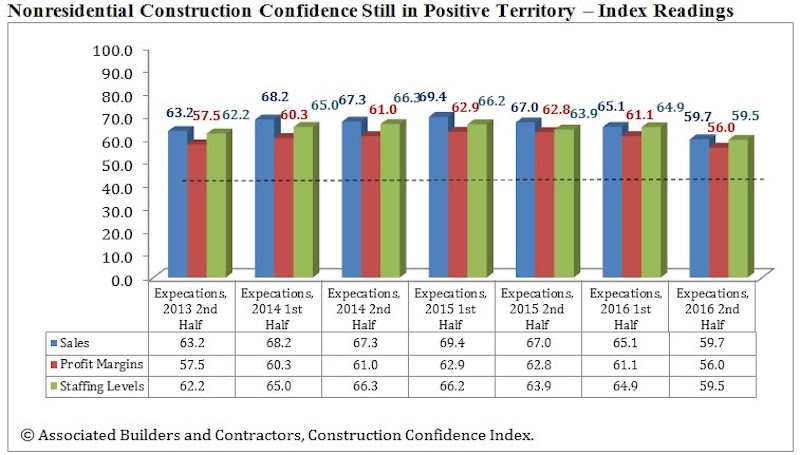

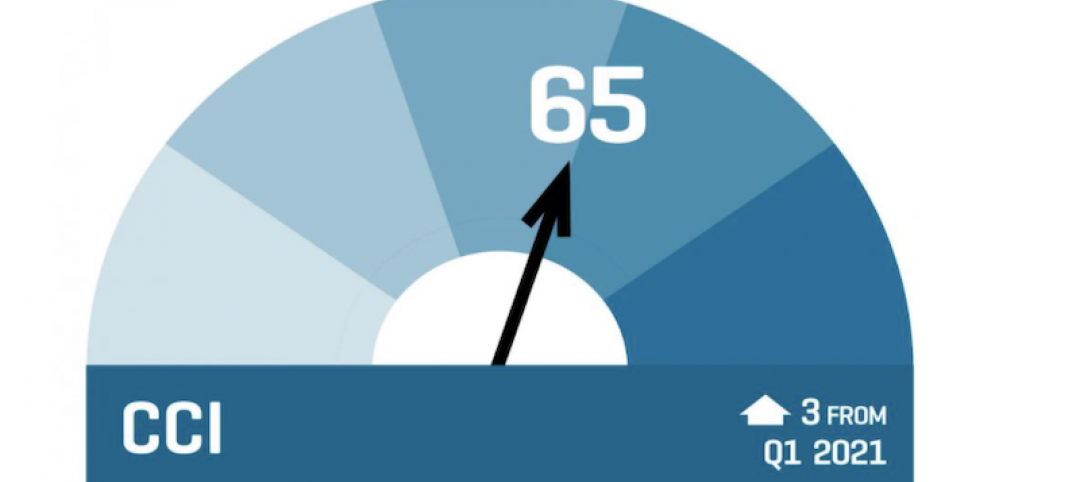

Expectations for 2017 have become less optimistic, but the majority of industrial and commercial construction contractors still expect growth this year, according to the latest Associated Builders and Contractors (ABC) Construction Confidence Index (CCI). Although all three diffusion indices in the survey — profit margins, sales and staffing levels—fell by more than five points, they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

The latest survey revealed that:

- The CCI for sales expectations fell from 65.1 to 59.7;

- The CCI for profit margin expectations fell from 61.1 to 56;

- The CCI for staffing levels fell from 64.9 to 59.5.

“There may be a period during which the pro-business agenda being forwarded in Washington, D.C., will significantly impact construction firm expectations,” says ABC Chief Economist Anirban Basu in a release. “In fact, many construction executives have become more confident, including those who would stand to benefit most directly from an infrastructure package. However, there is a realization among construction firms that, if implemented, many of these pro-business initiatives would begin impacting the economy beyond the six-month timeframe built into ABC’s construction confidence survey.

“Despite an ongoing dearth of public construction spending growth, certain construction segments have experienced significant expansion over time, including office, hotel, healthcare and multifamily segments,” says Basu. “This helps explain why more than 60% of respondents expect their sales to rise during early 2017 and the same number expect staffing levels to rise.

“Respondents from Florida and other rapidly growing states are reporting significant shortages of appropriately skilled workers, which is helping to drive compensation costs higher,” says Basu. “This helps explain why fewer than half (48%) of respondents now expect profit margins to climb. That is down from 54% from the previous CCI, supporting the proposition that the construction skills shortfall has worsened over the past six months.

“For now, confidence appears to be supported less by policymaking than by the ongoing momentum of the U.S. construction industry,” says Basu. “Going forward, confidence is likely to depend more intensely on the new administration’s capacity to move its pro-business agenda from theory to practice.”

The following chart reflects the distribution of responses to ABC’s most recent surveys.

Related Stories

Market Data | Jul 19, 2021

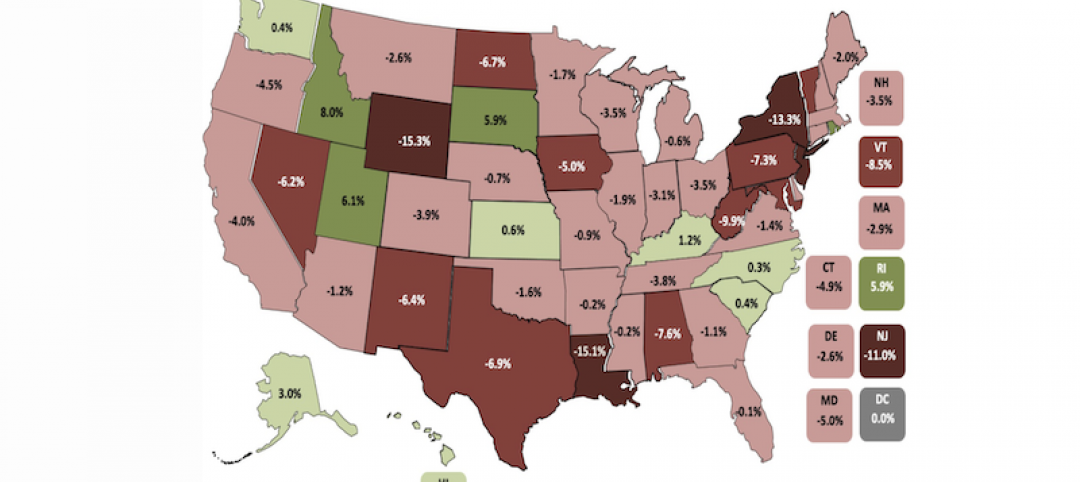

Construction employment trails pre-pandemic level in 39 states

Supply chain challenges, rising materials prices undermine demand.

Market Data | Jul 15, 2021

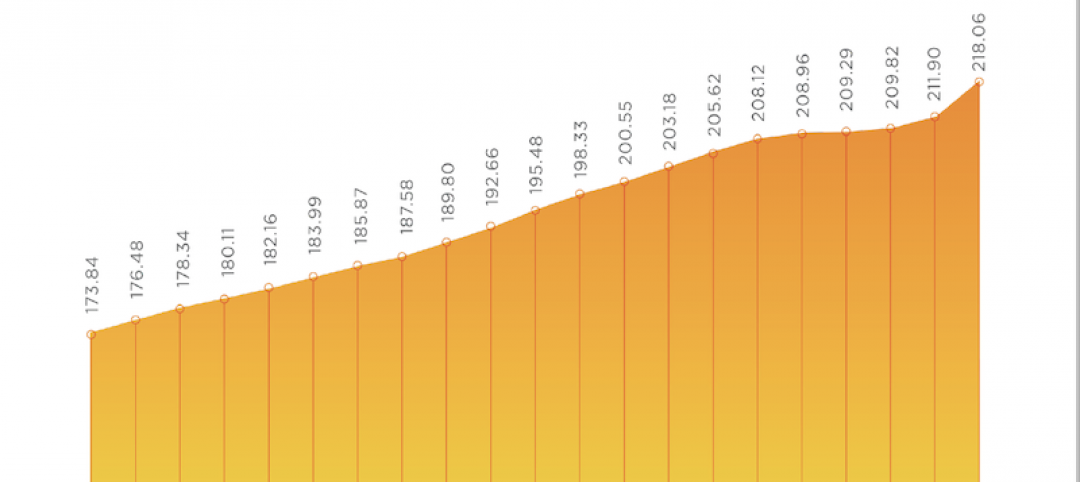

Producer prices for construction materials and services soar 26% over 12 months

Contractors cope with supply hitches, weak demand.

Market Data | Jul 13, 2021

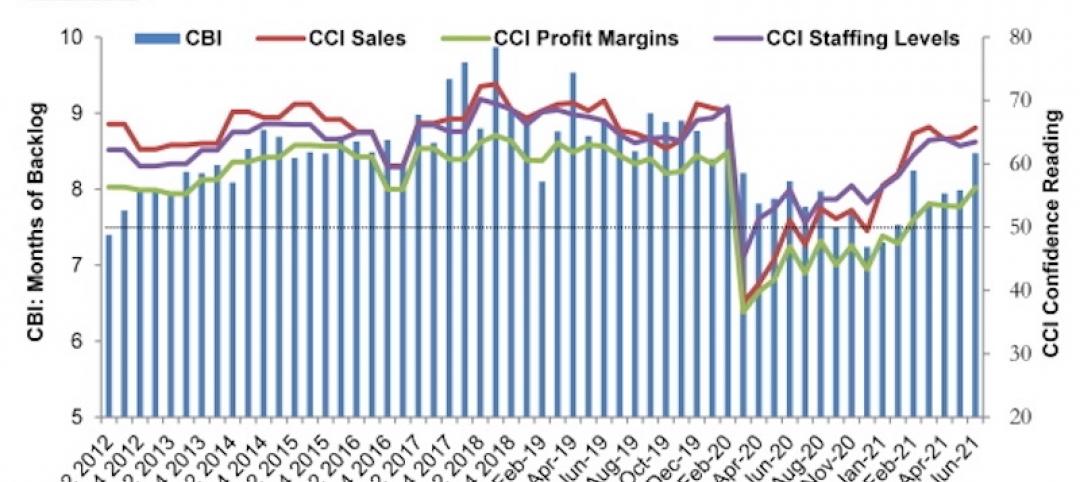

ABC’s Construction Backlog Indicator and Contractor Confidence Index rise in June

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased modestly in June.

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Market Data | Jul 7, 2021

Construction employment declines by 7,000 in June

Nonresidential firms struggle to find workers and materials to complete projects.

Market Data | Jun 30, 2021

Construction employment in May trails pre-covid levels in 91 metro areas

Firms struggle to cope with materials, labor challenges.

Market Data | Jun 23, 2021

Construction employment declines in 40 states between April and May

Soaring material costs, supply-chain disruptions impede recovery.

Market Data | Jun 22, 2021

Architecture billings continue historic rebound

AIA’s Architecture Billings Index (ABI) score for May rose to 58.5 compared to 57.9 in April.

Market Data | Jun 17, 2021

Commercial construction contractors upbeat on outlook despite worsening material shortages, worker shortages

88% indicate difficulty in finding skilled workers; of those, 35% have turned down work because of it.