Another round of steep price increases and supply-chain disruptions are wreaking hardships on contractors, driving up construction costs and slowing projects, according to an analysis by the Associated General Contractors of America of government data released today. The data comes a day after the association released a new survey showing materials delays and price increases are affecting most contractors. Association officials urged the Biden administration to end a range of trade tariffs in place, including for Canadian lumber, that are contributing to the price increases, and to help uncork supply-chain bottlenecks.

“Both today’s producer price index report and our survey results show escalating materials costs and lengthening delivery times are making life difficult for contractors and their customers, including hospitals, schools, and other facilities needed to get the economy back on track,” said Ken Simonson, the association’s chief economist. “Project owners and budget officials should anticipate that projects will cost more and have longer—perhaps uncertain—completion times, owing to these circumstances that contractors cannot control.”

Prices for materials and services used in construction and contractors’ bid prices both declined at the beginning of the pandemic but have diverged sharply since last April, Simonson said. A government index that measures the selling price for materials and services used in new nonresidential construction jumped 1.9% from January to February and 12.8% since April 2020. Meanwhile, the producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—increased only 0.3% last month and 0.5% in the 10 months since April.

“The nearly 1500 contractors who responded to our survey overwhelmingly reported rising costs, shortages, and delays in receiving needed materials, parts, and supplies,” Simonson added. “Eighty-five% of respondents said their costs for these items have risen in the past year, and a majority—58%—reported projects were taken longer than before the pandemic struck. This situation will intensify the cost squeeze apparent in the producer price index data.”

Association officials called on the president to remove tariffs on key construction materials, including steel and lumber. They also urged Washington officials to look at ways to address supply chain problems by making it easier for Canadian materials to enter the country and exploring regulatory measures to increase shipping capacity. They noted that construction firms are already absorbing the costs associated with protecting workers from the pandemic, and that materials price spikes and shipping delays are making it harder for firms to cope.

“Contractors are caught between a pandemic market that isn’t willing to pay more for projects and materials prices that continue to spike even as delivery schedules become less reliable,” said Stephen E. Sandherr, the association’s chief executive officer. “Construction firms won’t be able to thrive if rising materials prices continue to shrink already pressured profit margins.”

View producer price index data. View chart of gap between input costs and bid prices. View AGC’s survey.

Related Stories

Market Data | Nov 30, 2016

Marcum Commercial Construction Index reports industry outlook has shifted; more change expected

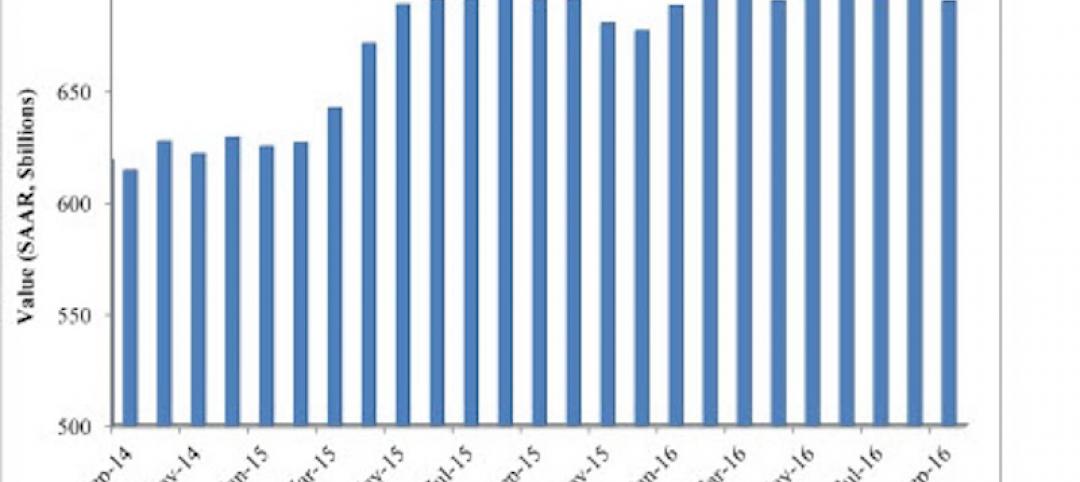

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier.

Industry Research | Nov 30, 2016

Multifamily millennials: Here is what millennial renters want in 2017

It’s all about technology and convenience when it comes to the things millennial renters value most in a multifamily facility.

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Multifamily Housing | Nov 28, 2016

Axiometrics predicts apartment deliveries will peak by mid 2017

New York is projected to lead the nation next year, thanks to construction delays in 2016

Market Data | Nov 22, 2016

Construction activity will slow next year: JLL

Risk, labor, and technology are impacting what gets built.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Nov 11, 2016

Brand marketing: Why the B2B world needs to embrace consumers

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.

Market Data | Nov 2, 2016

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.