According to a new report from Mid-America Real Estate Corp.’s Urban Team, much of Chicago lacks the type of product that today’s downsized big box retailers—or “mid-box”—are looking for.

“Retailers’ footprints are shrinking,” says Mid-America Principal Dan Tausk, author of the report. “From Wal-Mart to Best Buy to Office Depot, we continue to see a national trend toward shrinking square footage, which is expanding the vernacular from ‘super’ or ‘mega’ stores to include ‘market,’ ‘express’ and ‘neighborhood’ stores. If that trend continues—and I expect it to—then we’ve got a real lack of product to offer them in most of urban Chicago.”

Because of the national trend in retailer downsizing, Mid-America undertook its first “Urban Chicago Mid-Box Retail Study” this summer to create a better barometer of supply and demand in this sector. The team defined City limits and all directly neighboring suburbs into eight zones roughly following existing retail trade areas.

The team then examined existing and vacant space for stores between 15,000 and 50,000-sf, excluding proposed new development that hadn’t been delivered. To get a clearer picture of category activity, the team also excluded Chicago’s dense penetration of urban drugstores, typically 10,000 to 14,000-sf, but included the newer large format “market” drugstores that are between 25,000 and 30,000-sf. The study uncovered nearly 11.2 million square feet of existing supply in the mid-box category, or 389 total spaces. It also discovered a vacancy rate in this size category at 7%, with strong absorption of existing vacancy.

While it was not surprising to find that Central City (Zone 1)—with State Street, Michigan Avenue and Lincoln Park—carries 34% of the mid-box supply and only 8.6 % of the population, it was a surprise for Tausk to see that pockets of densely populated, high income submarkets such as Lincoln Square, River Forest, Streeterville, West Loop and Bucktown have virtually no mid-box retail supply in this size range. While Zone 5 (the Northeast City) holds the highest percentage of the population in the study, 20.4%, it holds only 9.5% of the mid-box supply.

“The average amount of mid-box retail in urban Chicago is 3.5 square feet/person,” says Tausk., “Zone 1 (Central City) shows 14.6 square feet/person while Zone 5 shows the lowest in Chicago of 1.2 square feet/person. That’s a wide disparity of haves and have-nots.”

He says the residential density in Zone 5 is obviously high enough to support more retail with residents. But he suggests that because the price of land here is high and land size is limited, retailers are pushed to accept multi-level buildings, which are lacking in this zone. “Right now, it’s difficult for them to expand here, despite the desirable demographics,” he says.

Overall, according to the report, five of the eight zones show that almost every category of mid-box retail is underserved for similar reasons -- from grocery and apparel to electronics and discount. The three zones that are doing best are Central City (Zone 1) with 14.6 square feet/person, Near Southwest Suburban (Zone 7) with 5.7 square feet/person, and Near West Suburban (Zone 8) with 4.4 square feet/person.

As was similarly indicated in Mid-America’s Urban Grocery Study last year, the West City (Zone 2) is the most underserved with only 16 mid-box retail stores or 4.11% of Chicago’s total supply. “In addition,” Tausk says, “the West Side has the least amount of category options. While each zone’s dominant category is grocery, that category averages only + 20% Citywide. In the West City, however, grocery accounts for 53% of the mid-box retail, showing a void of other shopping options.”

Other category highlights:

- Zone 1 (Central City) showed a dominating penetration of apparel versus all other zones combined. State Street and Michigan Avenue, and Lincoln Park carry the most supply. Zone 1 also dominates in the home furnishings category with 12 mid-box retail stores, as well as electronics with 9 and office supply with 6.

- Zone 2 (West City), as already noted above, is void of shopping options in most categories other than grocery. There is plenty of affordable, developable land, but lower incomes and high crime rates continue to stall development.

- Zone 5 (S/SE City) has a large number of grocers totaling 35% of all mid-box categories in that zone. Category sales clearly bleed from the south and southeast side to the Southwest City or Southwest suburbs, due to lack of options in other retail categories.

“In conclusion,” says Tausk. “There’s demand for mid-box growth in urban Chicago, despite a tough economy.” However, existing supply is tight everywhere and almost non-existent in the most attractive zones. He adds that there are three main considerations retailers will be forced to evaluate in the process.

- Retailers with expansion/rollouts for Chicago will need to continue to think creatively, finding opportunities in multi-levels, mezzanines or even smaller stores to meet future demand.

- Retailers can expect rents to remain high in the mid-size sector due to obvious lack of supply and low vacancy.

- Future opportunity in this mid-box size category may best come from downsizing / sublease space or the splitting of outdated larger footprints and future bankruptcies of other retailers.

Absorption in this size range is strong and happens quickly with greater than a half-million square feet of leasing currently proposed in existing space.

From the supply side, Tausk says that based on this supply/demand dynamic, “we can expect to see a slow but steady flow of new projects in this size range. Several developments are underway currently that are focused on the 15,000 to 50,000-sf user. Mid-box retailers such as Ross Dress for Less, Marshalls, Michaels, WalMart Market, hhGregg and Planet Fitness continue to pursue active expansion across Chicagoland.” +

Related Stories

Codes and Standards | Apr 8, 2024

Boston’s plans to hold back rising seawater stall amid real estate slowdown

Boston has placed significant aspects of its plan to protect the city from rising sea levels on the actions of private developers. Amid a post-Covid commercial development slump, though, efforts to build protective infrastructure have stalled.

Sustainability | Apr 8, 2024

3 sustainable design decisions to make early

In her experience as an architect, Megan Valentine AIA, LEED AP, NCARB, WELL AP, Fitwel, Director of Sustainability, KTGY has found three impactful sustainable design decisions: site selection, massing and orientation, and proper window-to-wall ratios.

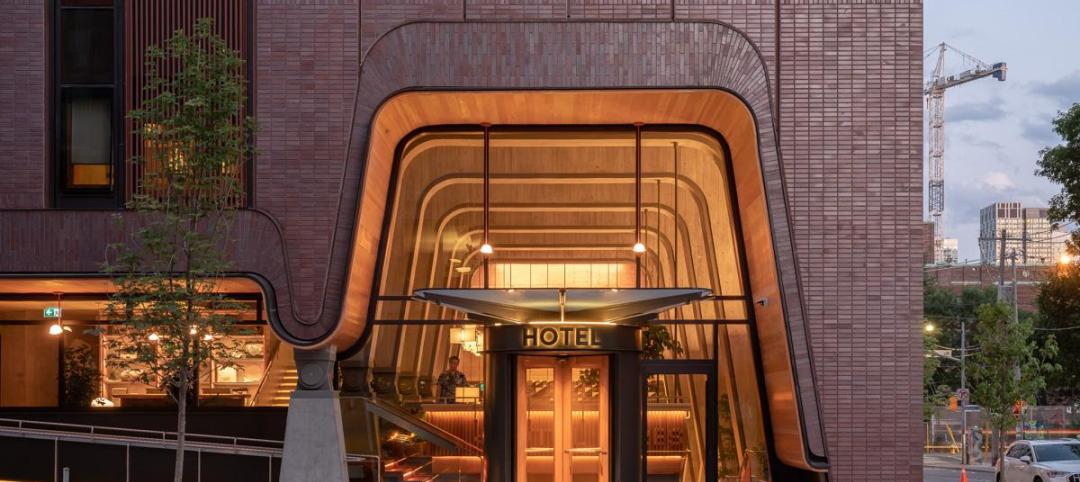

Brick and Masonry | Apr 4, 2024

Best in brick buildings: 9 projects take top honors in the Brick in Architecture Awards

The Ace Hotel Toronto, designed by Shim-Sutcliffe Architects, and the TCU Music Center by Bora Architecture & Interiors are among nine "Best in Class" winners and 44 overall winners in the Brick Industry Association's 2023 Brick in Architecture Awards.

Retail Centers | Apr 4, 2024

Retail design trends: Consumers are looking for wellness in where they shop

Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation. That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about retail design and what consumers want in healthier shopping experiences.

Healthcare Facilities | Apr 3, 2024

Foster + Partners, CannonDesign unveil design for Mayo Clinic campus expansion

A redesign of the Mayo Clinic’s downtown campus in Rochester, Minn., centers around two new clinical high-rise buildings. The two nine-story structures will reach a height of 221 feet, with the potential to expand to 420 feet.

Sports and Recreational Facilities | Apr 2, 2024

How university rec centers are evolving to support wellbeing

In a LinkedIn Live, Recreation & Wellbeing’s Sadat Khan and Abby Diehl joined HOK architect Emily Ostertag to discuss the growing trend to design and program rec centers to support mental wellbeing and holistic health.

Architects | Apr 2, 2024

AE Works announces strategic acquisition of WTW Architects

AE Works, an award-winning building design and consulting firm is excited to announce that WTW Architects, a national leader in higher education design, has joined the firm.

Office Buildings | Apr 2, 2024

SOM designs pleated façade for Star River Headquarters for optimal daylighting and views

In Guangzhou, China, Skidmore, Owings & Merrill (SOM) has designed the recently completed Star River Headquarters to minimize embodied carbon, reduce energy consumption, and create a healthy work environment. The 48-story tower is located in the business district on Guangzhou’s Pazhou Island.

K-12 Schools | Apr 1, 2024

High school includes YMCA to share facilities and connect with the broader community

In Omaha, Neb., a public high school and a YMCA come together in one facility, connecting the school with the broader community. The 285,000-sf Westview High School, programmed and designed by the team of Perkins&Will and architect of record BCDM Architects, has its own athletic facilities but shares a pool, weight room, and more with the 30,000-sf YMCA.

Market Data | Apr 1, 2024

Nonresidential construction spending dips 1.0% in February, reaches $1.179 trillion

National nonresidential construction spending declined 1.0% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.179 trillion.