Following President Trump’s signing of the historic Coronavirus Aid, Relief, and Economic Security (CARES) Act, SBA Administrator Jovita Carranza and Treasury Secretary Steven T. Mnuchin announced that the SBA and Treasury Department have initiated a robust mobilization effort of banks and other lending institutions to provide small businesses with the capital they need.

The CARES Act establishes a new $349 billion Paycheck Protection Program. The Program will provide much-needed relief to millions of small businesses so they can sustain their businesses and keep their workers employed.

The new loan program will help small businesses with their payroll and other business operating expenses. It will provide critical capital to businesses without collateral requirements, personal guarantees, or SBA fees – all with a 100% guarantee from SBA. All loan payments will be deferred for six months. Most importantly, the SBA will forgive the portion of the loan proceeds that are used to cover the first eight weeks of payroll costs, rent, utilities, and mortgage interest.

The Paycheck Protection Program is specifically designed to help small businesses keep their workforce employed. Visit http://www.

- The new loan program will be available retroactive from Feb. 15, 2020, so employers can rehire their recently laid-off employees through June 30, 2020.

- Attached are the Payroll Protection Program loan related documents, along with a fact sheet on the program.

Loan Terms & Conditions

- Eligible businesses: All small businesses, including non-profits, Veterans organizations, Tribal concerns, sole proprietorships, self-employed individuals, and independent contractors, with 500 or fewer employees, or no greater than the number of employees set by the SBA as the size standard for certain industries

- Maximum loan amount up to $10 million

- Loan forgiveness if proceeds used for payroll costs and other designated business operating expenses in the 8 weeks following the date of loan origination (due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs)

-

All loans under this program will have the following identical features:

- Interest rate of 0.5%

- Maturity of 2 years

- First payment deferred for six months

- 100% guarantee by SBA

- No collateral

- No personal guarantees

- No borrower or lender fees payable to SBA

SBA’s announcement comes on the heels of a series of steps taken by the Agency since the President’s Emergency Declaration to expeditiously provide capital to financially distressed businesses affected by the Coronavirus (COVID-19) pandemic.

Related Stories

Coronavirus | May 7, 2020

White paper clarifies steps, roles for use of metal composite material

Responsibilities of manufacturers, distributors, and fabricators outlined.

Coronavirus | May 7, 2020

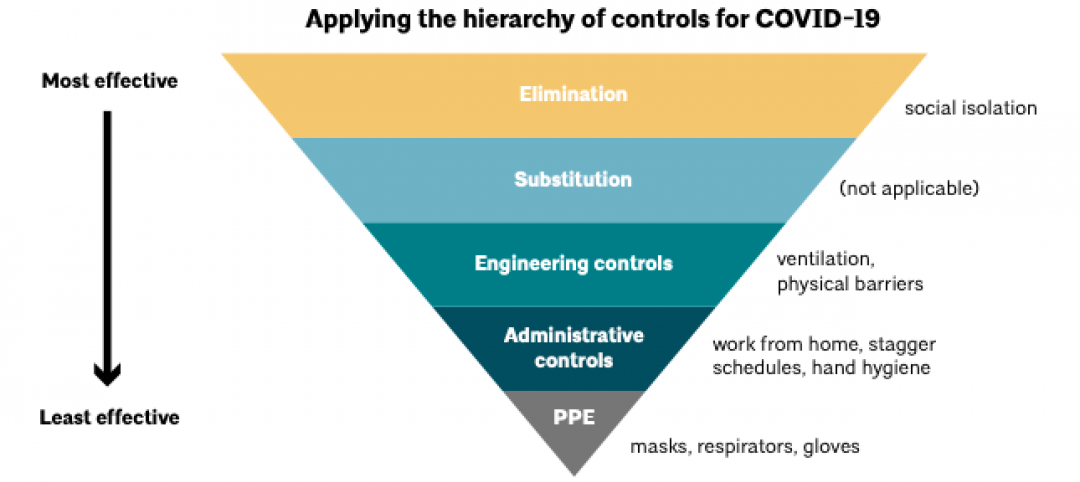

Architects release new resource for safer re-occupancy of buildings

The American Institute of Architects (AIA) is releasing a new Re-occupancy Assessment Tool today that provides strategies for limiting exposure to COVID-19 in buildings.

Coronavirus | May 6, 2020

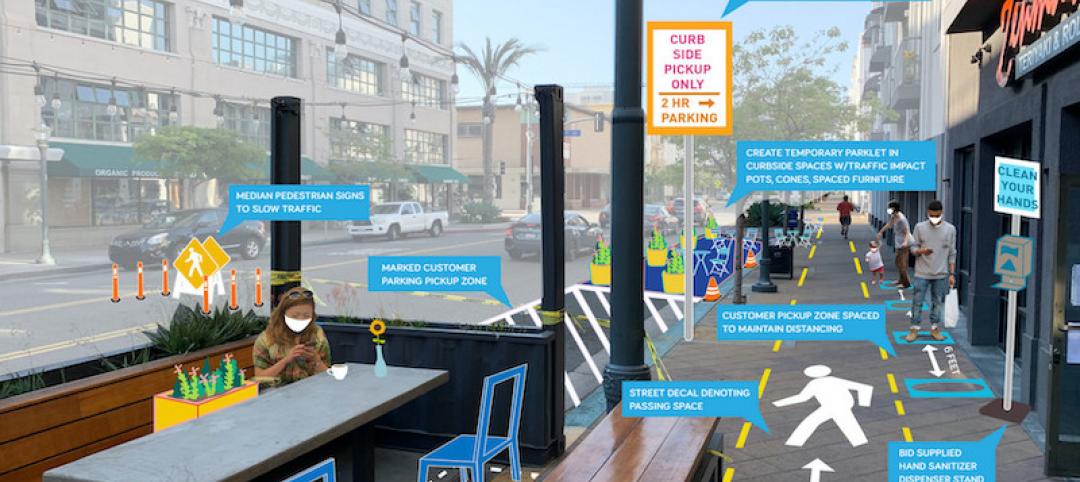

Reopening Main Street post-COVID-19 quarantine

Cities and communities will need to adjust public space to allow customers back in with distancing in mind.

Coronavirus | May 6, 2020

Making jobsites safer in the COVID-19 world

A leading construction manager and installer certification alliance share their insights.

Coronavirus | May 6, 2020

National Construction Association and Procore to release new data showing the impacts of the coronavirus on the constructionindustry

Data will be released on Friday, may 8 at 12 pm EDT.

Healthcare Facilities | May 5, 2020

Holt Construction, U.S. Army Corps of Engineers complete temporary hospital in two weeks

The project is located in Paramus, N.J.

Coronavirus | May 5, 2020

How will COVID-19 change the procurement of professional design services?

We can use this moment as a test-case to build greater flexibility into how we pursue, win and deliver capital projects, better preparing the industry to meet the next disruption.

Coronavirus | May 4, 2020

Design steps for reopening embattled hotels

TPG Architecture recommends post-coronavirus changes in three stages.

Coronavirus | Apr 30, 2020

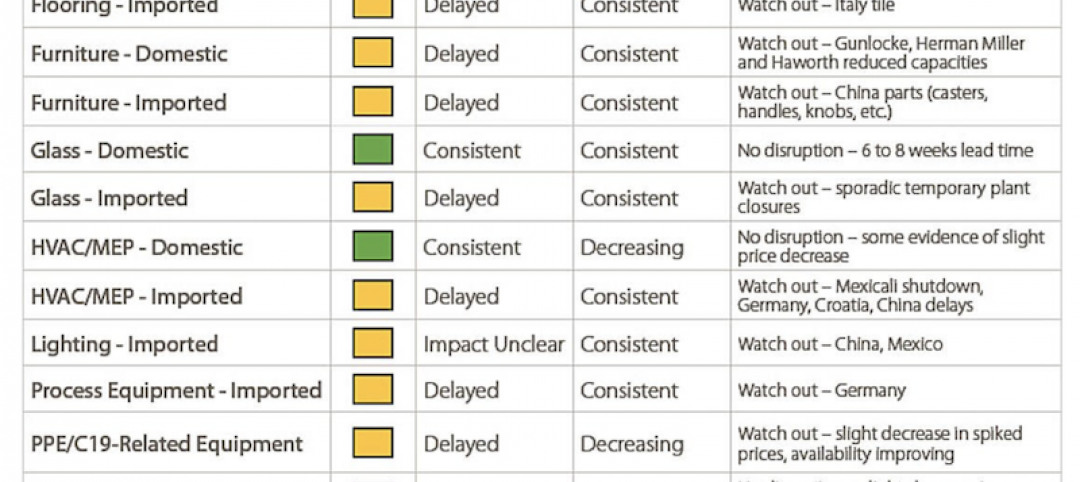

Gilbane shares supply-chain status of products affected by coronavirus

Imported products seem more susceptible to delays

Coronavirus | Apr 26, 2020

PCL Construction rolls out portable coronavirus testing centers

The prefabricated boxes offer walk-up and drive-thru options.