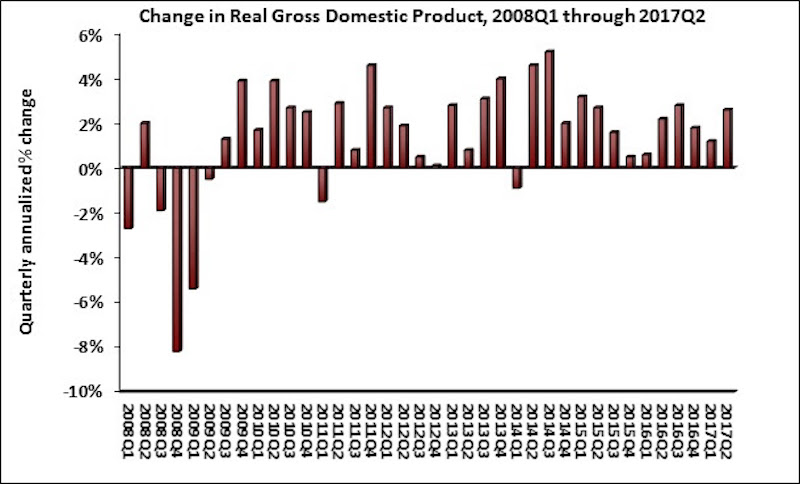

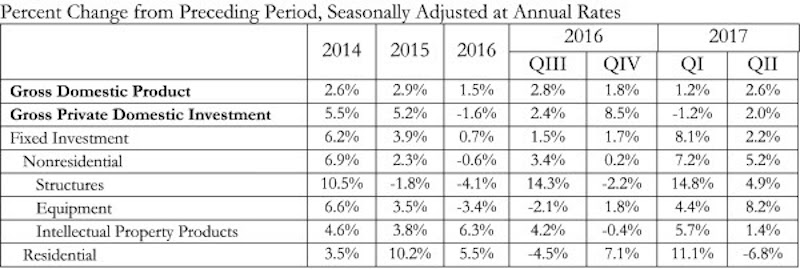

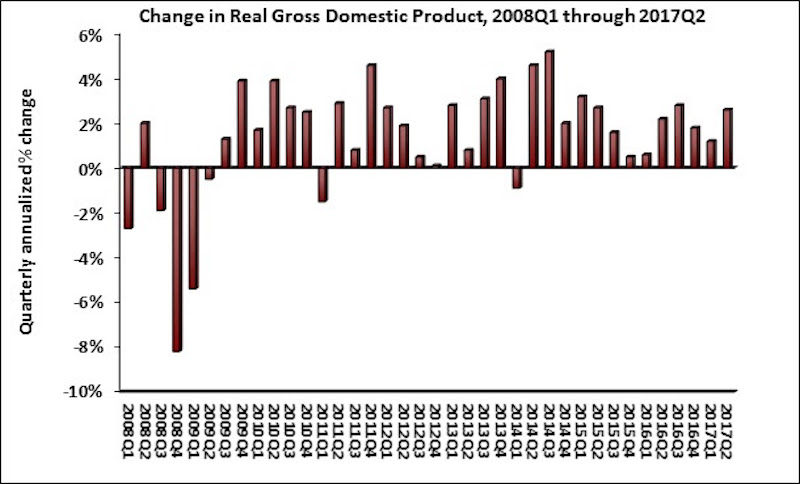

Real gross domestic product (GDP) expanded by 2.6% on a seasonally adjusted annualized basis during the year’s second quarter, according to Associated Builders and Contractors’ analysis of data released today by the Bureau of Economic Analysis. Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate. This follows a 7.2% expansion during the first quarter.

The expansion in nonresidential fixed investment indicates that growth in business outlays continues to support the ongoing economic recovery, now in its ninth year. The expansion of nonresidential fixed investment contributed more than sixth-tenths of a percentage point to GDP growth. This was due in large measure to an uptick in investment in construction equipment. The other two components of nonresidential fixed investment—investment in structures and intellectual property—also expanded, but at a slower pace.

“This was a good report from the perspective of the nation’s nonresidential construction firms, particularly those primarily engaged in private as opposed to public construction,” says ABC Chief Economist Anirban Basu in a release. “The uptick in investment in construction equipment is particularly noteworthy because it signals a general belief that construction activity will continue to recover in America. Backlog among many nonresidential construction firms is already healthy, and today’s report suggests that backlog is not set to decline in any meaningful way anytime soon.

“One might wonder why construction firms remain so busy in an economic environment still characterized by roughly 2 percent growth,” says Basu. “There are many factors at work, including the ongoing boom of the e-commerce economy, which has continued to trigger demand for massive fulfillment and distribution centers even as stores close in massive numbers at America’s malls. The influx of global investment to a number of segments, including hotel and office construction, also helps explain disproportionate growth in certain private categories. With global fixed-income yields remaining so low, investors from around the world, including from the United States, are likely to continue to seek out opportunities for higher rates of return in commercial real estate, which thus far has had the impact of increasing property values and triggering construction.

“For the broader economy to accelerate, policymakers in Washington, D.C., will need to begin to make progress on corporate tax relief and infrastructure,” says Basu.

Related Stories

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.

Market Data | Dec 7, 2015

2016 forecast: Continued growth expected for the construction industry

ABC forecasts growth in nonresidential construction spending of 7.4% in 2016 along with growth in employment and backlog.