Both Nonresidential and Residential Spending Retreat from January Levels amid Extreme Winter Weather; Association Posts Inflation Alert to Aid Understanding of Squeeze on Nonresidential Construction Firms

Construction spending slumped in February as unseasonably severe weather hammered the industry and a decline in new projects squeezed nonresidential contractors experiencing rising costs and delivery times, according to an analysis of new federal construction spending data by the Associated General Contractors of America. The association posted a Construction Inflation Alert to inform project owners and government officials about the threat to project completion dates and contractors’ financial health.

“The downturn in February reflects both an unfavorable change from mild January weather and an ongoing decline in new nonresidential projects,” said Ken Simonson, the association’s chief economist. “Unfortunately, it will take more than mild weather to help nonresidential contractors overcome the multiple challenges of falling demand for many project types, steeply rising costs, and lengthening or uncertain delivery times for key materials.”

Construction spending in February totaled $1.52 trillion at a seasonally adjusted annual rate, a decrease of 0.8% from the pace in January. Although the overall total was 5.3% higher than in February 2020, the year-over-year gain was limited to residential construction, Simonson noted. That segment slipped 0.2% for the month but jumped 21% year-over-year. Meanwhile, combined private and public nonresidential spending declined 1.3% from January and 6.1% over 12 months.

Private nonresidential construction spending fell 1.0% from January to February and 9.7% since February 2020, with year-over-year decreases in all 11 subsegments. The largest private nonresidential category, power construction, retreated 9.7% year-over-year and 0.4% from January to February. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—slumped 7.1% year-over-year and 1.2% for the month. Manufacturing construction tumbled 10.4% from a year earlier despite a pickup of 0.3% in February. Office construction decreased 5.0% year-over-year and 0.5% in February.

Public construction spending dipped 0.9% year-over-year and 1.7% for the month. Among the largest segments, highway and street construction declined 1.0% from a year earlier and 0.6% for the month, while educational construction decreased 2.3 percent year-over-year and 3.2 percent in February. Spending on transportation facilities declined 2.3 percent over 12 months and 2.5 percent in February.

Association officials said that rising materials prices and unreliable delivery schedules are making it hard for firms to remain profitable as they have difficulty passing raising prices for construction work. They said that proposed new infrastructure projects will help boost demand for many types of construction projects. But they urged Washington officials to also take steps to address supply-chain challenges, including by ending tariffs on key materials like lumber and steel.

“Contractors are having a hard time finding work, and when they do, they are getting squeezed by rapidly rising materials prices,” said Stephen E. Sandherr, the association’s chief executive officer. “New infrastructure investments will certainly help with demand, but the industry also needs Washington to help address supply-chain problems and rising costs.”

Related Stories

Student Housing | Feb 21, 2024

Student housing preleasing continues to grow at record pace

Student housing preleasing continues to be robust even as rent growth has decelerated, according to the latest Yardi Matrix National Student Housing Report.

Architects | Feb 21, 2024

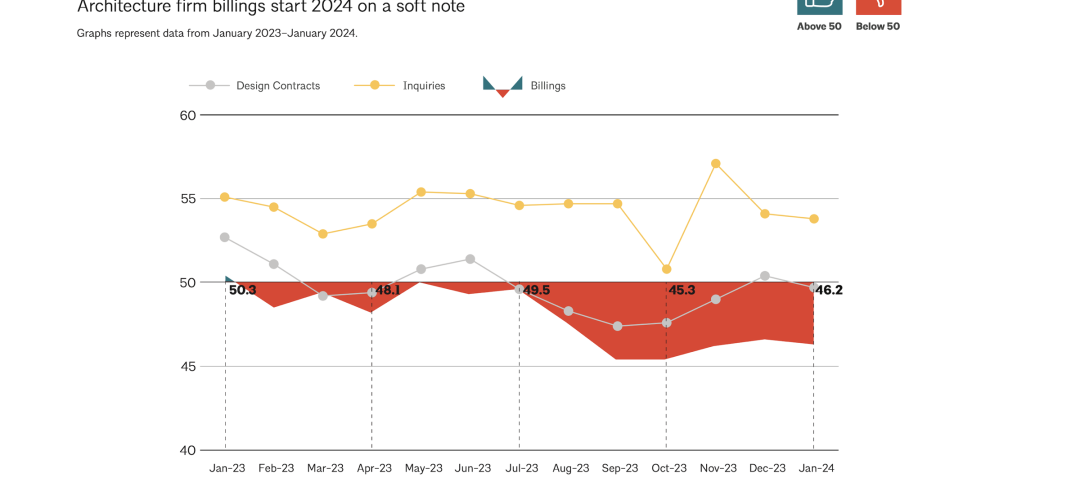

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Student Housing | Feb 13, 2024

Student housing market expected to improve in 2024

The past year has brought tough times for student housing investment sales due to unfavorable debt markets. However, 2024 offers a brighter outlook if debt conditions improve as predicted.

Contractors | Feb 13, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of January 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Industry Research | Jan 31, 2024

ASID identifies 11 design trends coming in 2024

The Trends Outlook Report by the American Society of Interior Designers (ASID) is the first of a three-part outlook series on interior design. This design trends report demonstrates the importance of connection and authenticity.

Apartments | Jan 26, 2024

New apartment supply: Top 5 metros delivering in 2024

Nationally, the total new apartment supply amounts to around 1.4 million units—well exceeding the apartment development historical average of 980,000 units.

Self-Storage Facilities | Jan 25, 2024

One-quarter of self-storage renters are Millennials

Interest in self-storage has increased in over 75% of the top metros according to the latest StorageCafe survey of self-storage preferences. Today, Millennials make up 25% of all self-storage renters.