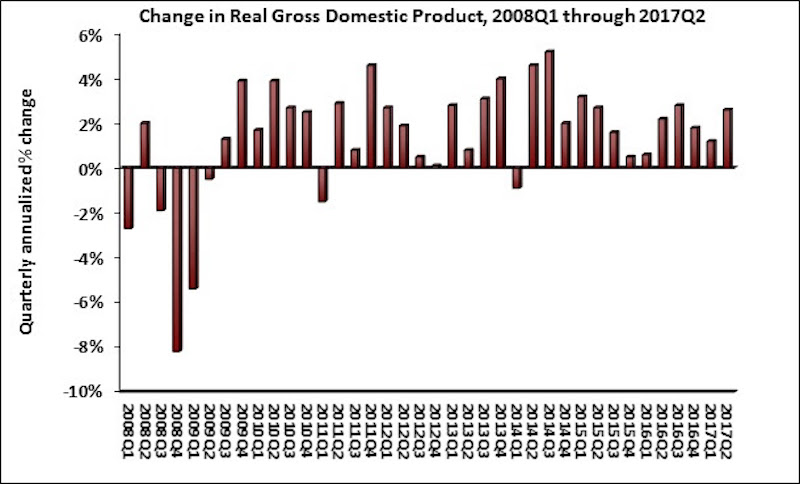

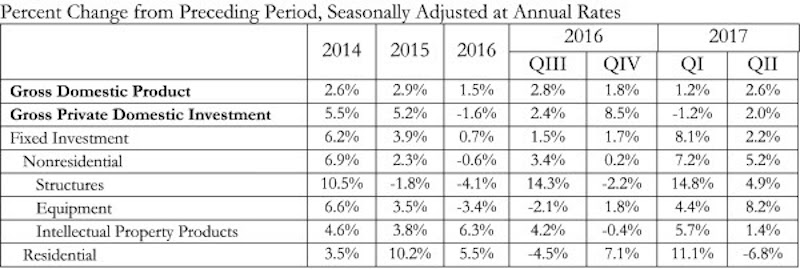

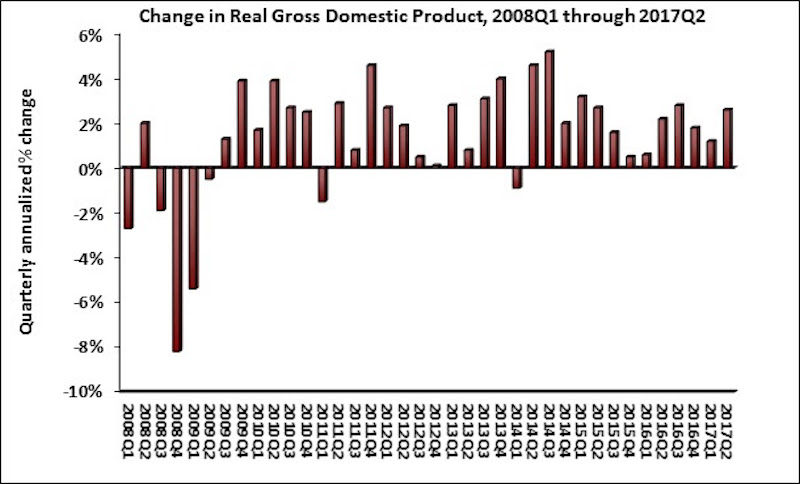

Real gross domestic product (GDP) expanded by 2.6% on a seasonally adjusted annualized basis during the year’s second quarter, according to Associated Builders and Contractors’ analysis of data released today by the Bureau of Economic Analysis. Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate. This follows a 7.2% expansion during the first quarter.

The expansion in nonresidential fixed investment indicates that growth in business outlays continues to support the ongoing economic recovery, now in its ninth year. The expansion of nonresidential fixed investment contributed more than sixth-tenths of a percentage point to GDP growth. This was due in large measure to an uptick in investment in construction equipment. The other two components of nonresidential fixed investment—investment in structures and intellectual property—also expanded, but at a slower pace.

“This was a good report from the perspective of the nation’s nonresidential construction firms, particularly those primarily engaged in private as opposed to public construction,” says ABC Chief Economist Anirban Basu in a release. “The uptick in investment in construction equipment is particularly noteworthy because it signals a general belief that construction activity will continue to recover in America. Backlog among many nonresidential construction firms is already healthy, and today’s report suggests that backlog is not set to decline in any meaningful way anytime soon.

“One might wonder why construction firms remain so busy in an economic environment still characterized by roughly 2 percent growth,” says Basu. “There are many factors at work, including the ongoing boom of the e-commerce economy, which has continued to trigger demand for massive fulfillment and distribution centers even as stores close in massive numbers at America’s malls. The influx of global investment to a number of segments, including hotel and office construction, also helps explain disproportionate growth in certain private categories. With global fixed-income yields remaining so low, investors from around the world, including from the United States, are likely to continue to seek out opportunities for higher rates of return in commercial real estate, which thus far has had the impact of increasing property values and triggering construction.

“For the broader economy to accelerate, policymakers in Washington, D.C., will need to begin to make progress on corporate tax relief and infrastructure,” says Basu.

Related Stories

Market Data | Oct 31, 2016

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

High-rise Construction | Oct 21, 2016

The world’s 100 tallest buildings: Which architects have designed the most?

Two firms stand well above the others when it comes to the number of tall buildings they have designed.

Market Data | Oct 19, 2016

Architecture Billings Index slips consecutive months for first time since 2012

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker.

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.