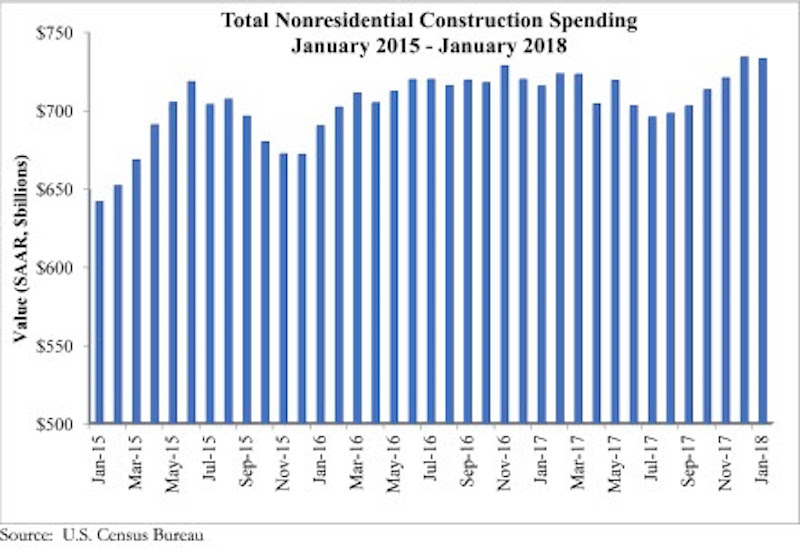

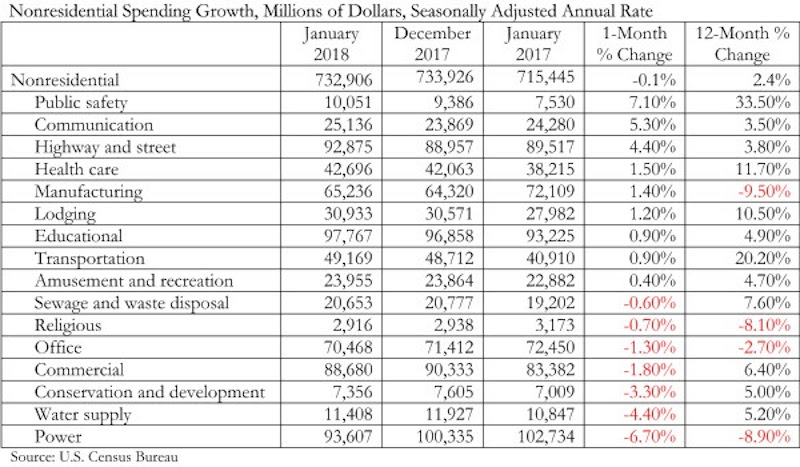

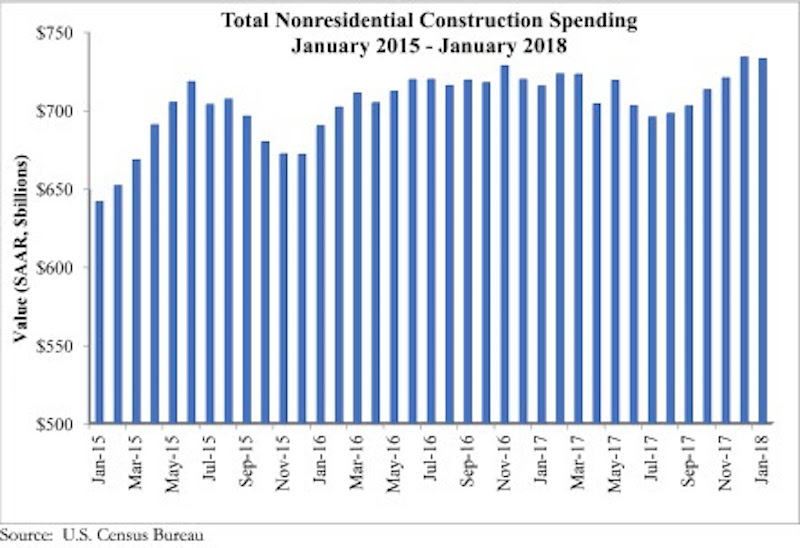

Nonresidential construction spending fell 0.1% on a monthly basis in January 2018, while year-over-year spending increased, according to an Associated Builders and Contractors (ABC) analysis of U.S. Census Bureau data released March 1. Nonresidential January spending totaled $732.9 billion on a seasonally adjusted annual rate, adding up to a 2.4% increase year over year.

Private nonresidential construction fell 1.5% for the month, while public sector nonresidential spending increased 1.9%. The largest year-over-year increases occurred in public safety (33.5%) and transportation (20.2%).

“Today’s data indicates that nonresidential spending continues to expand erratically and unevenly,” said ABC’s Chief Economist Anirban Basu. “On a monthly basis, nonresidential construction spending declined in January. While the decline was minimal, and may have been primarily attributable to freezing temperatures in much of the country, there has been a long-lived pattern of occasional spending setbacks in the context of broader expansion cycles. The result of the most recent spending setback is that nonresidential construction outlays are only 2.4% above year-ago levels.

“Interestingly, there is evidence of a reversal of fortune as spending picks up in certain public segments while flattening out in certain private ones,” said Basu. “With the housing market recovering, property tax and other forms of real estate tax collections have increased. This has positioned a growing number of public agencies to step up construction spending in education, public safety and other publicly financed categories.

“Meanwhile, there are growing concerns regarding excess inventory of commercial and office space in certain metropolitan areas,” said Basu. “This may help explain recent construction spending setbacks in a variety of privately financed construction segments. That said, there is little reason to believe that private construction will falter in 2018. Economic growth, including job growth, remains robust. Confidence is surging among many economic actors, including bankers and developers. The combination of capital and confidence should be enough to drive spending growth in most private segments as 2018 progresses.”

Related Stories

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Apartments | Aug 22, 2023

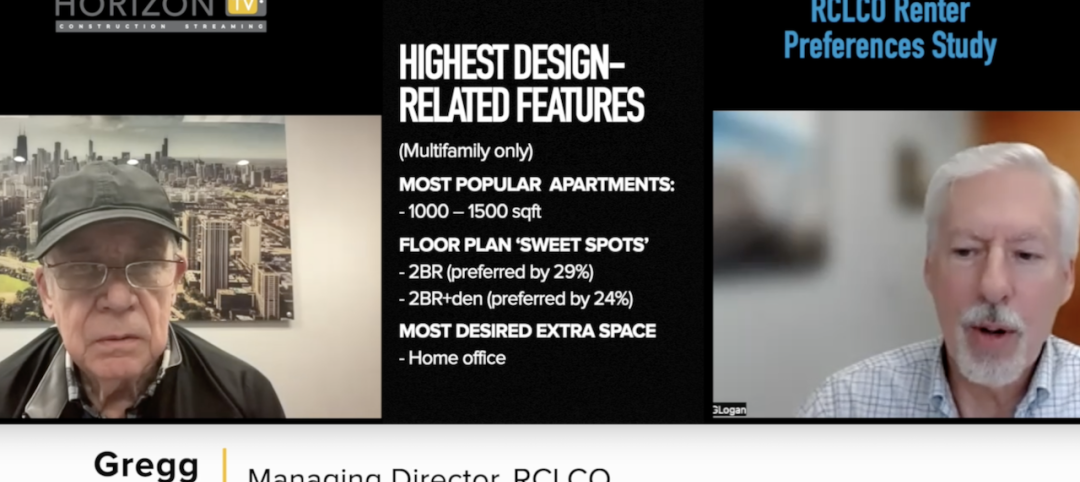

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

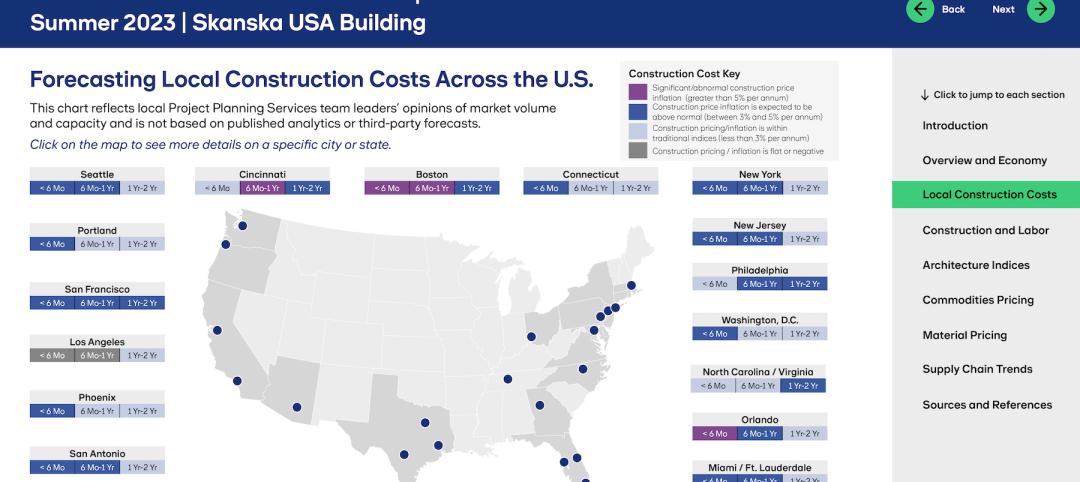

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.