A recent poll of healthcare providers found that 85% agree that most patients will not require an in-person physician evaluation by 2021. Virtual doctor visits will be common, smartphones and wearable sensors will be used widely to record a patient’s health information, and patients will have greater access to self-serving their health needs via technology equipped unmanned kiosks.

These are some of the predictions from the Mortenson Leadership Series Healthcare Study, the construction firm’s fourth in the last six years. The study is based on a poll of more than 900 healthcare professionals, facilities leaders, and architects who support them, conducted during last year’s ASHE Planning, Design, and Construction Summit.

While most of the study’s findings weren’t surprising, they confirm trends about Millennials’ healthcare expectations, how and where healthcare institutions will be investing, the role of technology in healthcare, and what roadblocks might lie ahead for project management.

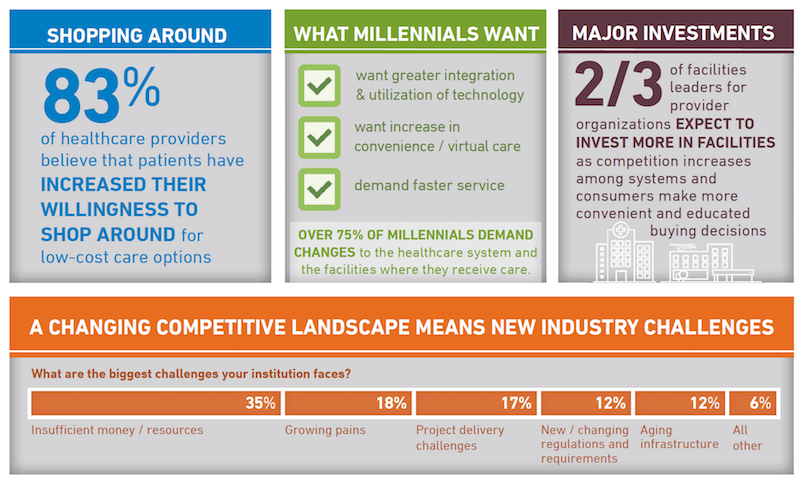

Millennials' preferences for how they receive healthcare are having a major impact on how health systems are investing. Image: Mortenson

One thing is certain: patients are taking more ownership of their health. Eighty-three percent of the healthcare providers polled observe that patients are far more willing these days to shop for lower-cost care options. By 2021, 85% predict that providers will screen patients first to guide them to the appropriate treatment. And that won’t necessarily be toward a medical office or clinic.

One of the biggest disparities between the 2018 and 2015 surveys was the responses to the question about how common virtual doctors would be in three years’ time. Last year, 88% responded to this question affirmatively, compared to 63% in 2015. And 85% in the 2018 surveyed participants thought that most patients don’t require an in-person physician evaluation, versus 49% in 2015.

As one 2018 respondent noted, “Millennials expect immediate access. This access will drive how we design facilities as well as garner a new age of telehealth.” Two-fifths of healthcare providers and architects mentioned that virtual telemedicine and self-service treatments would be typical delivery care within the next decade, with much less reliance on physical structures to deliver goods and services.

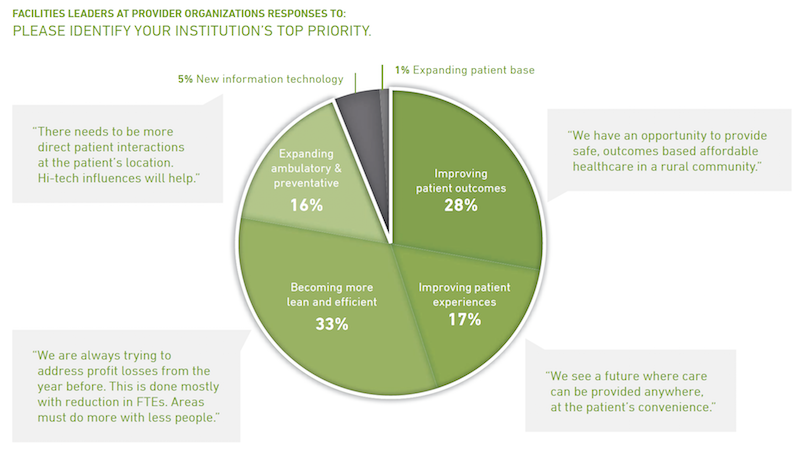

Healthcare facilities managers say their institutions must become leaner to grapple with insufficient project resources. Many see opportunities in reducing waste and energy consumption. Image: Mortenson

More than two-fifths (44%) of architects polled also said that Millennials’ expectations about the need for more integration and utilization of technology is impacting healthcare and its facilities, followed by 22% who cited the demand for convenience and virtual care. “Less acute, more ambulatory. Less invasive procedures. More virtual … diagnosis and treatments,” stated one respondent.

Two thirds of facilities leaders polled said that their institutions would invest more over the next two to three years. But 35% added that their biggest challenge continues to be insufficient money and resources (including receiving adequate payments for services rendered), followed by “growing pains” (18%) and project delivery (17%).

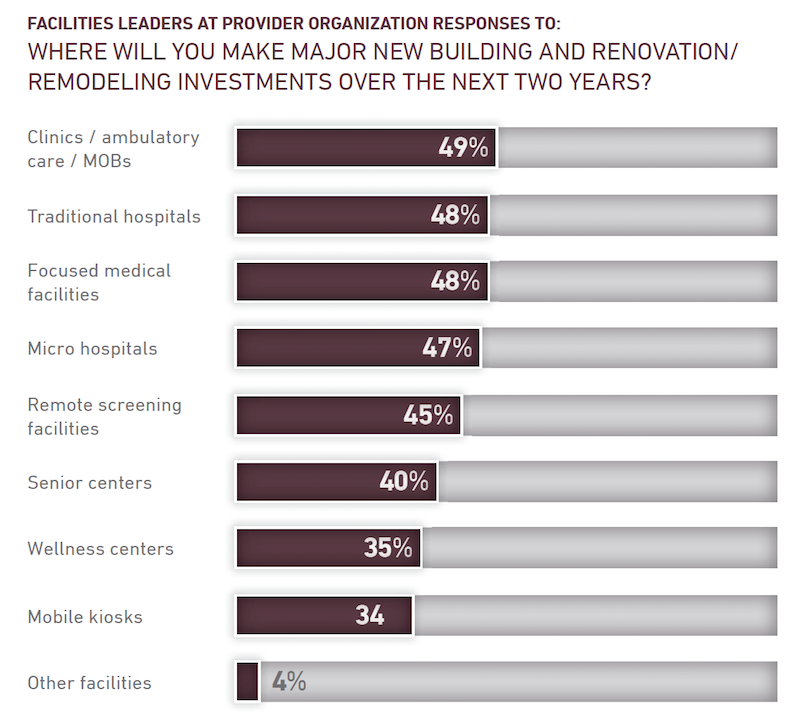

Nearly half of facilities leaders polled say their healthcare systems continue to invest in clinics, ambulatory care centers, and medical offices. Image: Mortenson

Nearly all of the facilities leaders see significant opportunities to eliminate waste and reduce energy use.

Despite all of speculation about virtual care expressed in the study, 49% of facilities leaders said their institutions would be making major investments in clinics, ambulatory care, and MOBs, followed by traditional hospitals and focused medical facilities (48% each), microhospitals (47%), and remote screening facilities (45%).

The respondents were evenly split about how much their institutions might spend over the next two years, with 33% each projecting moderate, substantial, or flat growth.

The study includes a section about the Affordable Care Act. Fewer respondents in 2018 than in 2015 thought the legislation had done enough to address the country’s long-term healthcare needs. And between 94% and 97% of those polled last year said that the Act still needed “significant changes or revisions,” had created uncertainty for their institutions, and had challenged their organization’s near-term financial condition.

Related Stories

| Aug 11, 2010

Perkins+Will master plans Vedanta University teaching hospital in India

Working together with the Anil Agarwal Foundation, Perkins+Will developed the master plan for the Medical Precinct of a new teaching hospital in a remote section of Puri, Orissa, India. The hospital is part of an ambitious plan to develop this rural area into a global center of education and healthcare that would be on par with Harvard, Stanford, and Oxford.

| Aug 11, 2010

Turner Building Cost Index dips nearly 4% in second quarter 2009

Turner Construction Company announced that the second quarter 2009 Turner Building Cost Index, which measures nonresidential building construction costs in the U.S., has decreased 3.35% from the first quarter 2009 and is 8.92% lower than its peak in the second quarter of 2008. The Turner Building Cost Index number for second quarter 2009 is 837.

| Aug 11, 2010

AGC unveils comprehensive plan to revive the construction industry

The Associated General Contractors of America unveiled a new plan today designed to revive the nation’s construction industry. The plan, “Build Now for the Future: A Blueprint for Economic Growth,” is designed to reverse predictions that construction activity will continue to shrink through 2010, crippling broader economic growth.

| Aug 11, 2010

PCL Construction, HITT Contracting among nation's largest commercial building contractors, according to BD+C's Giants 300 report

A ranking of the Top 50 Commercial Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Webcor, Hunt Construction lead the way in mixed-use construction, according to BD+C's Giants 300 report

A ranking of the Top 30 Mixed-Use Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Report: Fraud levels fall for construction industry, but companies still losing $6.4 million on average

The global construction, engineering and infrastructure industry saw a significant decline in fraud activity with companies losing an average of $6.4 million over the last three years, according to the latest edition of the Kroll Annual Global Fraud Report, released today at the Association of Corporate Counsel’s 2009 Annual Meeting in Boston. This new figure represents less than half of last year’s amount of $14.2 million.

| Aug 11, 2010

Jacobs, HDR top BD+C's ranking of the nation's 100 largest institutional building design firms

A ranking of the Top 100 Institutional Design Firms based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Nonprofit healthcare providers turn to real estate for liquidity and to preserve capital, says Jones Lang LaSalle report

Long considered to be stable investments immune to recession, hospitals and other healthcare facilities are now feeling the effects of a cash-strapped economy as decreased charitable contributions are forcing nonprofit hospitals to pare back and seek new financing sources, according to Jones Lang LaSalle’s 2009 Healthcare Real Estate Financing Outlook.