By the end of 2015, 49 of 54 U.S. markets tracked by CoStar Group, the commercial real estate research firm, are expected to see their apartment vacancy rates increase.

That would suggest that supply in the multifamily sector is catching up with—or in several markets surpassing—demand. Last year, the 340,000 multifamily units started represented the highest level of construction since the 1980s. And some 20,000 new apartments are expected to come online in both Dallas and Denver alone this year.

Yet, despite the threat of oversupply there appears to be a consensus emerging, that positive demographic and economic forces could keep multifamily demand robust—and construction humming—at least through 2016.

The ever-optimistic National Association of Home Builders, for example, forecasts 358,000 multifamily starts in 2015, a level that Robert Denk, NAHB’s senior economist, thinks is “healthy and sustainable.” He told Multifamily Housing News recently that he expects that construction level to be maintained “for the next couple of years.” Denk also expects the country’s economic growth rates to be “high” in 2016.

In its Fourth-Quarter and Year-End 2014 Report, CoStar acknowledges that developers may need to “dial back” new construction after 2015 to keep vacancies (which ended last year at their lowest point in 10 years) and rents at healthy levels. CoStar estimates that new supply could push vacancy rates to 5.5% by the end of 2015.

On the other hand, today’s renter cohort, comprised largely of Millennials, “will take longer to transition into home buying than any demographic group in the last 30 years—obviously a good trend for apartment owners,” says CoStar. The research firm also foresees a 2-million-person increase in Millennial employment over the next few years, resulting in 1.53 million new households. “Apartment investors will find plenty of demand for new product.”

While some renters eventually will start families and relocate to homes in the suburbs, “a larger share of older households will be in the rental market,” mostly for lifestyle reasons. CoStar expects landlords to make a concerted effort to address the needs of renters as they age.

Multifamily as an asset class now exceeds $3 trillion, according to Andrew Florance, Founder and CEO of CoStar Group, which has detailed information on over 450,000 apartment properties in its database, the industry’s largest. More than 100 million Americans now rent, and 30 million people move annually. On Feb. 17, CoStar re-launched Apartments.com, its website for online searches of apartments, condos, and rental homes. Florance projects that, based on anticipated demand, within the next 10 years CoStar Group could achieve $550 million in annual revenue and $250 million in annual cash flow from this site.

CoStar will invest $75 million into marketing Apartments.com in 2015, a multimedia campaign that is scheduled to kick off on March 1.

Related Stories

Coronavirus | Jun 19, 2020

Experts address COVID-19's impact on nursing homes and schools on The Weekly

The June 18 episode of BD+C's "The Weekly" is available for viewing on demand.

Coronavirus | Jun 12, 2020

BD+C launches 'The Weekly,' a streaming program for the design and construction industry

The first episode, now available on demand, features experts from Robins & Morton, Gensler, and FMI on the current state of the AEC market.

Architects | Jun 8, 2020

Two Frank Lloyd Wright sites set to reopen for tours with enhanced health and safety protocols

The sites will reopen on Thursday, June 11.

Architects | May 28, 2020

Ghafari joins forces with Eview 360

Global architecture + engineering firm announces investment in experiential design agency.

Coronavirus | May 26, 2020

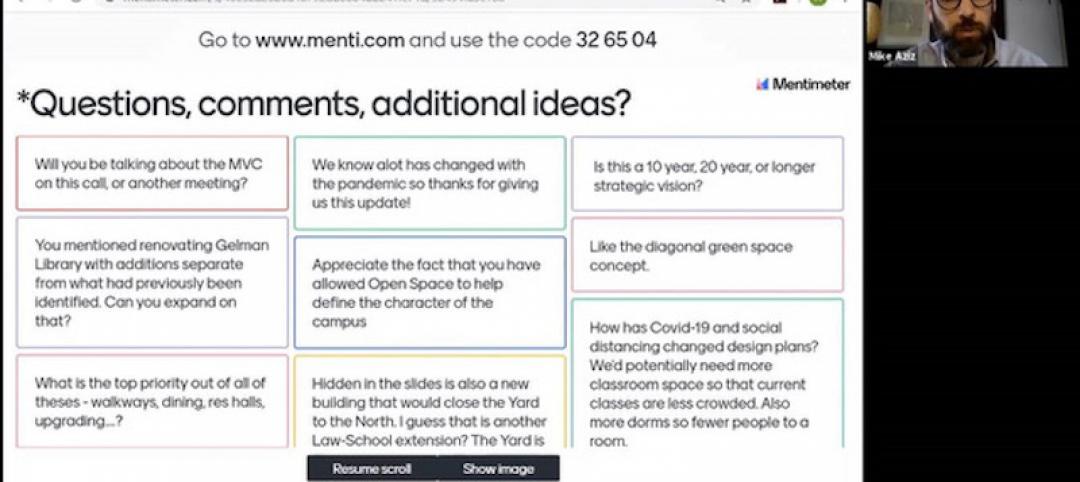

9 tips for mastering virtual public meetings during the COVID-19 pandemic

Mike Aziz, AIA, presents 9 tips for mastering virtual public meetings during the COVID-19 pandemic.

Architects | May 26, 2020

AIA honors exceptional designs with its COTE Top Ten Awards

Projects integrate high design with advanced performance in ten key areas.

Coronavirus | May 22, 2020

COVID-19: Healthcare designers look to the future of medical facilities in light of coronavirus pandemic

The American College of Healthcare Architects (ACHA) has released the key findings of a survey of its members revealing their insights on the future of healthcare architecture and the role of design in the context of the COVID-19 healthcare crisis.

Coronavirus | May 18, 2020

Infection control in office buildings: Preparing for re-occupancy amid the coronavirus

Making workplaces safer will require behavioral resolve nudged by design.

Data Centers | May 8, 2020

Data centers as a service: The next big opportunity for design teams

As data centers compete to process more data with lower latency, the AEC industry is ideally positioned to develop design standards that ensure long-term flexibility.

Coronavirus | Apr 30, 2020

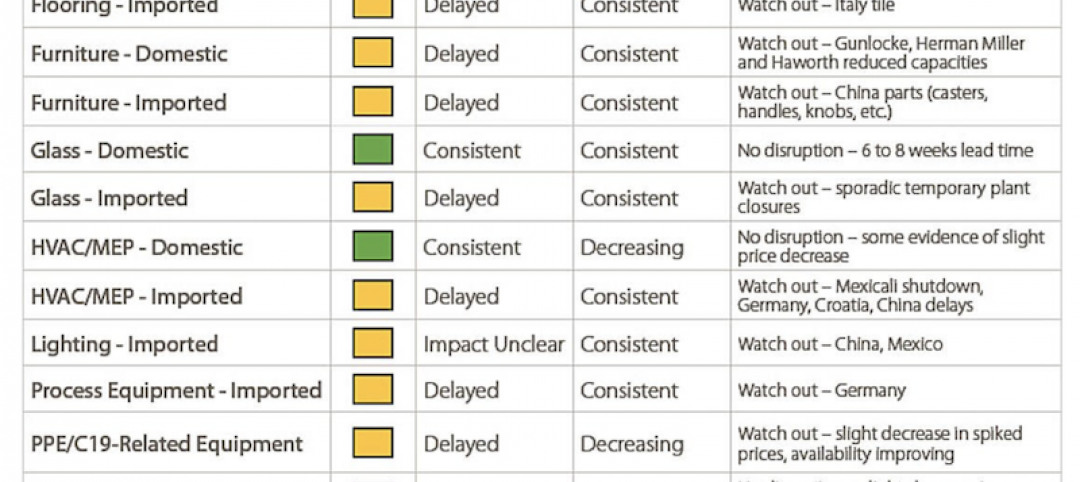

Gilbane shares supply-chain status of products affected by coronavirus

Imported products seem more susceptible to delays