The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report. The report looked through 139 of the nation’s largest markets to find where the hottest renting spots are located.

RentCafe used five relevant metrics in terms of rental competitiveness to determine an overall score. The metrics were averaged using October through December 2023 data:

- Number of days apartments were vacant

- Percentage of apartments that were occupied by renters

- Number of prospective renters competing for an apartment

- Percentage of renters who renewed their leases

- Share of new apartments completed recently

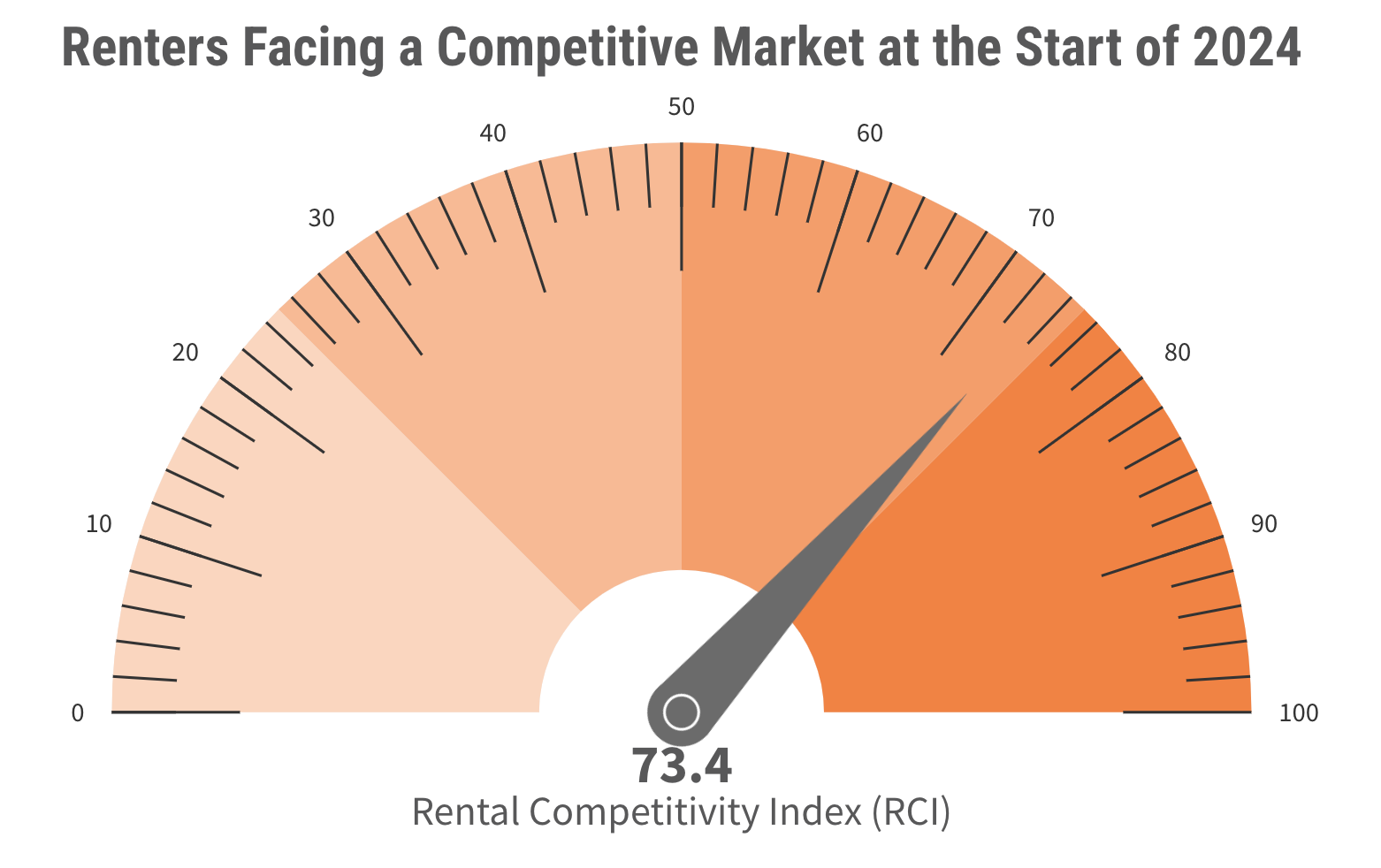

RentCafe analyzed the metrics on a national level to determine a Rental Competitiveness Index (RCI). At the start of 2024, the national RCI score was 73.4, indicating a moderately competitive rental market.

Compared to 2023, slightly more renters renewed their leases (61.5%) than the previous year (60.7%). The number of already occupied apartments went down (93%—down from 94.2% in 2023) but this is likely because there was a greater amount of apartments being built. By 2024, 0.67% of available rental units were built, as opposed to 0.43% in 2023.

Top 20 Most Competitive Rental Markets at the Start of 2024

At the regional level, markets with a thriving economy are more attractive than others. With a competitive score of 92, Miami, Fla., continues to be the most competitive rental market in the U.S. at the start of the year.

Where do other markets fare? Here are 20 of the most competitive and sought-after rental markets in 2024:

1. Miami-Dade, Fla.

The Miami-Dade market has a competitive score of just under 92, topping the list. A staggering 96.5% of the area’s apartments are occupied and have a 73% renewal rate.

Each apartment sees competition from an average of 14 prospective tenants. The average timeframe for units being vacant is 36 days.

2. Milwaukee, Wis.

Milwaukee has a competitive score of 87. Over 95% of the area’s apartments are occupied and have a 72% renewal rate.

Each apartment sees competition from an average of nine prospective residents. The average time a unit stays on the market before becoming occupied is 37 days.

3. North Jersey, N.J.

The North Jersey area meets an overall competitive score of 85 points. Nearly 96% of its apartments are occupied, with an average lease renewal rate of 73%.

There are an average of nine prospective renters for each apartment. Units are vacant for around 38 days before finding a tenant.

4. Suburban Chicago, Ill.

The Suburban Chicago market has a competitive score of 85. With 95% of the area’s apartments already occupied, the area’s renewal rate averages out to 68%.

Each apartment sees competition from an average of 10 prospective tenants. The average timeframe for units being vacant is 37 days.

5. Grand Rapids, Mich.

Grand Rapids has a competitive score of 85. Over 95% of the area’s apartments are occupied and have a 77% renewal rate—the highest lease renewal rate of the list.

Each apartment sees competition from an average of six prospective residents. The average time a unit stays on the market before becoming occupied is 39 days.

6. Oklahoma City, Okla.

Oklahoma City meets an overall competitive score of 83 points. Over 93% of its apartments are occupied, with an average lease renewal rate of 63%.

There are an average of six prospective renters for each apartment. Units are vacant for around 35 days—one of the lowest among the list—before finding a tenant.

7. Bridgeport-New Haven, Conn.

The Bridgeport-New Haven market has a competitive score of 83. Over 95% of the area’s apartments are occupied and have a 63% renewal rate.

Each apartment sees competition from an average of nine prospective tenants. The average timeframe for units being vacant is 39 days.

8. Cincinnati, Ohio

Cincinnati has a competitive score of 82. Nearly 95% of the area’s apartments are occupied and have a 66% renewal rate.

Each apartment sees competition from an average of nine prospective residents. The average time a unit stays on the market before becoming occupied is 38 days.

9. Lansing-Ann Arbor, Mich.

The Lansing-Ann Arbor area meets an overall competitive score of 82 points. Over 94% of its apartments are occupied, with an average lease renewal rate of 69%.

There are an average of 6 prospective renters for each apartment. Like Cincinnati, units are vacant for 38 days before finding a tenant.

10. Orlando, Fla.

Orlando has a competitive score of 81. With 94% of the area’s apartments already occupied, the area’s renewal rate averages out to 69%.

Each apartment sees competition from an average of eight prospective tenants. The average timeframe for units being vacant is 39 days.

11. Orange County, Calif.

Orange County has a competitive score of 81. Over 96% of the area’s apartments are occupied with a 60% renewal rate.

Each apartment sees competition from an average of 11 prospective residents—the second-most amount behind Miami. The average time a unit stays on the market before becoming occupied is 40 days.

12. Brooklyn, N.Y.

Brooklyn meets an overall competitive score of 81 points. Over 96% of its apartments are occupied, with an average lease renewal rate of 69%.

There are an average of five prospective renters for each apartment—the lowest of all the markets. Units are vacant for around 39 days before finding a tenant.

13. Omaha, Neb.

The Omaha market has a competitive score of just under 80. With 95% of the area’s apartments already occupied, lease renewal rates average out to 66%.

Each apartment sees competition from an average of eight prospective tenants. The average timeframe for units being vacant is 35 days.

14. Southwest Florida

Southwest Florida has a competitive score of 79. Over 94% of the area’s apartments are occupied, leaving the area’s lease renewal rate at 70%.

Each apartment sees competition from an average of seven prospective tenants. The average timeframe for units being vacant is 38 days.

15. Eastern Virginia

The Eastern Virginia region has a competitive score of 79. Nearly 94% of the area’s apartments are occupied with a 63% renewal rate.

Each apartment sees competition from an average of eight prospective residents. The average time a unit stays on the market before becoming occupied is 40 days.

16. Kansas City, Kan.

Kansas City has a competitive score of 79. Over 93% of the area’s apartments are occupied and have a 68% renewal rate.

Each apartment sees competition from an average of six prospective residents. The average time a unit stays on the market before becoming occupied is 39 days.

17. Tampa, Fla.

Tampa meets an overall competitive score of 78 points. Nearly 94% of its apartments are occupied, with an average lease renewal rate of 65%.

There are an average of eight prospective renters for each apartment. Units are vacant for around 40 days before finding a tenant.

18. San Diego, Calif.

The San Diego market also has a competitive score of 78. With nearly 95% of the area’s apartments already occupied, the area’s renewal rate averages out to just under 50%—the second lowest of the list.

Each apartment sees competition from an average of nine prospective tenants. The average timeframe for units being vacant is 38 days.

19. Suburban Philadelphia, Pa.

Suburban Philadelphia has a competitive score of 78. Over 94% of the area’s apartments are occupied and have a 75% renewal rate.

Each apartment sees competition from an average of seven prospective residents. The average time a unit stays on the market before becoming occupied is 45 days—the longest time frame of the list.

20. Silicon Valley, Calif.

Silicon Valley meets an overall competitive score of exactly 78 points. Over 94% of its apartments are occupied, with the lowest lease renewal rate of 47%.

There are an average of nine prospective renters for each apartment. Units are vacant for around 37 days before finding a tenant.

Related Stories

Market Data | Oct 23, 2023

New data finds that the majority of renters are cost-burdened

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic.

Giants 400 | Oct 23, 2023

Top 115 Multifamily Construction Firms for 2023

Clark Group, Suffolk Construction, Summit Contracting Group, Whiting-Turner Contracting, and McShane Companies top the ranking of the nation's largest multifamily housing sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 75 Multifamily Engineering Firms for 2023

Kimley-Horn, WSP, Tetra Tech, Olsson, and Langan head the ranking of the nation's largest multifamily housing sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 190 Multifamily Architecture Firms for 2023

Humphreys and Partners, Gensler, Solomon Cordwell Buenz, Niles Bolton Associates, and AO top the ranking of the nation's largest multifamily housing sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Senior Living Design | Oct 19, 2023

Senior living construction poised for steady recovery

Senior housing demand, as measured by the change in occupied units, continued to outpace new supply in the third quarter, according to NIC MAP Vision. It was the ninth consecutive quarter of growth with a net absorption gain. On the supply side, construction starts continued to be limited compared with pre-pandemic levels.

Urban Planning | Oct 12, 2023

Top 10 'future-ready' cities

With rising climate dilemmas, breakthroughs in technology, and aging infrastructure, the needs of our cities cannot be solved with a single silver bullet. This Point2 report compared the country's top cities over a variety of metrics.

Multifamily Housing | Sep 26, 2023

Midwest metros see greatest rent increase in September 2023

While the median monthly price of rent has increased by 0.71% in August, the year-over-year estimates show a national change of -0.06 percent.

Engineers | Sep 15, 2023

NIST investigation of Champlain Towers South collapse indicates no sinkhole

Investigators from the National Institute of Standards and Technology (NIST) say they have found no evidence of underground voids on the site of the Champlain Towers South collapse, according to a new NIST report. The team of investigators have studied the site’s subsurface conditions to determine if sinkholes or excessive settling of the pile foundations might have caused the collapse.

MFPRO+ Research | Sep 11, 2023

Conversions of multifamily dwellings to ‘mansions’ leading to dwindling affordable stock

Small multifamily homes have historically provided inexpensive housing for renters and buyers, but developers have converted many of them in recent decades into larger, single-family units. This has worsened the affordable housing crisis, say researchers.

Multifamily Housing | Aug 23, 2023

Constructing multifamily housing buildings to Passive House standards can be done at cost parity

All-electric multi-family Passive House projects can be built at the same cost or close to the same cost as conventionally designed buildings, according to a report by the Passive House Network. The report included a survey of 45 multi-family Passive House buildings in New York and Massachusetts in recent years.