The construction industry added 158,000 jobs on net in June, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. During the last two months, the industry has added 591,000 jobs, recovering 56% of the industrywide jobs lost since the start of the pandemic.

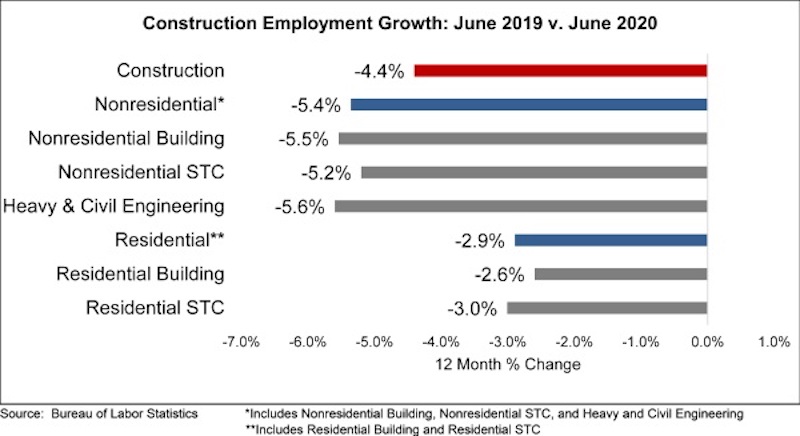

Nonresidential construction employment added 74,700 jobs on net in June. There was positive job growth in two of the three nonresidential segments, with the largest increase in nonresidential specialty trade contractors, which added 71,300 jobs. Employment in the nonresidential building segment increased by 13,100 jobs, while heavy and civil engineering lost 9,700 jobs.

The construction unemployment rate was 10.1% in June, up 6.1 percentage points from the same time last year but down from 12.7% in May and 16.6% in April. Unemployment across all industries dropped from 13.3% in May to 11.1% in June.

“Since the pandemic devastated the economy, most economists have been predicting a V-shaped recovery,” said ABC Chief Economist Anirban Basu. “To date, this has proven correct. While recovery is likely to become more erratic during the months ahead due to a number of factors, including the reemergence of rapid COVID-19 spread, recent employment, unemployment, residential building permits and retail sales data all highlight the potential of the U.S. economy to experience a rapid rebound in economic activity as 2021 approaches. ABC’s Construction Backlog Indicator rose to 7.9 months in May, an increase of less than 0.1 months from April’s reading, and its Construction Confidence Indicator continued to rebound from the historically low levels observed in the March survey.

“However, even if the broader U.S. economy continues to rebound in 2020, construction is less likely to experience a smooth recovery,” said Basu. “The recession, while brief, wreaked havoc on the economic fundamentals of a number of key segments of the construction market, including office, retail and hotel construction. Moreover, state and local government finances have become increasingly fragile, putting both operational and capital spending at risk.

“After this initial period of recovery in U.S. nonresidential construction, there are likely to be periods of slower growth or even contraction,” said Basu. “Nonresidential construction activity tends to lag the broader economy by 12-18 months, and this suggests that there will be some shaky industry performance in 2021 and perhaps beyond.”

Related Stories

Market Data | Feb 10, 2016

Nonresidential building starts and spending should see solid gains in 2016: Gilbane report

But finding skilled workers continues to be a problem and could inflate a project's costs.

Market Data | Feb 9, 2016

Cushman & Wakefield is bullish on U.S. economy and its property markets

Sees positive signs for construction and investment growth in warehouses, offices, and retail

Market Data | Feb 5, 2016

CMD/Oxford forecast: Nonresidential building growth will recover modestly in 2016

Increased government spending on infrastructure projects should help.

Market Data | Feb 4, 2016

Mortenson: Nonresidential construction costs expected to increase in six major metros

The Construction Cost Index, from Mortenson Construction, indicated rises between 3 and 4% on average.

Contractors | Feb 1, 2016

ABC: Tepid GDP growth a sign construction spending may sputter

Though the economy did not have a strong ending to 2015, the data does not suggest that nonresidential construction spending is set to decline.

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.