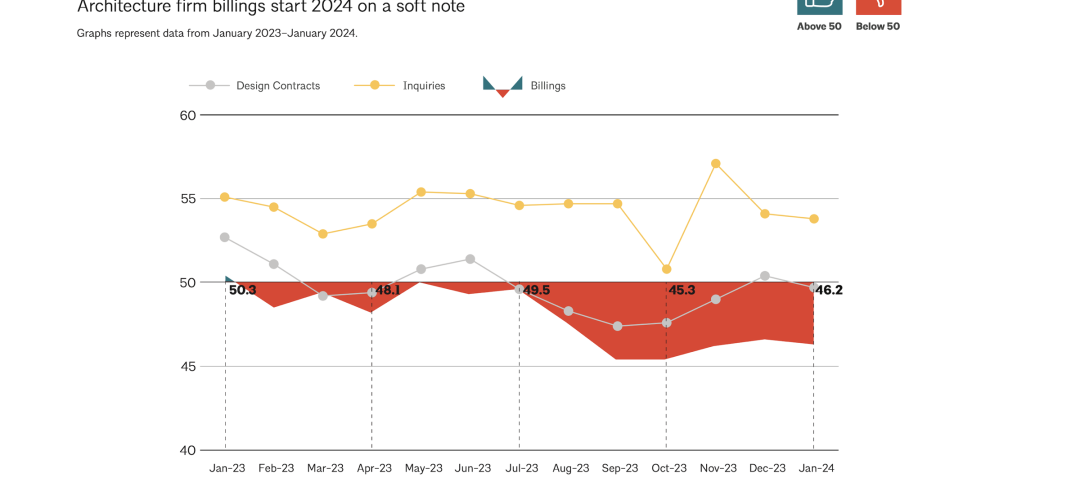

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.