Yardi® Matrix analyzed multifamily transaction activity for its final special report of 2020, and found that property sales are down sharply – though impact varies regionally - as a result of the pandemic.

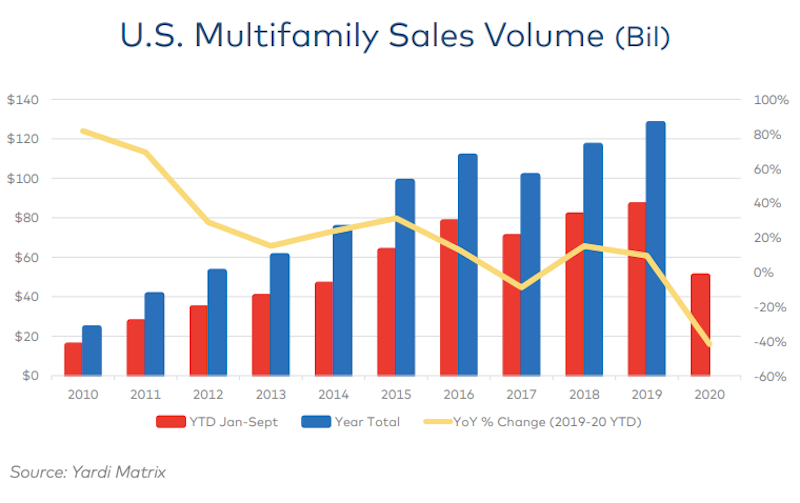

Through three quarters in 2020, $50.6 billion of multifamily property sales were completed in the U.S., down 41.7% from $86.5 billion through the same period a year ago, according to the report. There’s little hope full-year volume will get close to 2019’s record high of $127.8 billion. Gateway and coastal metros have generally seen a larger decline in deal flow than secondary and tertiary markets in the Sun Belt and Southwest.

“Much of the change could be described as a ‘filtering’ effect: investors moving from urban cores to inner-ring suburbs, from primary to secondary metros and from secondary to tertiary metros. This phenomenon results from several factors, including owners putting fewer properties on the market, disagreement between buyers and sellers about prices, the composition of buyers, and the competition for assets,” states the report.

Like many industries, multifamily sales saw a stronger performance in Q3 than during earlier in the year. Capital availability is relatively strong due to lack of better alternatives, optimism about future demand for housing, and the stability afforded by the government-sponsored enterprises Fannie Mae and Freddie Mac.

Gain all the insight in this special multifamily transaction report from industry data leader Yardi Matrix.

Yardi Matrix offers the industry’s most comprehensive market intelligence tool for investment professionals, equity investors, lenders and property managers who underwrite and manage investments in commercial real estate. Yardi Matrix covers multifamily, industrial, office and self storage property types. Email matrix@yardi.com, call 480-663-1149 or visit yardimatrix.com to learn more.

Related Stories

Market Data | Feb 10, 2016

Nonresidential building starts and spending should see solid gains in 2016: Gilbane report

But finding skilled workers continues to be a problem and could inflate a project's costs.

Market Data | Feb 9, 2016

Cushman & Wakefield is bullish on U.S. economy and its property markets

Sees positive signs for construction and investment growth in warehouses, offices, and retail

Market Data | Feb 5, 2016

CMD/Oxford forecast: Nonresidential building growth will recover modestly in 2016

Increased government spending on infrastructure projects should help.

Market Data | Feb 4, 2016

Mortenson: Nonresidential construction costs expected to increase in six major metros

The Construction Cost Index, from Mortenson Construction, indicated rises between 3 and 4% on average.

Contractors | Feb 1, 2016

ABC: Tepid GDP growth a sign construction spending may sputter

Though the economy did not have a strong ending to 2015, the data does not suggest that nonresidential construction spending is set to decline.

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.