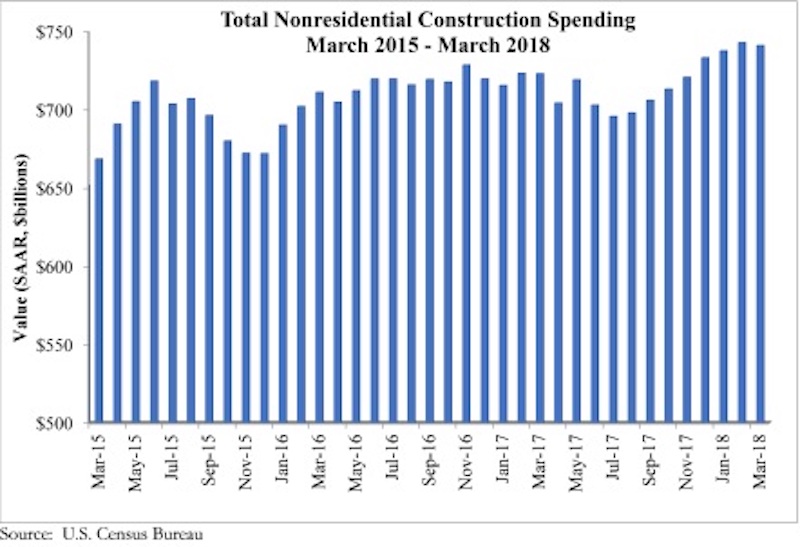

Nonresidential construction spending declined 0.3% in March, according to an Associated Builders and Contractors (ABC) analysis of U.S. Census Bureau data recently released. Nonresidential spending, which totaled $740.9 billion on a seasonally adjusted, annualized basis, has expanded 2.5% on a year-over-year basis. February’s spending estimate was revised roughly $10 billion higher, from $732.8 billion to $742.8 billion, rendering the March decline less meaningful.

Private sector nonresidential construction spending fell 0.4% on a monthly basis, but rose 2.2% from a year ago. Public sector nonresidential spending remained unchanged in March, but it is up 2.9% year-over-year.

“The nonresidential construction spending data emerging from the Census Bureau continue to be a bit at odds with other data characterizing growth in the level of activity,” said ABC’s Chief Economist Anirban Basu. “For instance, first quarter GDP data indicated brisk expansion in nonresidential investment. Data from ABC’s Construction Backlog Indicator, the Architecture Billings Index and other leading industry indicators have also been suggesting ongoing growth. Despite that, private nonresidential construction spending is up by roughly the inflation rate, indicating that the volume of services delivered over the past year has not expanded in real terms.

“That said, most economists who follow the industry presumed that March data would be somewhat soft,” said Basu. “The Northeast and Midwest were impacted by unusually persistent storm activity in March. The same phenomenon impacted March’s employment estimates, which indicated that construction actually lost 15,000 jobs that month. Other weather-sensitive industries, including retail trade, also experienced slow to negative job growth in March.

“The upshot is that CEOs and other construction leaders should remain upbeat regarding near-term prospects despite today’s construction spending report,” said Basu. “Leading indicators, including a host of confidence measures, collectively suggest that business investment will be on the rise during the months ahead. Improved state and local government finances should also support additional nonresidential construction activity.

“At the same time, construction industry leaders must remain wary of a sea of emerging risks to the ongoing economic and construction industry expansions,” said Basu. “Interest rates are on the rise. Materials prices, including those associated with softwood lumber, steel and aluminum, are expanding briskly. Wage pressures continue to build. There are also issues related to America’s expanding national debt, increasingly volatile financial markets, geopolitical uncertainty that has helped to propel fuel prices higher, and lack of transparency regarding America’s infrastructure investment intentions. The challenge for construction CEOs and others, therefore, is to prepare for growing activity in the near-term, but for something potentially rather different two to three years from now.”

Related Stories

Market Data | Sep 22, 2016

Architecture Billings Index slips, overall outlook remains positive

Business conditions are slumping in the Northeast.

Market Data | Sep 20, 2016

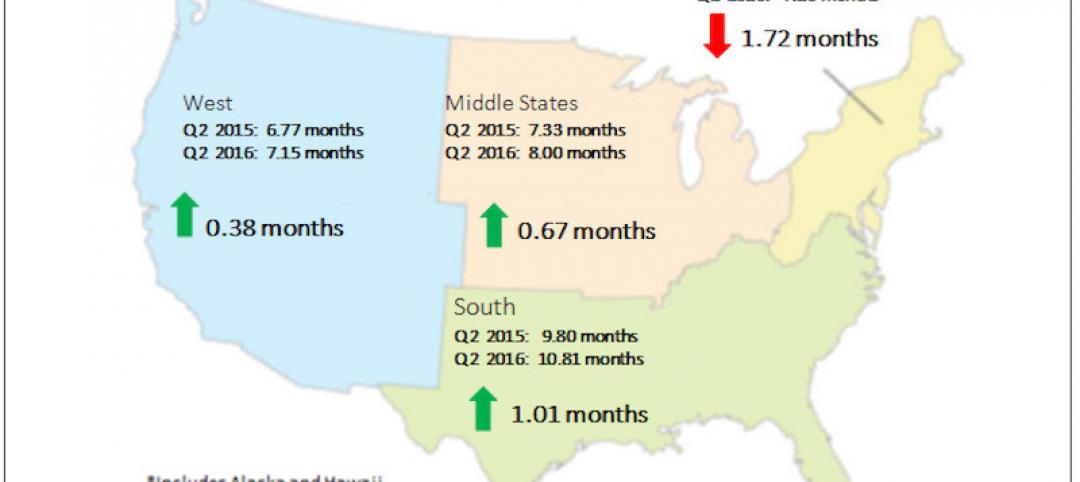

Backlog skyrockets for largest firms during second quarter, but falls to 8.5 months overall

While a handful of commercial construction segments continue to be associated with expanding volumes, for the most part, the average contractor is no longer getting busier, says ABC Chief Economist Anirban Basu.

Designers | Sep 13, 2016

5 trends propelling a new era of food halls

Food halls have not only become an economical solution for restauranteurs and chefs experiencing skyrocketing retail prices and rents in large cities, but they also tap into our increased interest in gourmet locally sourced food, writes Gensler's Toshi Kasai.

Building Team | Sep 6, 2016

Letting your resource take center stage: A guide to thoughtful site selection for interpretive centers

Thoughtful site selection is never about one factor, but rather a confluence of several components that ultimately present trade-offs for the owner.

Market Data | Sep 2, 2016

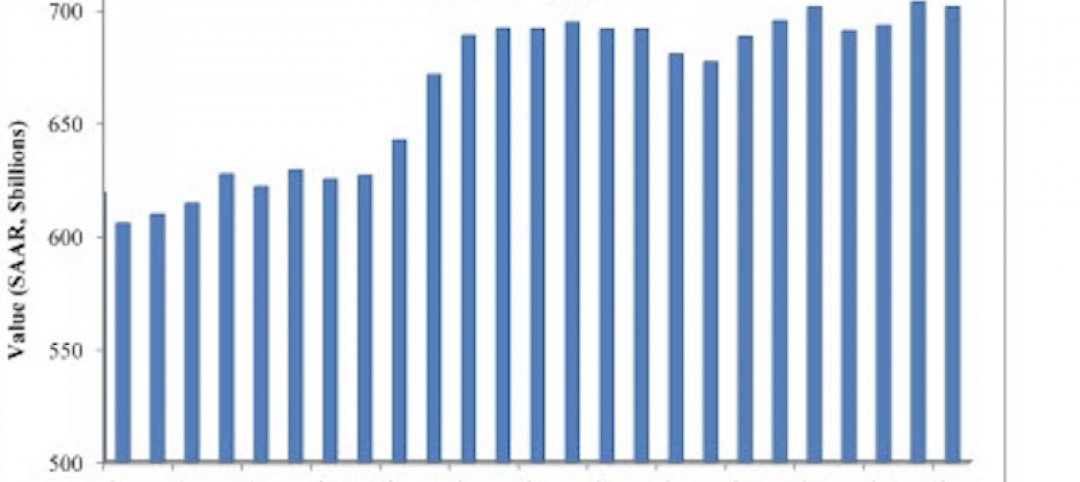

Nonresidential spending inches lower in July while June data is upwardly revised to eight-year record

Nonresidential construction spending has been suppressed over the last year or so with the primary factor being the lack of momentum in public spending.

Industry Research | Sep 1, 2016

CannonDesign releases infographic to better help universities obtain more R&D funding

CannonDesign releases infographic to better help universities obtain more R&D funding.

Industry Research | Aug 25, 2016

Building bonds: The role of 'trusted advisor' is earned not acquired

A trusted advisor acts as a guiding partner over the full course of a professional relationship.

Multifamily Housing | Aug 17, 2016

A new research platform launches for a data-deprived multifamily sector

The list of leading developers, owners, and property managers that are funding the NMHC Research Foundation speaks to the information gap it hopes to fill.

Hotel Facilities | Aug 17, 2016

Hotel construction continues to flourish in major cities

But concerns about overbuilding persist.

Market Data | Aug 16, 2016

Leading economists predict construction industry growth through 2017

The Chief Economists for ABC, AIA, and NAHB all see the construction industry continuing to expand over the next year and a half.