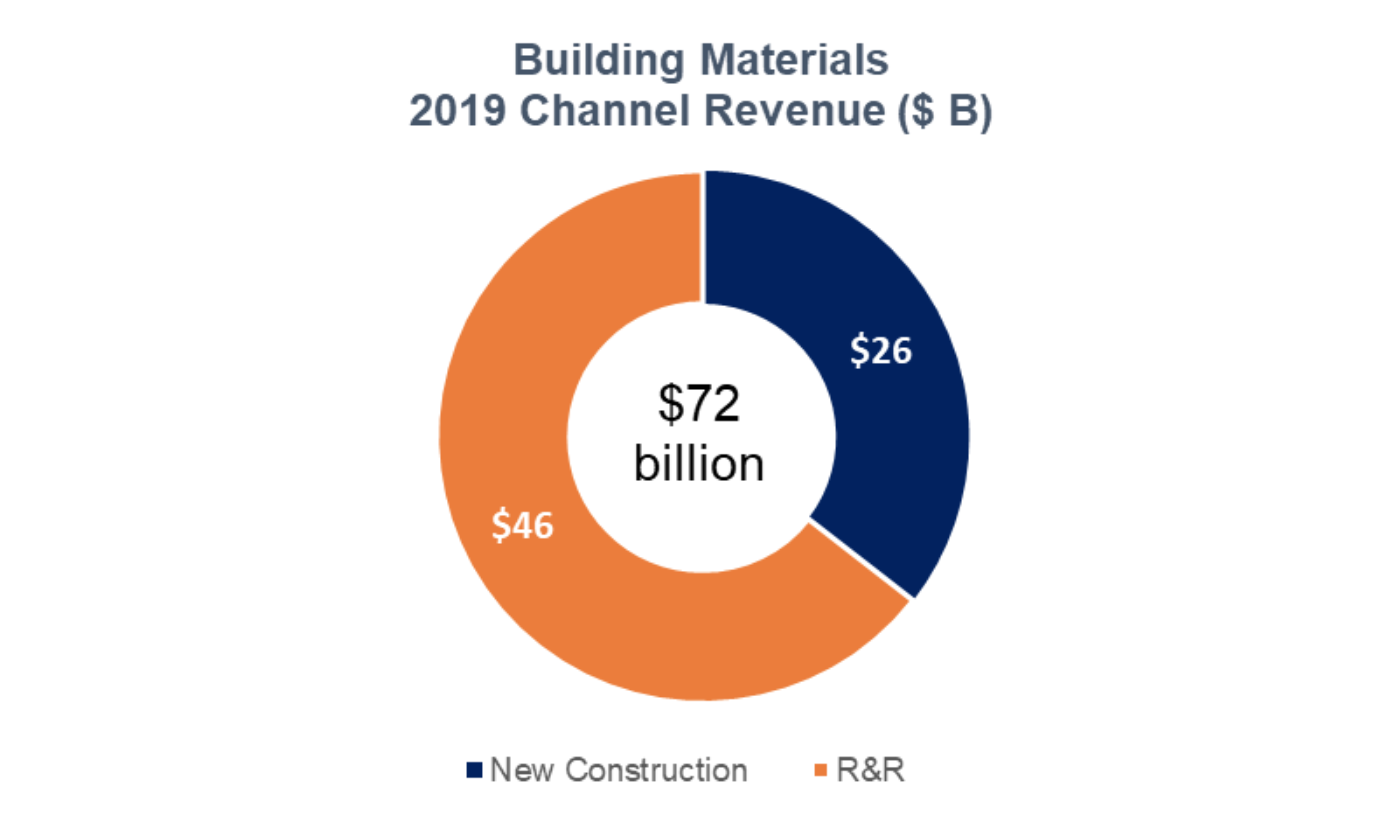

Principia, a provider of business insights to the building materials and business construction industry, tracks $72 billion of residential revenue sold in selected building product categories (roofing, siding, exterior trim, windows, doors, decking, railing, and insulation) through the lumber and building materials (LBM) channel in 2019. Remodeling and repair represented $46 billion (over 64%) of channel revenues, with new construction accounting for $26 billion.

Principia's has issued a bulletin on COVID-19 impact on LBM distribution.

MOST LBM DISTRIBUTORS ARE STILL OPEN FOR BUSINESS

Distributors are open for business, with most states also deeming them essential.

- Most distributors are not experiencing material shortages, except in areas like personal protection equipment and some stuff from China.

- Deliveries from suppliers are proceeding apace. Some distributors have heard from dealers that they would like to push April deliveries to May. If this activity is widespread, distributor inventory levels will start rising, leading to a pullback on orders from suppliers.Focusing on inventories and receivables. Distributors are staying in touch with their dealer customers and watching their accounts receivables and destocking efforts at the same time they are watching their own accounts receivables and inventory levels.

- Distributors are staying in touch with their dealer customers and watching their accounts receivables and destocking efforts.

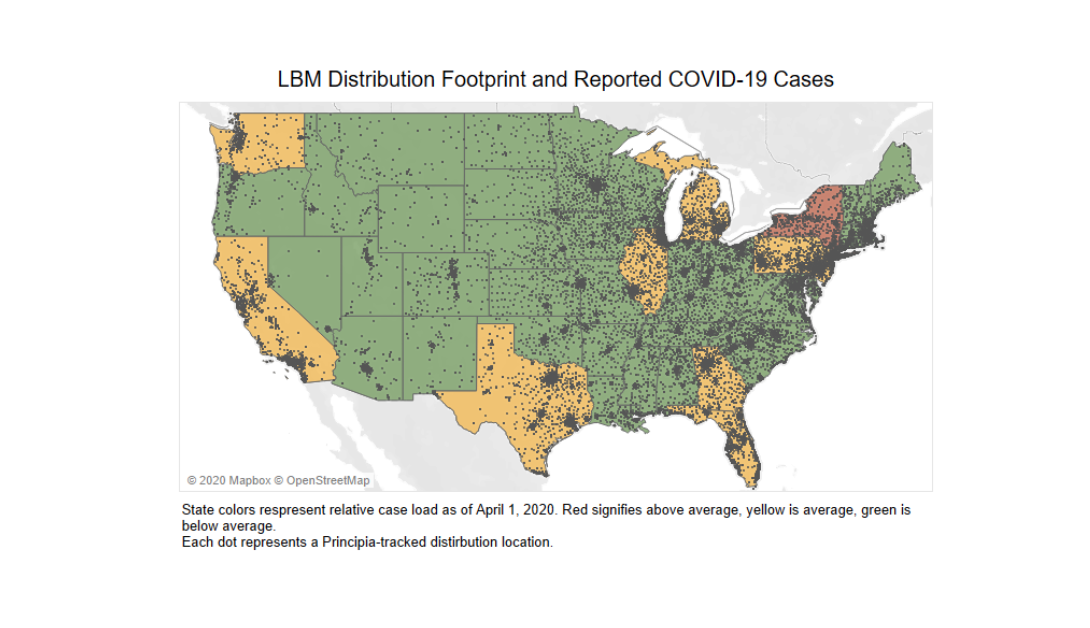

- Areas with higher concentrations of COVID-19 cases are reporting more disruptions. Distributors overexposed to a state where construction has not been exempted are faring less well than their counterparts.

MOST STATES DEEM LBM DEALERS 'ESSENTIAL BUSINESSES'

Most states have deemed building materials dealerships essential, so most dealers are open for business.

Most have made changes to operate safely—reduced store hours, limitation on the number of people entering the building at one time, more reliance on curbside pickup and online orders with store pickup.

Small dealers in states where construction has not been exempted from stay-at-home restrictions are faring worse than those in other states. Dealers are watching inventory levels and are slowing restocking of slow-moving products.

This map correlates COVID-19 intensity with LBM distribution tracked by Principia:

State colors indicate relative COVID-19 case load as of 04-02-01: red, above average; yellow, average; green, below average. Dots represent Principia-tracked locations. Map © 2020 Mapbox © OpenStreetMap Source: Principia

Related Stories

Coronavirus | Jun 12, 2020

BD+C launches 'The Weekly,' a streaming program for the design and construction industry

The first episode, now available on demand, features experts from Robins & Morton, Gensler, and FMI on the current state of the AEC market.

Coronavirus | Jun 9, 2020

Going viral: How the coronavirus pandemic could change the built environment

Architecture and construction firms—and their clients—are asking new questions about infection control as it pertains to people assembly, building wellness, and technology.

Fire and Life Safety | Jun 9, 2020

NFPA develops business reopening checklist for fire and life safety measures

The new checklist helps building owners and facility managers ensure fire and life safety as businesses prepare to re-open amid the coronavirus pandemic.

Coronavirus | Jun 9, 2020

CannonDesign unveils COVID Shield

As the world evolves its response to the COVID-19 pandemic, one clear reality is testing for the virus will be part of our daily lives for the foreseeable future.

Coronavirus | Jun 5, 2020

3 strategies to improve the wellness of building systems and gain tenant trust

Three operational issues that must be prioritized for every building in order to achieve tenant trust are air quality/ventilation, relative humidity, and building commissioning.

Coronavirus | Jun 2, 2020

5 ways to improve hand washing and minimize germs in public restrooms

Bradley Corp. offers five upgrades to make public restrooms more sanitary.

Coronavirus | Jun 2, 2020

Perkins and Will, Healthy Building Network advise against the use of antimicrobial building products

Even during a pandemic, antimicrobial building products may do more harm than good.

Coronavirus | May 30, 2020

A welcoming entry-point for wellness screening anywhere

Modular WorkWell™ ecosystem can process up to 40 people per minute.

Coronavirus | May 29, 2020

Black & Veatch, DPR, Haskell, McCarthy launch COVID-19 construction safety coalition

The NEXT Coalition will challenge engineering and construction firms to enhance health and safety amid the Coronavirus pandemic.

Coronavirus | May 28, 2020

Cushman & Wakefield report examines work-at-home pros and cons

The office, now part of a larger workplace ecosystem, still reinforces employees’ connections with their companies.