The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report. The report looked through 139 of the nation’s largest markets to find where the hottest renting spots are located.

RentCafe used five relevant metrics in terms of rental competitiveness to determine an overall score. The metrics were averaged using October through December 2023 data:

- Number of days apartments were vacant

- Percentage of apartments that were occupied by renters

- Number of prospective renters competing for an apartment

- Percentage of renters who renewed their leases

- Share of new apartments completed recently

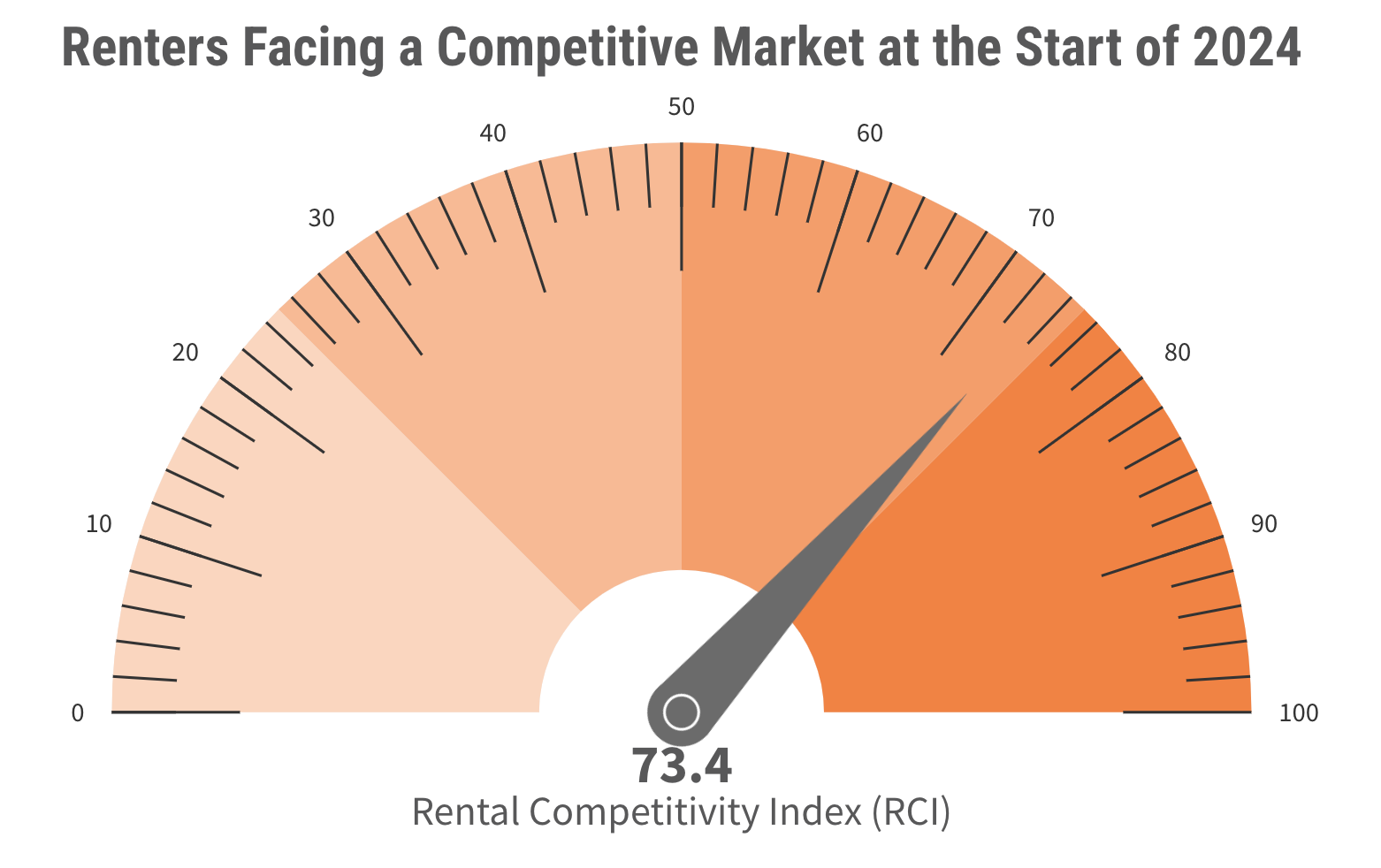

RentCafe analyzed the metrics on a national level to determine a Rental Competitiveness Index (RCI). At the start of 2024, the national RCI score was 73.4, indicating a moderately competitive rental market.

Compared to 2023, slightly more renters renewed their leases (61.5%) than the previous year (60.7%). The number of already occupied apartments went down (93%—down from 94.2% in 2023) but this is likely because there was a greater amount of apartments being built. By 2024, 0.67% of available rental units were built, as opposed to 0.43% in 2023.

Top 20 Most Competitive Rental Markets at the Start of 2024

At the regional level, markets with a thriving economy are more attractive than others. With a competitive score of 92, Miami, Fla., continues to be the most competitive rental market in the U.S. at the start of the year.

Where do other markets fare? Here are 20 of the most competitive and sought-after rental markets in 2024:

1. Miami-Dade, Fla.

The Miami-Dade market has a competitive score of just under 92, topping the list. A staggering 96.5% of the area’s apartments are occupied and have a 73% renewal rate.

Each apartment sees competition from an average of 14 prospective tenants. The average timeframe for units being vacant is 36 days.

2. Milwaukee, Wis.

Milwaukee has a competitive score of 87. Over 95% of the area’s apartments are occupied and have a 72% renewal rate.

Each apartment sees competition from an average of nine prospective residents. The average time a unit stays on the market before becoming occupied is 37 days.

3. North Jersey, N.J.

The North Jersey area meets an overall competitive score of 85 points. Nearly 96% of its apartments are occupied, with an average lease renewal rate of 73%.

There are an average of nine prospective renters for each apartment. Units are vacant for around 38 days before finding a tenant.

4. Suburban Chicago, Ill.

The Suburban Chicago market has a competitive score of 85. With 95% of the area’s apartments already occupied, the area’s renewal rate averages out to 68%.

Each apartment sees competition from an average of 10 prospective tenants. The average timeframe for units being vacant is 37 days.

5. Grand Rapids, Mich.

Grand Rapids has a competitive score of 85. Over 95% of the area’s apartments are occupied and have a 77% renewal rate—the highest lease renewal rate of the list.

Each apartment sees competition from an average of six prospective residents. The average time a unit stays on the market before becoming occupied is 39 days.

6. Oklahoma City, Okla.

Oklahoma City meets an overall competitive score of 83 points. Over 93% of its apartments are occupied, with an average lease renewal rate of 63%.

There are an average of six prospective renters for each apartment. Units are vacant for around 35 days—one of the lowest among the list—before finding a tenant.

7. Bridgeport-New Haven, Conn.

The Bridgeport-New Haven market has a competitive score of 83. Over 95% of the area’s apartments are occupied and have a 63% renewal rate.

Each apartment sees competition from an average of nine prospective tenants. The average timeframe for units being vacant is 39 days.

8. Cincinnati, Ohio

Cincinnati has a competitive score of 82. Nearly 95% of the area’s apartments are occupied and have a 66% renewal rate.

Each apartment sees competition from an average of nine prospective residents. The average time a unit stays on the market before becoming occupied is 38 days.

9. Lansing-Ann Arbor, Mich.

The Lansing-Ann Arbor area meets an overall competitive score of 82 points. Over 94% of its apartments are occupied, with an average lease renewal rate of 69%.

There are an average of 6 prospective renters for each apartment. Like Cincinnati, units are vacant for 38 days before finding a tenant.

10. Orlando, Fla.

Orlando has a competitive score of 81. With 94% of the area’s apartments already occupied, the area’s renewal rate averages out to 69%.

Each apartment sees competition from an average of eight prospective tenants. The average timeframe for units being vacant is 39 days.

11. Orange County, Calif.

Orange County has a competitive score of 81. Over 96% of the area’s apartments are occupied with a 60% renewal rate.

Each apartment sees competition from an average of 11 prospective residents—the second-most amount behind Miami. The average time a unit stays on the market before becoming occupied is 40 days.

12. Brooklyn, N.Y.

Brooklyn meets an overall competitive score of 81 points. Over 96% of its apartments are occupied, with an average lease renewal rate of 69%.

There are an average of five prospective renters for each apartment—the lowest of all the markets. Units are vacant for around 39 days before finding a tenant.

13. Omaha, Neb.

The Omaha market has a competitive score of just under 80. With 95% of the area’s apartments already occupied, lease renewal rates average out to 66%.

Each apartment sees competition from an average of eight prospective tenants. The average timeframe for units being vacant is 35 days.

14. Southwest Florida

Southwest Florida has a competitive score of 79. Over 94% of the area’s apartments are occupied, leaving the area’s lease renewal rate at 70%.

Each apartment sees competition from an average of seven prospective tenants. The average timeframe for units being vacant is 38 days.

15. Eastern Virginia

The Eastern Virginia region has a competitive score of 79. Nearly 94% of the area’s apartments are occupied with a 63% renewal rate.

Each apartment sees competition from an average of eight prospective residents. The average time a unit stays on the market before becoming occupied is 40 days.

16. Kansas City, Kan.

Kansas City has a competitive score of 79. Over 93% of the area’s apartments are occupied and have a 68% renewal rate.

Each apartment sees competition from an average of six prospective residents. The average time a unit stays on the market before becoming occupied is 39 days.

17. Tampa, Fla.

Tampa meets an overall competitive score of 78 points. Nearly 94% of its apartments are occupied, with an average lease renewal rate of 65%.

There are an average of eight prospective renters for each apartment. Units are vacant for around 40 days before finding a tenant.

18. San Diego, Calif.

The San Diego market also has a competitive score of 78. With nearly 95% of the area’s apartments already occupied, the area’s renewal rate averages out to just under 50%—the second lowest of the list.

Each apartment sees competition from an average of nine prospective tenants. The average timeframe for units being vacant is 38 days.

19. Suburban Philadelphia, Pa.

Suburban Philadelphia has a competitive score of 78. Over 94% of the area’s apartments are occupied and have a 75% renewal rate.

Each apartment sees competition from an average of seven prospective residents. The average time a unit stays on the market before becoming occupied is 45 days—the longest time frame of the list.

20. Silicon Valley, Calif.

Silicon Valley meets an overall competitive score of exactly 78 points. Over 94% of its apartments are occupied, with the lowest lease renewal rate of 47%.

There are an average of nine prospective renters for each apartment. Units are vacant for around 37 days before finding a tenant.

Related Stories

MFPRO+ Research | Feb 28, 2024

New download: BD+C's 2023 Multifamily Amenities report

New research from Building Design+Construction and Multifamily Pro+ highlights the 127 top amenities that developers, property owners, architects, contractors, and builders are providing in today’s apartment, condominium, student housing, and senior living communities.

Student Housing | Feb 21, 2024

Student housing preleasing continues to grow at record pace

Student housing preleasing continues to be robust even as rent growth has decelerated, according to the latest Yardi Matrix National Student Housing Report.

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Industry Research | Jan 31, 2024

ASID identifies 11 design trends coming in 2024

The Trends Outlook Report by the American Society of Interior Designers (ASID) is the first of a three-part outlook series on interior design. This design trends report demonstrates the importance of connection and authenticity.

Apartments | Jan 26, 2024

New apartment supply: Top 5 metros delivering in 2024

Nationally, the total new apartment supply amounts to around 1.4 million units—well exceeding the apartment development historical average of 980,000 units.

Adaptive Reuse | Jan 23, 2024

Adaptive reuse report shows 55K impact of office-to-residential conversions

The latest RentCafe annual Adaptive Reuse report shows that there are 55,300 office-to-residential units in the pipeline as of 2024—four times as much compared to 2021.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Apartments | Jan 9, 2024

Apartment developer survey indicates dramatic decrease in starts this year

Over 56 developers, operators, and investors across the country were surveyed in John Burns Research and Consulting's recently-launched Apartment Developer and Investor Survey.

Giants 400 | Jan 8, 2024

Top 60 Senior Living Facility Construction Firms for 2023

Whiting-Turner, Ryan Companies US, Weis Builders, Suffolk Construction, and W.E. O'Neil Construction top BD+C's ranking of the nation's largest senior living facility general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.