At the end of the second quarter, analysts at Lodging Econometrics (LE) report that the total U.S. construction pipeline stands at 5,312 projects/634,501 rooms, up 7% from 2017’s 4,973 projects/598,371 rooms. The pipeline has been growing moderately and incrementally each quarter and should continue its upward growth trend as long as the economy remains strong. Pipeline totals are still significantly below the all-time high of 5,883 projects/785,547 rooms reached in 2008.

Projects scheduled to start construction in the next 12 months have seen minimal change year-over-year (YOY) with 2,291 projects/266,878 rooms. Projects currently under construction are at 1,594 projects/208,509 rooms, the highest recorded since 2007. This also marks the fourth consecutive quarter that the number of rooms under construction has been over 200,000 units.

Early planning with 1,427 projects/159,114 rooms, saw a 25% increase in projects and 18% increase in rooms YOY. This increase in early planning is typical late cycle activity where developers are anxious to move from the drawing board into the permitting phase prior to any economic slowdown. Many are larger projects that wait for peak operating performance in their markets before seeking financing.

Both the increase in projects under construction and those in the early planning stage are reflective of the urgency developers currently have before the economy softens and/or interest rates further accelerate.

The top five markets with the largest hotel construction pipelines are: New York City with 169 projects/29,365 rooms; Dallas with 156 projects/18, 908 rooms; Houston with 150 projects/16,321 rooms; Nashville with 123 projects/16,392 rooms; and Los Angeles with 121 projects/18,037 rooms.

The five top markets with the most projects currently under construction are New York City with 101 projects/17,108 rooms, Dallas with 47 projects/6,350 rooms, Nashville with 43 projects/7,005 rooms, Houston with 40 projects/4,738 rooms, and Atlanta with 28 projects/3,387 rooms.

In the second quarter, Nashville has the largest number of new projects announced into the pipeline with 13 projects/1,351 rooms, followed by Los Angeles with 12 projects/1,845 rooms, New York City with 11 projects/1,075 rooms, Houston with 11 projects/909 rooms, and Dallas with 10 projects/1,229 rooms. If all of the projects in their pipelines come to fruition, these leading markets will increase their current room supply by: Nashville 38.2%, Austin 29.3%, Fort Worth 28.5%, San Jose 25.3%, and New York City 25.2%.

Hotels forecast to open in 2018 are led by New York City with 45 projects/7,762 rooms, followed by Dallas with 33 projects/ 3,813 rooms, and then Houston with 27 projects/3,114 rooms. In 2019, New York is forecast to again top the list of new hotel openings with 52 projects/7,356 rooms while, at this time, Dallas is anticipated to take the lead in 2020 with 40 projects/4,943 rooms expected to open.

Related Stories

Market Data | Oct 31, 2016

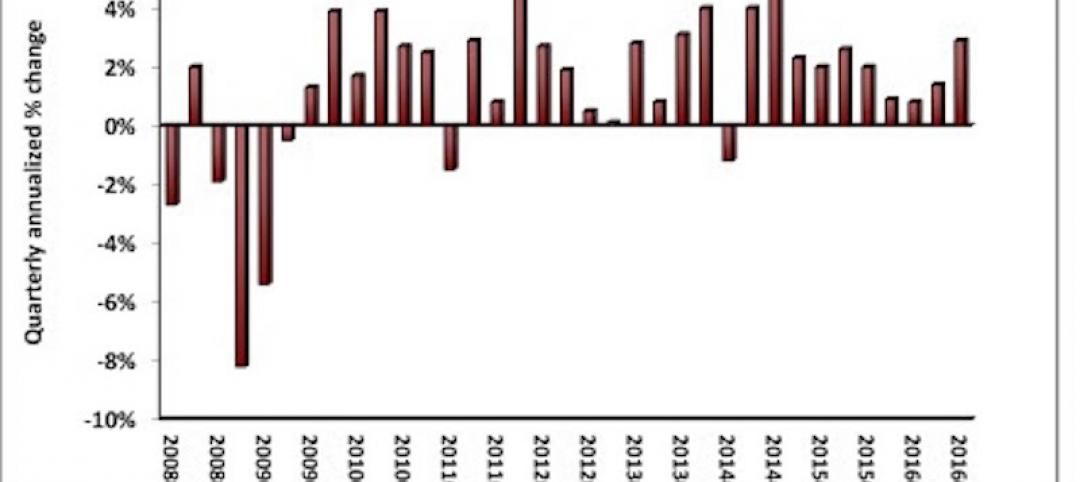

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

High-rise Construction | Oct 21, 2016

The world’s 100 tallest buildings: Which architects have designed the most?

Two firms stand well above the others when it comes to the number of tall buildings they have designed.

Market Data | Oct 19, 2016

Architecture Billings Index slips consecutive months for first time since 2012

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker.

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.