Following President Trump’s signing of the historic Coronavirus Aid, Relief, and Economic Security (CARES) Act, SBA Administrator Jovita Carranza and Treasury Secretary Steven T. Mnuchin announced that the SBA and Treasury Department have initiated a robust mobilization effort of banks and other lending institutions to provide small businesses with the capital they need.

The CARES Act establishes a new $349 billion Paycheck Protection Program. The Program will provide much-needed relief to millions of small businesses so they can sustain their businesses and keep their workers employed.

The new loan program will help small businesses with their payroll and other business operating expenses. It will provide critical capital to businesses without collateral requirements, personal guarantees, or SBA fees – all with a 100% guarantee from SBA. All loan payments will be deferred for six months. Most importantly, the SBA will forgive the portion of the loan proceeds that are used to cover the first eight weeks of payroll costs, rent, utilities, and mortgage interest.

The Paycheck Protection Program is specifically designed to help small businesses keep their workforce employed. Visit http://www.

- The new loan program will be available retroactive from Feb. 15, 2020, so employers can rehire their recently laid-off employees through June 30, 2020.

- Attached are the Payroll Protection Program loan related documents, along with a fact sheet on the program.

Loan Terms & Conditions

- Eligible businesses: All small businesses, including non-profits, Veterans organizations, Tribal concerns, sole proprietorships, self-employed individuals, and independent contractors, with 500 or fewer employees, or no greater than the number of employees set by the SBA as the size standard for certain industries

- Maximum loan amount up to $10 million

- Loan forgiveness if proceeds used for payroll costs and other designated business operating expenses in the 8 weeks following the date of loan origination (due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs)

-

All loans under this program will have the following identical features:

- Interest rate of 0.5%

- Maturity of 2 years

- First payment deferred for six months

- 100% guarantee by SBA

- No collateral

- No personal guarantees

- No borrower or lender fees payable to SBA

SBA’s announcement comes on the heels of a series of steps taken by the Agency since the President’s Emergency Declaration to expeditiously provide capital to financially distressed businesses affected by the Coronavirus (COVID-19) pandemic.

Related Stories

Coronavirus | Jul 20, 2020

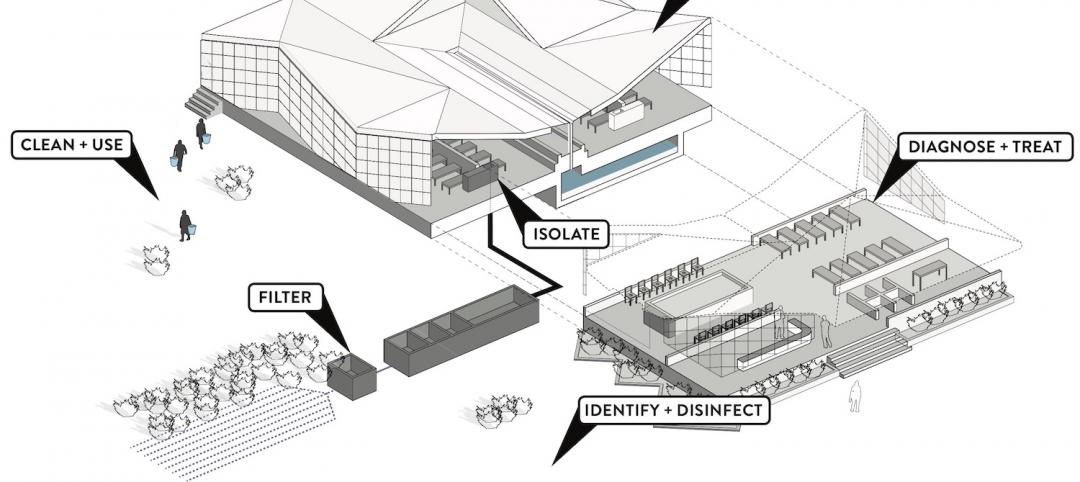

Student housing amid the pandemic, infection control in buildings, and future airport design on "The Weekly"

Experts from Core Spaces, Bala Consulting Engineers, and Populous were interviewed in the July 23 streaming program from Horizon TV.

Coronavirus | Jul 17, 2020

Never waste a crisis

The coronavirus outbreak has provided numerous lessons for AEC firms.

Coronavirus | Jul 17, 2020

The Weekly show: What 40K workers have to say about WFH, and design in the digital age

This week on The Weekly, BD+C editors spoke with leaders from Cushman & Wakefield, HMC Architects, and HOK on three timely topics.

Coronavirus | Jul 14, 2020

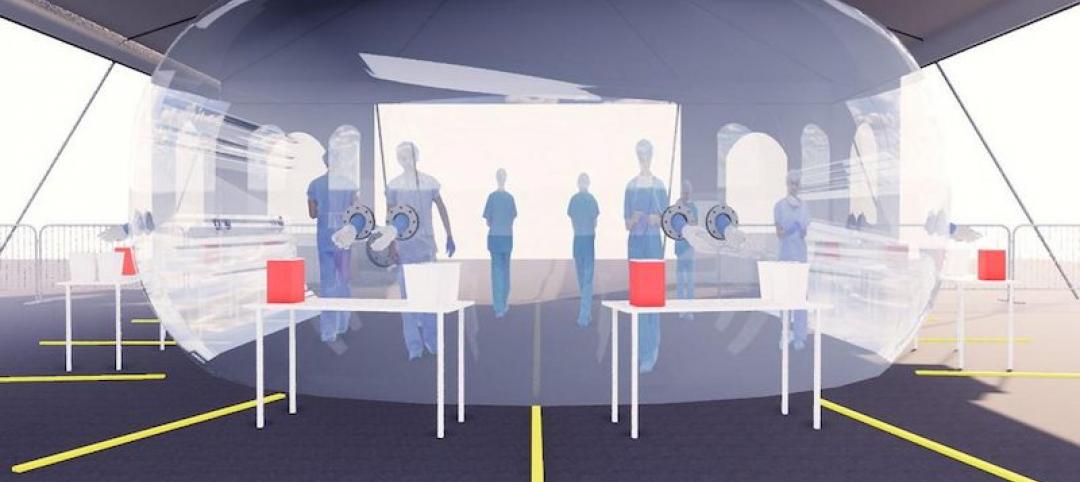

Is there a way to test for Covid-19 without PPE?

We developed a unique design concept: a testing booth that allows healthcare workers to administer tests without using PPE or being exposed.

Coronavirus | Jul 13, 2020

4 technologies for improving building sanitization in a post-pandemic society

Changes in building design and operations can drastically improve public health and safety.

Coronavirus | Jul 10, 2020

HOK, Cushman & Wakefield, and HMC Architects hold sway on July 16 "The Weekly"

“The Weekly,” a new streaming program for the commercial design and construction industry, to feature experts from HOK, Cushman & Wakefield, and HMC Architects. Tune in July 16 for insight on social media and interior design, the future of the workplace, and healthcare design after COVID-19.

Coronavirus | Jul 10, 2020

The Weekly show: Carbon-fiber reinforced concrete buildings and back to campus amid COVID-19

The July 9 episode of BD+C's "The Weekly" is available for viewing on demand.

Coronavirus | Jul 1, 2020

Are hospitals prepared for the next pandemic?

Caught off guard by COVID-19, healthcare systems take stock of the capacity and preparedness.

Coronavirus | Jun 30, 2020

The great reset and our new work life

As many countries begin to return to the office, it’s a chance to ask ourselves: what do we truly value?

Coronavirus | Jun 26, 2020

Infection control in buildings in the age of the coronavirus

Controlling future infection spreads could become job one for most buildings and spaces.