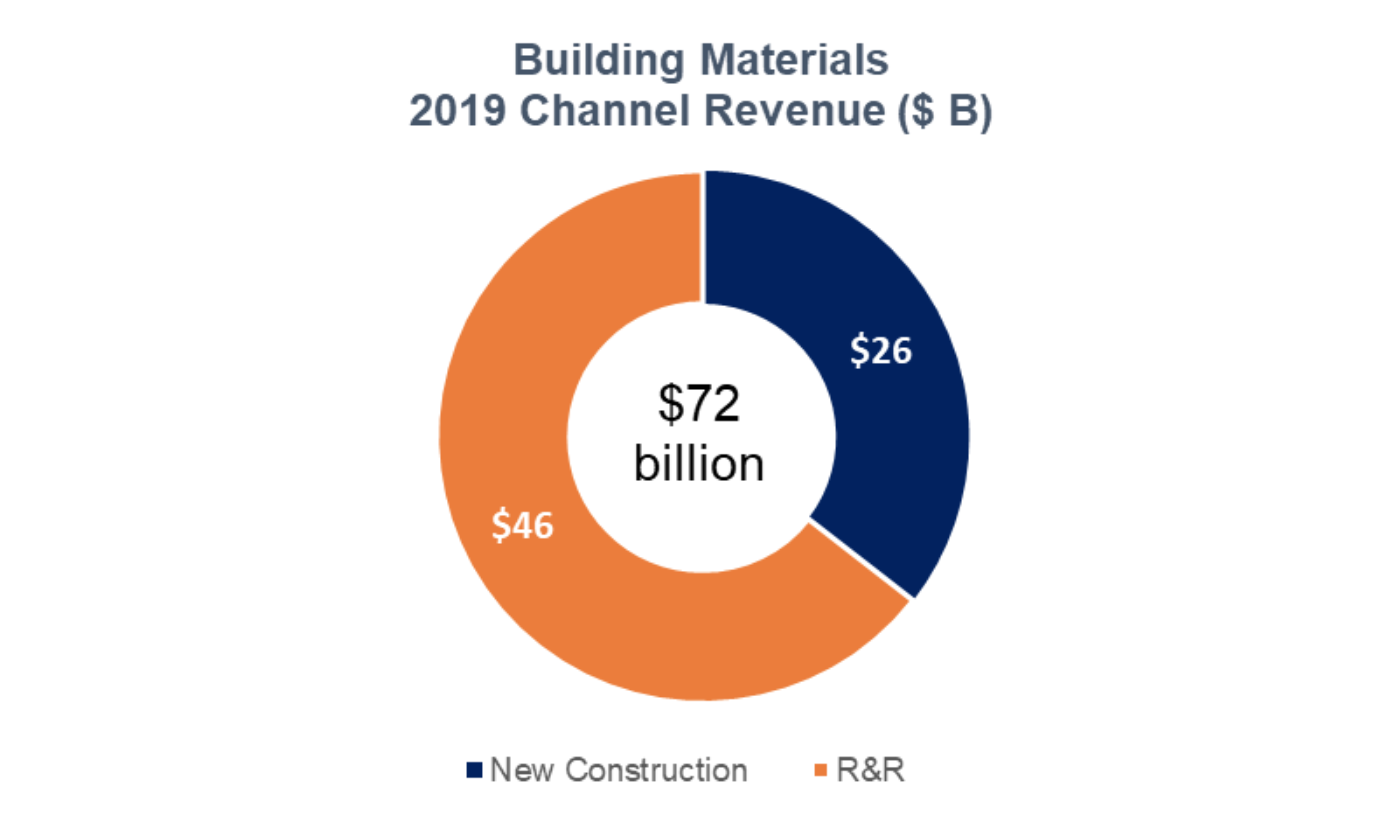

Principia, a provider of business insights to the building materials and business construction industry, tracks $72 billion of residential revenue sold in selected building product categories (roofing, siding, exterior trim, windows, doors, decking, railing, and insulation) through the lumber and building materials (LBM) channel in 2019. Remodeling and repair represented $46 billion (over 64%) of channel revenues, with new construction accounting for $26 billion.

Principia's has issued a bulletin on COVID-19 impact on LBM distribution.

MOST LBM DISTRIBUTORS ARE STILL OPEN FOR BUSINESS

Distributors are open for business, with most states also deeming them essential.

- Most distributors are not experiencing material shortages, except in areas like personal protection equipment and some stuff from China.

- Deliveries from suppliers are proceeding apace. Some distributors have heard from dealers that they would like to push April deliveries to May. If this activity is widespread, distributor inventory levels will start rising, leading to a pullback on orders from suppliers.Focusing on inventories and receivables. Distributors are staying in touch with their dealer customers and watching their accounts receivables and destocking efforts at the same time they are watching their own accounts receivables and inventory levels.

- Distributors are staying in touch with their dealer customers and watching their accounts receivables and destocking efforts.

- Areas with higher concentrations of COVID-19 cases are reporting more disruptions. Distributors overexposed to a state where construction has not been exempted are faring less well than their counterparts.

MOST STATES DEEM LBM DEALERS 'ESSENTIAL BUSINESSES'

Most states have deemed building materials dealerships essential, so most dealers are open for business.

Most have made changes to operate safely—reduced store hours, limitation on the number of people entering the building at one time, more reliance on curbside pickup and online orders with store pickup.

Small dealers in states where construction has not been exempted from stay-at-home restrictions are faring worse than those in other states. Dealers are watching inventory levels and are slowing restocking of slow-moving products.

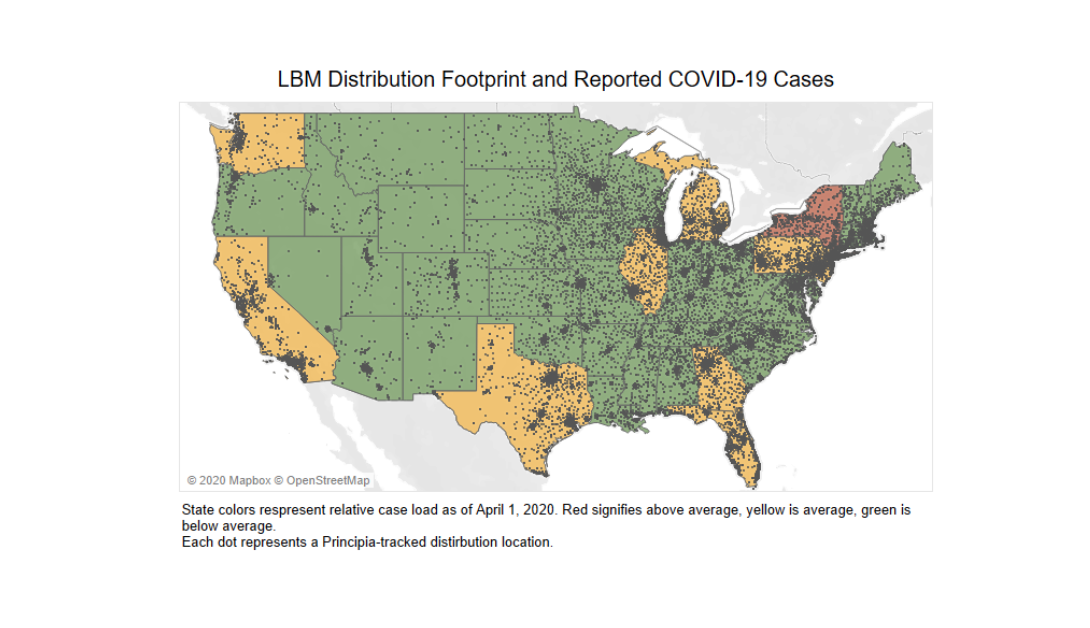

This map correlates COVID-19 intensity with LBM distribution tracked by Principia:

State colors indicate relative COVID-19 case load as of 04-02-01: red, above average; yellow, average; green, below average. Dots represent Principia-tracked locations. Map © 2020 Mapbox © OpenStreetMap Source: Principia

Related Stories

Coronavirus | May 7, 2020

White paper clarifies steps, roles for use of metal composite material

Responsibilities of manufacturers, distributors, and fabricators outlined.

Coronavirus | May 7, 2020

Architects release new resource for safer re-occupancy of buildings

The American Institute of Architects (AIA) is releasing a new Re-occupancy Assessment Tool today that provides strategies for limiting exposure to COVID-19 in buildings.

Coronavirus | May 6, 2020

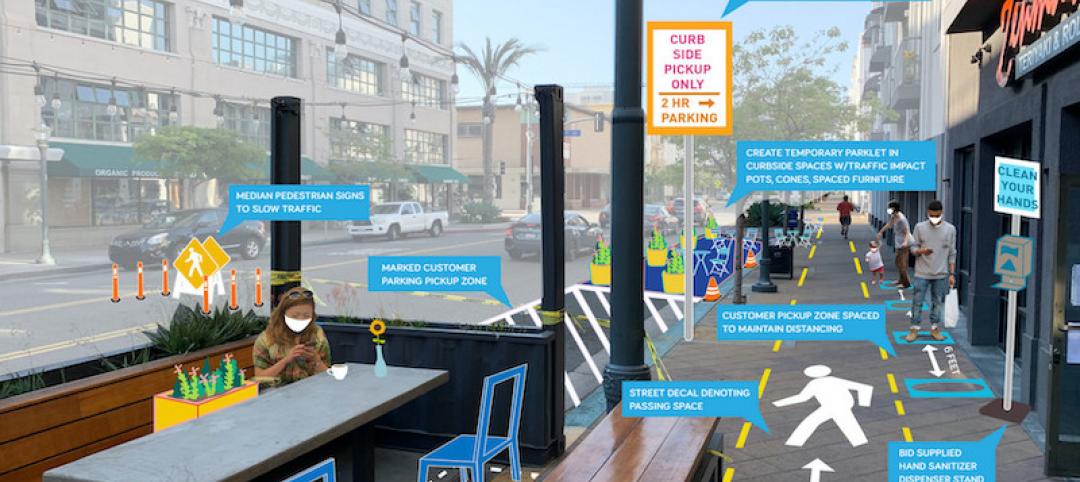

Reopening Main Street post-COVID-19 quarantine

Cities and communities will need to adjust public space to allow customers back in with distancing in mind.

Coronavirus | May 6, 2020

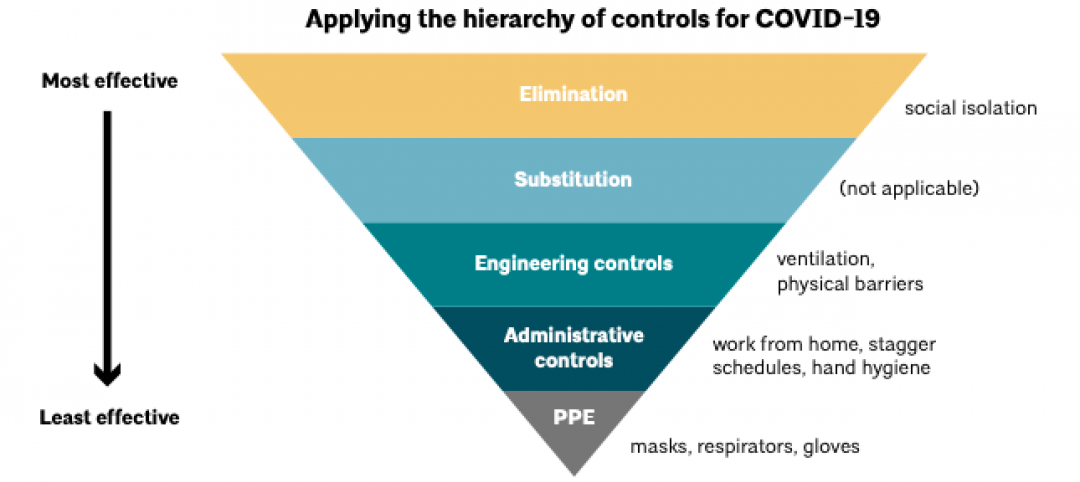

Making jobsites safer in the COVID-19 world

A leading construction manager and installer certification alliance share their insights.

Coronavirus | May 6, 2020

National Construction Association and Procore to release new data showing the impacts of the coronavirus on the constructionindustry

Data will be released on Friday, may 8 at 12 pm EDT.

Healthcare Facilities | May 5, 2020

Holt Construction, U.S. Army Corps of Engineers complete temporary hospital in two weeks

The project is located in Paramus, N.J.

Coronavirus | May 5, 2020

How will COVID-19 change the procurement of professional design services?

We can use this moment as a test-case to build greater flexibility into how we pursue, win and deliver capital projects, better preparing the industry to meet the next disruption.

Coronavirus | May 4, 2020

Design steps for reopening embattled hotels

TPG Architecture recommends post-coronavirus changes in three stages.

Coronavirus | Apr 30, 2020

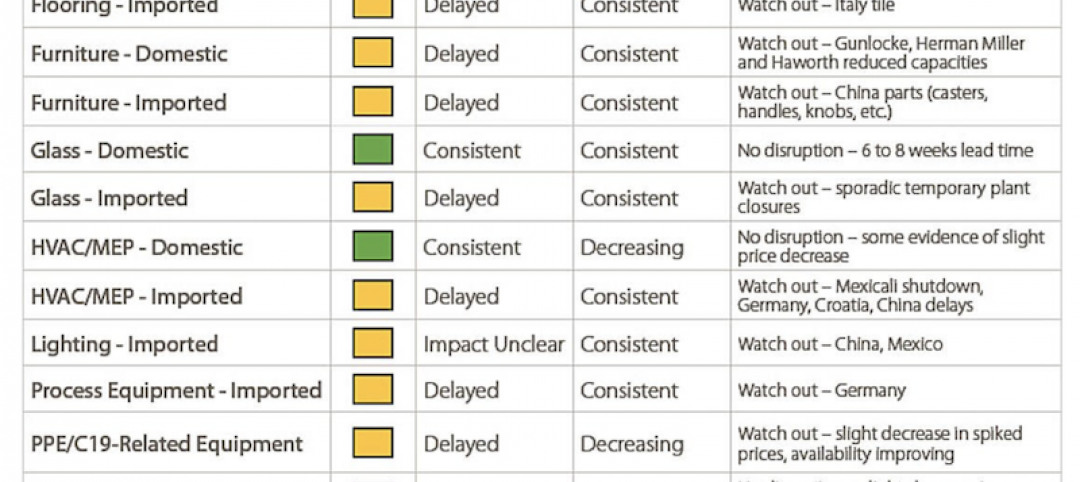

Gilbane shares supply-chain status of products affected by coronavirus

Imported products seem more susceptible to delays

Coronavirus | Apr 26, 2020

PCL Construction rolls out portable coronavirus testing centers

The prefabricated boxes offer walk-up and drive-thru options.