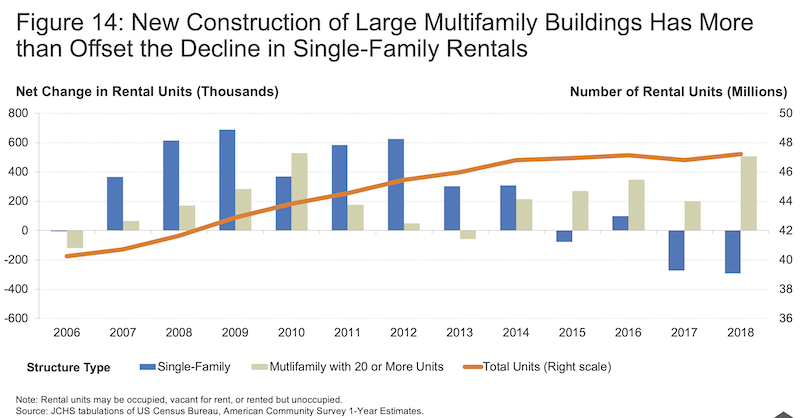

Starts of buildings with five or more housing units rose from December 2018 through December 2019 by 74.6% to a seasonally adjusted annual rate of 536,000, according to preliminary Census Bureau estimates. At the end of that period, the number of multifamily housing units under construction was up 7.3% to 177,000.

However, the seemingly endless demand for multifamily housing could finally be abating. After more than a decade-long runup, renter household growth appears to have plateaued. By the Housing Vacancy Survey’s count, the number of renters fell by a total of 222,000 between 2016 and 2018, but then more than made up for this lost ground with a gain of 350,000 through the first three quarters of 2019.

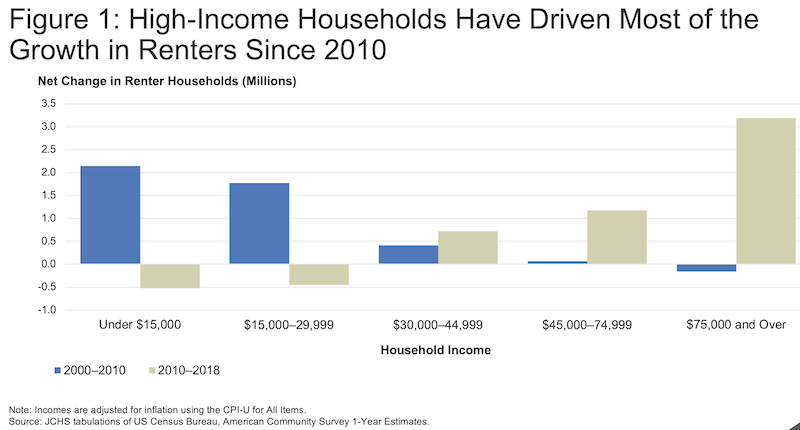

The National Association of Home Builders recently projected that multifamily housing starts would increase by only 1% in 2020. And what’s getting built in most markets is targeting higher-income renters, whose numbers increased by 545,000 in 2016–2018 alone. In fact, households with real incomes of at least $75,000 accounted for over three-quarters of the growth in renters (3.2 million) from 2010 to 2018,

Those are some of the findings in “America’s Rental Housing 2020,” the annual report released today by the Joint Center for Housing Studies of Harvard University. The John D. and Catherine T. MacArthur Foundation and the Joint Center’s Policy Advisory Board provided the funding for the report.

The report provides a rearview mirror perspective on the country’s rental landscape, where renting has become far more common and acceptable among the age groups and family types traditionally more likely to own their housing. For example, from the homeownership peak in 2004 to 2018, the number of married couples with children who owned homes fell by 2.7 million, while the number renting rose by 680,000.

Charts: Joint Center for Housing Studies at Harvard University

The increase in renting among high-income, older, and larger households reflects fundamental shifts in the composition of demand.

The American Dream of owning a house isn’t waning, necessarily. Public opinion surveys indicate that most renters are satisfied with their current housing situations, but still desire to eventually own homes. However, these same surveys also point to affordability as a major barrier to homeownership. Consistent with this finding, nearly all of the net growth in homeowners from 2010 to 2018 was among households with incomes of $150,000 or more.

“Rising rents are making it increasingly difficult for households to save for a downpayment and become homeowners,” says Whitney Airgood-Obrycki, a Research Associate at the Joint Center and lead author of the new report. “Young, college-educated households with high incomes are really driving current rental demand."

New rental construction remains near its highest levels in three decades. The share of newly completed apartments in structures with 50 or more units increased steadily from 11 percent in the 1990s, to 27 percent in the 2000s, to 61 percent in 2018.

Nearly all new multifamily units are built as rentals, with a growing share in larger buildings intended for the high end of the market. So it’s not surprising that rents continue to escalate.

The Joint Center estimates that the median asking rent for unfurnished units completed between July 2018 and June 2019 was $1,620—some 37% higher, in real terms, than the median for units completed in 2000. About one in five newly built apartments had an asking rent of at least $2,450, while only 12% had asking rents below $1,050.

Rents have been trending upward for a while. Between 2012 and 2017, the number of units renting for $1,000 or more in real terms shot up by five million, while the number of low-cost units renting for under $600 fell by 3.1 million. The supply of units with rents in the $600–$999 range also declined, but by a more modest 450,000. This marks a sharp departure from the preceding five-year period, when the number of units in all three rent segments grew by 1.2 to 1.8 million.

Low-cost rental units accounted for only 25% of the national rental stock in 2017, compared to 33% in 2012, with decreases in all 50 states and Washington, DC.

Contributing to rent escalation has been supply. Even as overall rental demand ebbs and new supply comes online, tight conditions prevail across the country. The Census Bureau reports that the national rental vacancy rate edged down again in mid-2019 to 6.8%—the lowest level since the mid-1980s.

According to RealPage, vacancy rates for units in professionally managed properties were down in 118 of the 150 markets tracked, with year-over-year declines averaging 0.7 percentage point in the third quarter of 2019.

With vacancy rates so low, rent gains continue to outrun general inflation. The Consumer Price Index for rent of primary residence was up 3.7% year-over-year in the third quarter of 2019, far outpacing the 1.1% increase in prices for all non-housing items over the same period. This brought the number of consecutive quarters of real rent growth to 29, the second-longest streak in records dating back to the 1940s.

RealPage reports that apartment rents in 142 of 150 metros rose from the third quarter of 2018 to the third quarter of 2019.

Thanks to strong growth in the number of high-income renters, the share of renters with cost burdens—i.e., those paying more than 30% of their household incomes for rent—fell more noticeably from a peak of 50.7% in 2011 to 47.4% in 2017, followed by a modest 0.1 percentage point increase in 2018. That year, there were six million more cost-burdened renters than in 2001 and the cost-burdened share was nearly 7 percentage points higher.

Meanwhile, 10.9 million renters—or one in four—spent more than half their incomes on housing in 2018.

Even as the overall share of cost-burdened renters has receded somewhat, the share of middle-income renters paying more than 30% of income for housing has steadily risen. While the improving economy has increased the share of middle-income renters, earnings growth has not caught up with the rise in rents.

Housing expense is also a burden that a sizable number of people simply can’t bear. After falling for six straight years, the number of people experiencing homelessness nationwide turned upward in 2016–2018, to 552,830. Much of this reversal reflects an 18,110 jump in the number of homeless individuals living outside or in places not intended for human habitation, with particularly large increases in the high-cost states of California, Oregon, and Washington.

Climate change is also playing havoc on the country’s housing landscape. The Joint Center estimates that 10.5 million renter households—one quarter of the total—live in zip codes with at least $1 million in home and business losses in 2008–2018 due to natural disasters.

As the nation’s rental affordability crisis evolves, efforts to address these challenges must evolve as well, the Joint Center states. However, the federal response has not kept up with need. HUD budget outlays for rental assistance programs grew from $37.4 billion in 2013 to $40.3 billion in 2018 in real terms, an average annual increase of just 1.5%. The shortfall in federal spending leaves about 75% of the 17.6 million eligible households without rental assistance.

State and local programs have attempted to fill these gaps in assistance by targeting low-income households without access to federal support. Chief among their efforts has been the issuance of $4.8 billion in tax-exempt bonds for multifamily housing in 2017–2018. Local governments have also passed reforms that mandate or incentivize new construction of affordable units, and 510 jurisdictions nationwide now have inclusionary zoning.

Related Stories

| Mar 11, 2011

Texas A&M mixed-use community will focus on green living

HOK, Realty Appreciation, and Texas A&M University are working on the Urban Living Laboratory, a 1.2-million-sf mixed-use project owned by the university. The five-phase, live-work-play project will include offices, retail, multifamily apartments, and two hotels.

| Mar 1, 2011

How to make rentals more attractive as the American dream evolves, adapts

Roger K. Lewis, architect and professor emeritus of architecture at the University of Maryland, writes in the Washington Post about the rising market demand for rental housing and how Building Teams can make these properties a desirable choice for consumer, not just an economically prudent and necessary one.

| Feb 15, 2011

New Orleans' rebuilt public housing architecture gets mixed reviews

The architecture of New Orleans’ new public housing is awash with optimism about how urban-design will improve residents' lives—but the changes are based on the idealism of an earlier era that’s being erased and revised.

| Feb 11, 2011

Chicago high-rise mixes condos with classrooms for Art Institute students

The Legacy at Millennium Park is a 72-story, mixed-use complex that rises high above Chicago’s Michigan Avenue. The glass tower, designed by Solomon Cordwell Buenz, is mostly residential, but also includes 41,000 sf of classroom space for the School of the Art Institute of Chicago and another 7,400 sf of retail space. The building’s 355 one-, two-, three-, and four-bedroom condominiums range from 875 sf to 9,300 sf, and there are seven levels of parking. Sky patios on the 15th, 42nd, and 60th floors give owners outdoor access and views of Lake Michigan.

| Feb 11, 2011

Sustainable community center to serve Angelinos in need

Harbor Interfaith Services, a nonprofit serving the homeless and working poor in the Harbor Area and South Bay communities of Los Angeles, engaged Withee Malcolm Architects to design a new 15,000-sf family resource center. The architects, who are working pro bono for the initial phase, created a family-centered design that consolidates all programs into a single building. The new three-story space will house a resource center, food pantry, nursery and pre-school, and administrative offices, plus indoor and outdoor play spaces and underground parking. The building’s scale and setbacks will help it blend with its residential neighbors, while its low-flow fixtures, low-VOC and recycled materials, and energy-efficient mechanical equipment and appliances will help it earn LEED certification.

| Feb 11, 2011

Apartment complex caters to University of Minnesota students

Twin Cities firm Elness Swenson Graham Architects designed the new Stadium Village Flats, in the University of Minnesota’s East Bank Campus, with students in mind. The $30 million, six-story residential/retail complex will include 120 furnished apartments with fitness rooms and lounges on each floor. More than 5,000 sf of first-floor retail space and two levels of below-ground parking will complete the complex. Opus AE Group Inc., based in Minneapolis, will provide structural engineering services.

| Jan 27, 2011

Perkins Eastman's report on senior housing signals a changing market

Top international design and architecture firm Perkins Eastman is pleased to announce that the Perkins Eastman Research Collaborative recently completed the “Design for Aging Review 10 Insights and Innovations: The State of Senior Housing” study for the American Institute of Architects (AIA). The results of the comprehensive study reflect the changing demands and emerging concepts that are re-shaping today’s senior living industry.

| Jan 21, 2011

Harlem facility combines social services with retail, office space

Harlem is one of the first neighborhoods in New York City to combine retail with assisted living. The six-story, 50,000-sf building provides assisted living for residents with disabilities and a nonprofit group offering services to minority groups, plus retail and office space.

| Jan 21, 2011

Nothing dinky about these residences for Golden Gophers

The Sydney Hall Student Apartments combines 125 student residences with 15,000 sf of retail space in the University of Minnesota’s historic Dinkytown neighborhood, in Minneapolis.

| Jan 21, 2011

Revamped hotel-turned-condominium building holds on to historic style

The historic 89,000-sf Hotel Stowell in Los Angeles was reincarnated as the El Dorado, a 65-unit loft condominium building with retail and restaurant space. Rockefeller Partners Architects, El Segundo, Calif., aimed to preserve the building’s Gothic-Art Nouveau combination style while updating it for modern living.