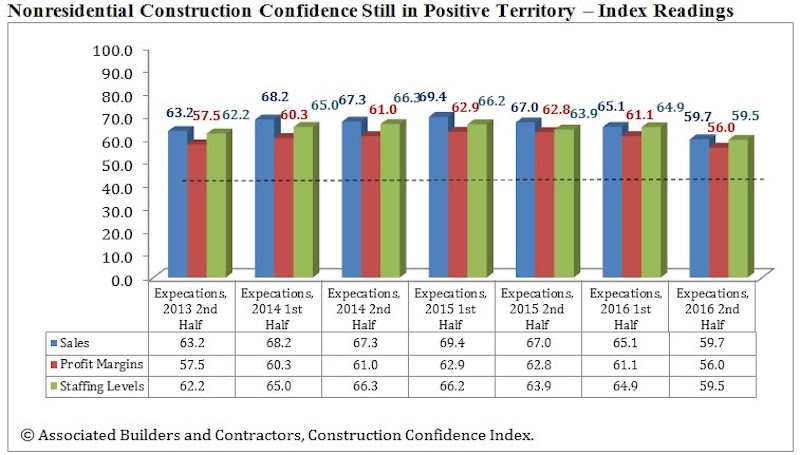

Expectations for 2017 have become less optimistic, but the majority of industrial and commercial construction contractors still expect growth this year, according to the latest Associated Builders and Contractors (ABC) Construction Confidence Index (CCI). Although all three diffusion indices in the survey — profit margins, sales and staffing levels—fell by more than five points, they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

The latest survey revealed that:

- The CCI for sales expectations fell from 65.1 to 59.7;

- The CCI for profit margin expectations fell from 61.1 to 56;

- The CCI for staffing levels fell from 64.9 to 59.5.

“There may be a period during which the pro-business agenda being forwarded in Washington, D.C., will significantly impact construction firm expectations,” says ABC Chief Economist Anirban Basu in a release. “In fact, many construction executives have become more confident, including those who would stand to benefit most directly from an infrastructure package. However, there is a realization among construction firms that, if implemented, many of these pro-business initiatives would begin impacting the economy beyond the six-month timeframe built into ABC’s construction confidence survey.

“Despite an ongoing dearth of public construction spending growth, certain construction segments have experienced significant expansion over time, including office, hotel, healthcare and multifamily segments,” says Basu. “This helps explain why more than 60% of respondents expect their sales to rise during early 2017 and the same number expect staffing levels to rise.

“Respondents from Florida and other rapidly growing states are reporting significant shortages of appropriately skilled workers, which is helping to drive compensation costs higher,” says Basu. “This helps explain why fewer than half (48%) of respondents now expect profit margins to climb. That is down from 54% from the previous CCI, supporting the proposition that the construction skills shortfall has worsened over the past six months.

“For now, confidence appears to be supported less by policymaking than by the ongoing momentum of the U.S. construction industry,” says Basu. “Going forward, confidence is likely to depend more intensely on the new administration’s capacity to move its pro-business agenda from theory to practice.”

The following chart reflects the distribution of responses to ABC’s most recent surveys.

Related Stories

Market Data | Jun 16, 2021

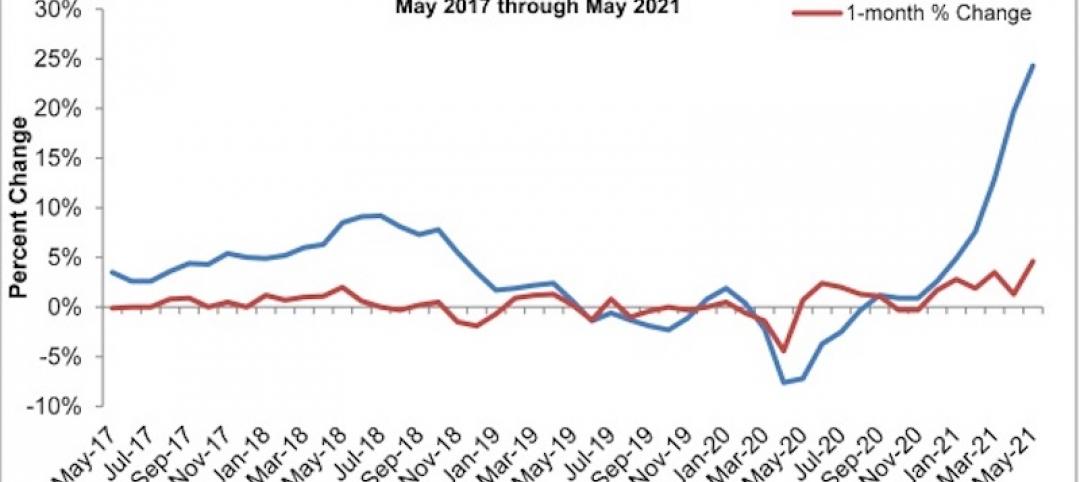

Construction input prices rise 4.6% in May; softwood lumber prices up 154% from a year ago

Construction input prices are 24.3% higher than a year ago, while nonresidential construction input prices increased 23.9% over that span.

Market Data | Jun 16, 2021

Producer prices for construction materials and services jump 24% over 12 months

The 24.3% increase in prices for materials used in construction from May 2020 to last month was nearly twice as great as in any previous year

Market Data | Jun 15, 2021

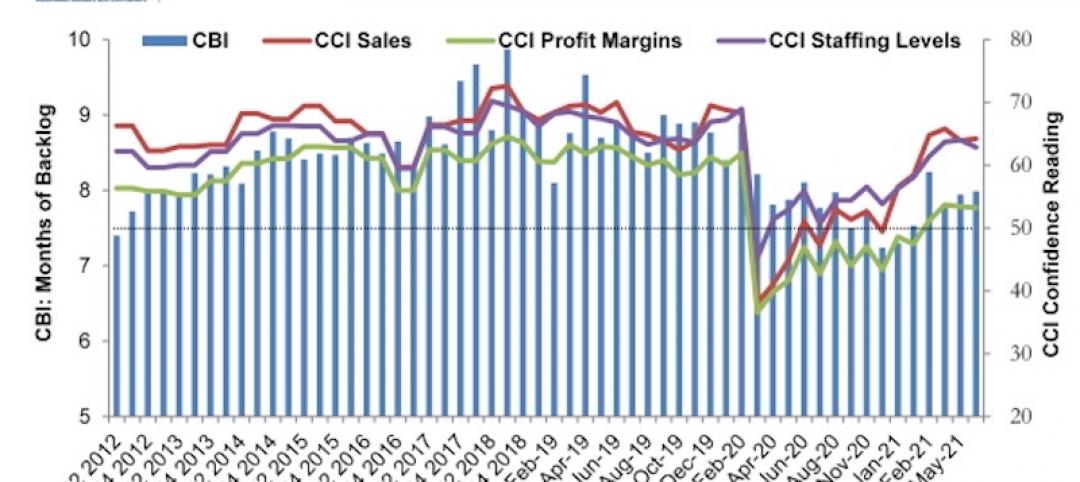

ABC’s Construction Backlog inches higher in May

Materials and labor shortages suppress contractor confidence.

Market Data | Jun 11, 2021

The countries with the most green buildings

As the country that set up the LEED initiative, the US is a natural leader in constructing green buildings.

Market Data | Jun 7, 2021

Construction employment slips by 20,000 in May

Seasonally adjusted construction employment in May totaled 7,423,000.

Market Data | Jun 2, 2021

Construction employment in April lags pre-covid February 2020 level in 107 metro areas

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 14-month construction job losses.

Market Data | Jun 1, 2021

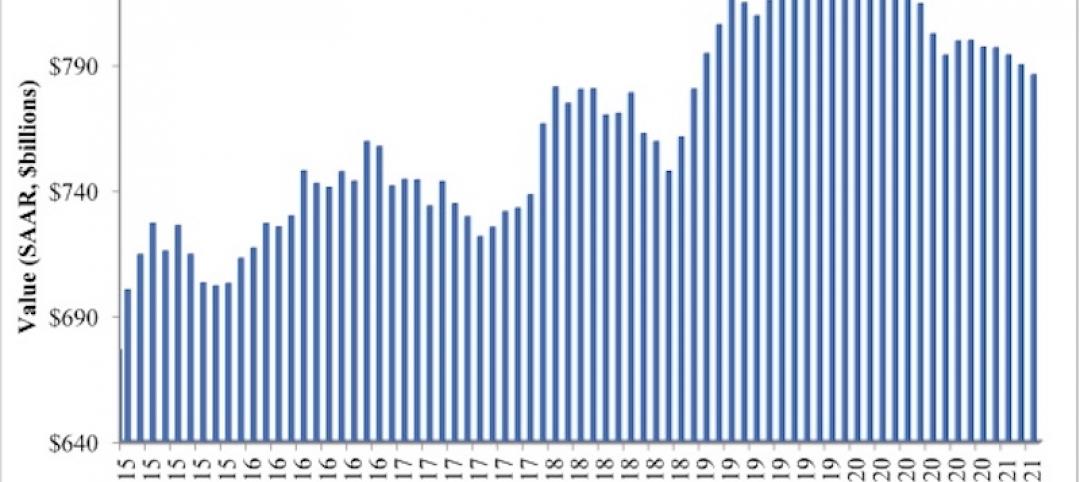

Nonresidential construction spending decreases 0.5% in April

Spending was down on a monthly basis in nine of 16 nonresidential subcategories.

Market Data | Jun 1, 2021

Nonresidential construction outlays drop in April to two-year low

Public and private work declines amid supply-chain woes, soaring costs.

Market Data | May 24, 2021

Construction employment in April remains below pre-pandemic peak in 36 states and D.C.

Texas and Louisiana have worst job losses since February 2020, while Utah and Idaho are the top gainers.

Market Data | May 19, 2021

Design activity strongly increases

Demand signals construction is recovering.