PwC's latest quarterly analysis reported that the worldwide engineering and construction industries closed 218 merger and acquisition deals in 2014 worth more than $172 billion. The numbers are more than three times greater than 2013's total of $55 billion. Last year was the busiest year for M&A activity since 2007.

There were four mega deals in the fourth quarter of 2014, including one valued at $35 billion. Overall, there were 21 mega deals last year, totaling $127 billion. The greatest number of deals took place in Asia and Oceania.

“Some of the significant year-over-year growth in M&A activity can be attributed to companies seeking to better position themselves for mega projects that not only require a longer commitment of time and capital, but also deeper pools of highly skilled talent,” said H. Kent Goetjen, U.S. engineering and construction leader at PwC. “The lack of available talent, which is being fueled in the U.S. by the retirement of the baby boomer generation, is driving up the price of acquisitions and will continue to do so for the foreseeable future.”

PwC analysts are monitoring several other trends that are expected to affect the values and locations of deals in the engineering and construction sector, including:

• The integration of design and consultancy firms with construction companies is well under way as the E&C industry continues to move toward full service integration. Firms are generally looking to leverage higher-value added services, such as design, while balancing out their regional exposure.

• A major driver of consolidation is talent needs, as companies compete for specialized technical expertise in high-demand segments. As an alternative to acquiring expertise, some companies are embarking upon joint ventures, but these are complicated and add significant operational risk to any project. Companies are positioning themselves to bid on larger, increasingly complex projects with new partners and non-traditional sources of funding.

• A flurry of smaller, local deals took place, particularly within Asia. Cross-border activity dropped to 22% of the total in the quarter, with most local activity occurring in Asia.

• Cement oversupply and tepid demand continue to plague the industry. Top players, in an attempt to maintain their market share and margin, continue to acquire smaller companies post-merger announcement of Holcim and Lafarge.

• The consolidation in Asia was not limited to the construction materials segment, and not all driven by overcapacity, as all segments of E&C experienced a pick-up in local consolidation. The uncertain economic outlook in China raises many concerns for inbound activity in Asia but does not seem to be hindering deal activity in the region.

Related Stories

Giants 400 | Feb 8, 2024

Top 40 Performing Arts Center and Concert Venue Engineering Firms for 2023

KPFF Consulting Engineers, Morrison Hershfield, ME Engineers, Thornton Tomasetti, and Arup top BD+C's ranking of the nation's largest performing arts center and concert venue engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 40 Museum Engineering Firms for 2023

Arup, KPFF Consulting Engineers, Alfa Tech Consulting Engineers, Kohler Ronan, and Thornton Tomasetti top BD+C's ranking of the nation's largest museum and gallery engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

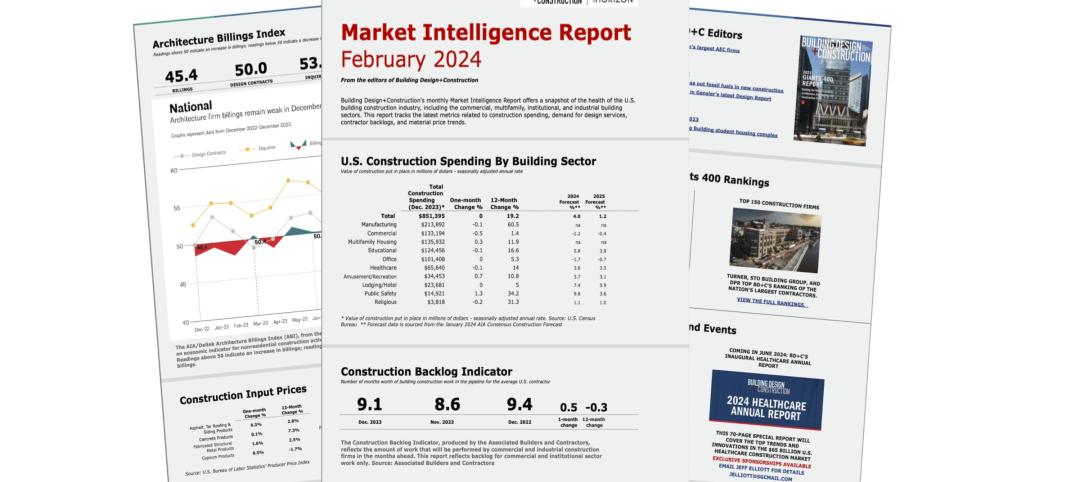

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

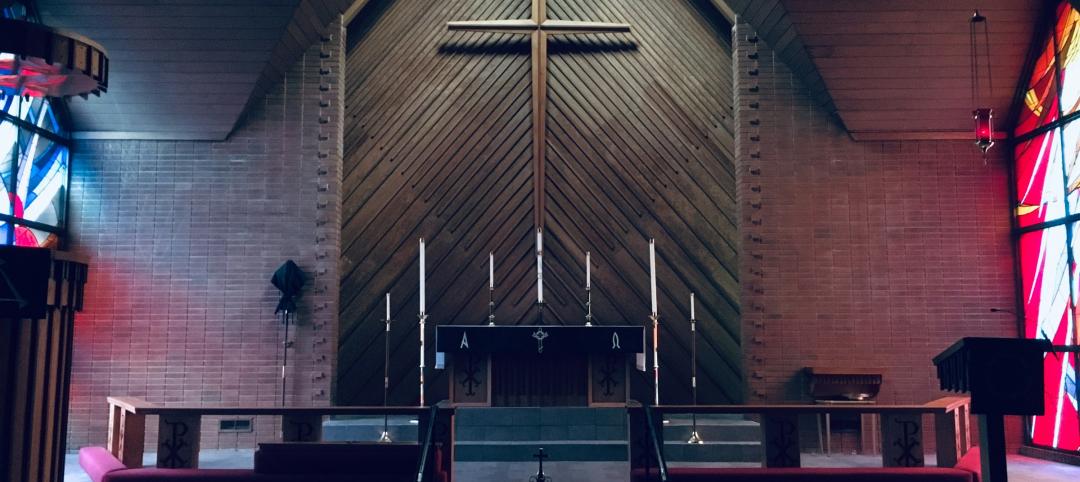

Religious Facilities | Feb 6, 2024

Top 50 Religious Facility Engineering Firms for 2023

KPFF Consulting Engineers, Wiss, Janney, Elstner Associates, Langan, Kimley-Horn, and Morrison Hershfield top BD+C's ranking of the nation's largest religious facility engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Feb 5, 2024

Top 40 Entertainment Center, Cineplex, and Theme Park Engineering Firms for 2023

Kimley-Horn, EXP, BRPH Companies, and Alfa Tech Consulting Engineers top BD+C's ranking of the nation's largest entertainment center, cineplex, and theme park engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Feb 5, 2024

Top 60 Shopping Mall, Big Box Store, and Strip Center Engineering Firms for 2023

Kimley-Horn, Henderson Engineers, Jacobs, WSP, and Wallace Design Collective top BD+C's ranking of the nation's largest shopping mall, big box store, and strip center engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Feb 1, 2024

Top 40 Restaurant Engineering Firms for 2023

Kimley-Horn, NV5 Global, Langan, RTM Engineering Consultants, and Henderson Engineers top BD+C's ranking of the nation's largest restaurant engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Standards | Feb 1, 2024

Prioritizing water quality with the WELL Building Standard

In this edition of Building WELLness, DC WELL Accredited Professionals Hannah Arthur and Alex Kircher highlight an important item of the WELL Building Standard: water.

Giants 400 | Jan 29, 2024

Top 80 Office Core and Shell Engineering Firms for 2023

Jacobs, WSP, Alfa Tech Consulting Engineers, Thornton Tomasetti, and Burns & McDonnell top BD+C's ranking of the nation's largest office core and shell engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 29, 2024

Top 50 Workplace Interior Engineering Firms for 2023

AECOM, Jacobs, Alfa Tech Consulting Engineers, Tetra Tech High Performance Buildings Group, and IMEG top BD+C's ranking of the nation's largest workplace interior and interior fitout engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.