The US construction & real estate industry saw a drop of 30.4% in overall deal activity during December 2019, when compared with the last 12-month average, according to GlobalData’s deals database.

A total of 48 deals worth $505.11m were announced in December 2019, compared to the 12-month average of 69 deals.

M&A was the leading category in the month in terms of volume with 34 deals which accounted for 70.8% of all deals.

In second place was private equity with 11 deals, followed by venture financing with three transactions, respectively accounting for 22.9% and 6.3% of overall deal activity in the country's construction & real estate industry during the month.

In terms of value of deals, M&A was the leading deal category in the US construction & real estate industry with total deals worth $463.1m, while private equity and venture financing deals totalled $40.21m and $1.8m, respectively.

US construction & real estate industry deals in December 2019: Top deals

The top five construction & real estate industry deals accounted for 99.6% of the overall value during December 2019.

The combined value of the top five construction & real estate deals stood at $503m, against the overall value of $505.11m recorded for the month.

The top five construction & real estate industry deals of December 2019 tracked by GlobalData were:

1. Huntsman's $350m acquisition of Icynene-Lapolla

2. The $92m acquisition of NewSouth Window Solutions by PGT Innovations

3. Accomplice, Insight Partners, JLL Spark Global Venture Fund, Navitas Capital and Pritzker Group Venture Capital's $34.2m venture financing of HqO

4. The $20.8m asset transaction with CBL & Associates Properties by Horizon Group Properties

5. Halogen Ventures, Link Ventures, LLLP, Luma Launch, Rest Seed Fund, Techstars Ventures and Western Technology Investment's venture financing of Trust & Will for $6m.

Related Stories

Industry Research | Aug 11, 2017

NCARB releases latest data on architectural education, licensure, and diversity

On average, becoming an architect takes 12.5 years—from the time a student enrolls in school to the moment they receive a license.

Market Data | Aug 4, 2017

U.S. grand total construction starts growth projection revised slightly downward

ConstructConnect’s quarterly report shows courthouses and sports stadiums to end 2017 with a flourish.

Market Data | Aug 2, 2017

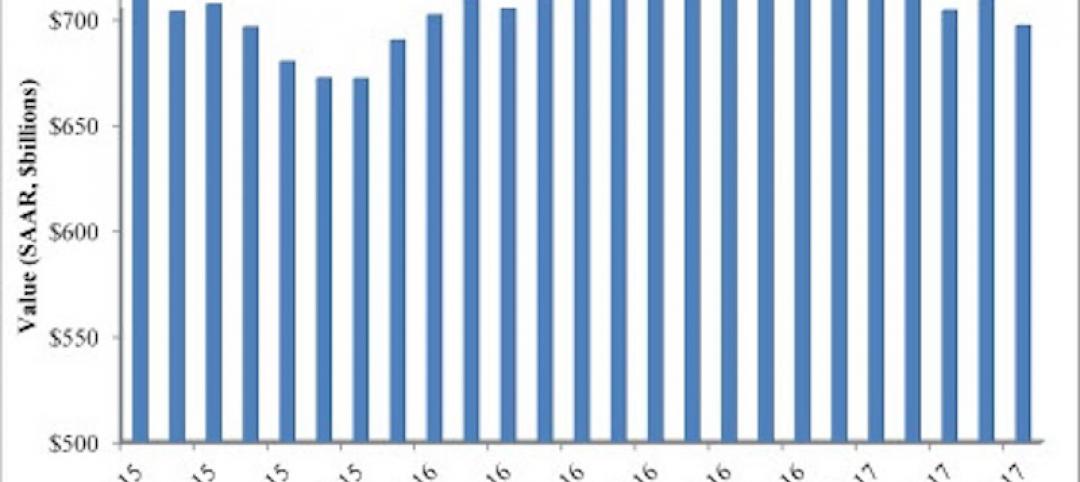

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

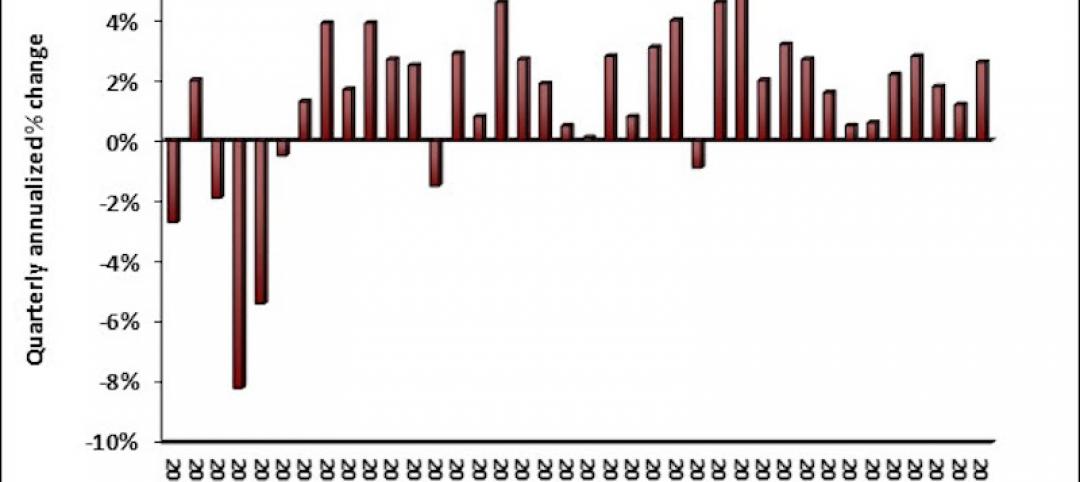

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

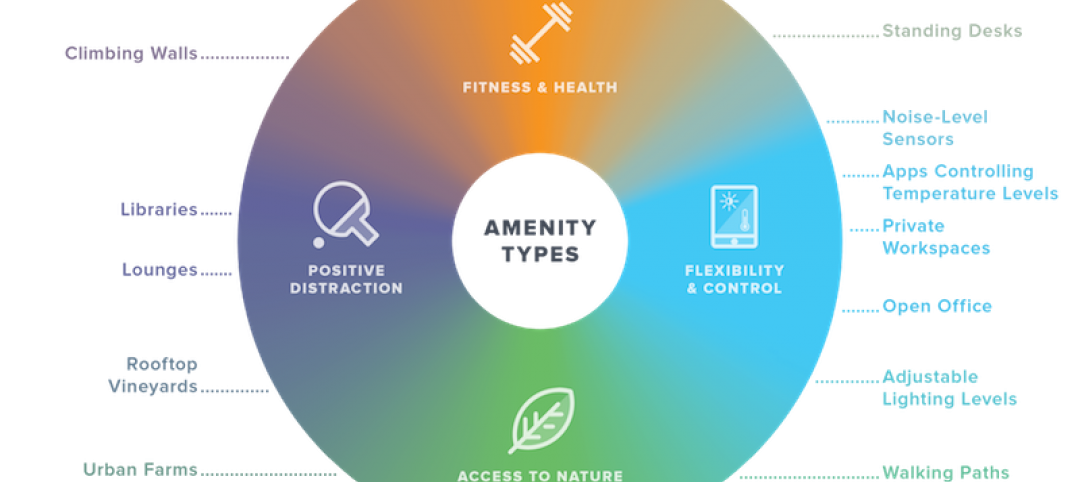

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Market Data | Jun 26, 2017

Construction disputes were slightly less contentious last year

But poorly written and administered contracts are still problems, says latest Arcadis report.