Construction spending increased by 1.4% in August as strong gains in residential construction outweighed decreases in most private nonresidential segments and many public categories, according to an analysis by the Associated General Contractors of America of government data released today. Association officials cautioned that nonresidential construction demand will likely continue to stagnate without new federal measures to offset the economic impacts from the coronavirus.

“The August spending report shows a stark divide between housing and nonresidential markets that appears likely to widen over the coming months,” said Ken Simonson, the association’s chief economist. “With steadily rising business closures and worker layoffs, and growing budget gaps for state and local governments, project cancellations are likely to mount and new starts will dwindle.”

Construction spending in August totaled $1.41 trillion at a seasonally adjusted annual rate, an increase of 1.4% from July’s upwardly revised total. Residential spending jumped by 3.7%, while private and public nonresidential spending inched down by a combined 0.1%.

Private nonresidential construction spending contracted by 0.3% from July to August, with decreases in nine out of 11 categories. The two largest private nonresidential segments, power construction and commercial construction—comprising retail, warehouse and farm structures—each shrank by 1.1%. Among other large segments, manufacturing construction rose 2.2% and office construction slipped 0.3%.

Public construction spending edged up 0.1% in August but eight of 13 categories declined. Despite the increase in August, public construction spending has trended down by 2.5% from its high point in March.

Private residential construction spending increased by 3.7% in August, powered by a 5.5% jump in single-family homebuilding and a 3.0% gain in residential improvements. In contrast, new multifamily construction spending dipped by 0.1% from July.

Association officials noted that demand for nonresidential construction was being impacted by broader economic challenges brought about by the coronavirus. These challenges are impacting demand for many commercial projects while also impacting state and local construction budgets. The construction officials urged Congress and the White House to work together to enact new recovery measures to help boost economic activity and demand for construction.

“One of the biggest challenges facing the construction industry is the lack of demand for many new types of commercial and local infrastructure projects, especially after the current crop of projects is completed,” said Stephen E. Sandherr, the association’s chief executive officer. “Washington officials can give a needed boost to construction demand and employment by boosting infrastructure and putting in place liability protections for firms that are protecting workers from the coronavirus.”

Related Stories

Market Data | Nov 30, 2016

Marcum Commercial Construction Index reports industry outlook has shifted; more change expected

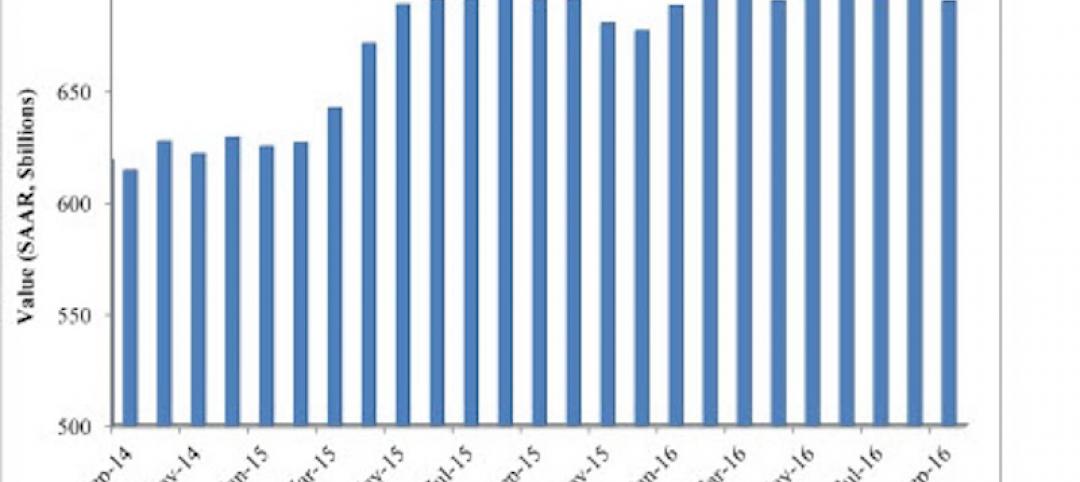

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier.

Industry Research | Nov 30, 2016

Multifamily millennials: Here is what millennial renters want in 2017

It’s all about technology and convenience when it comes to the things millennial renters value most in a multifamily facility.

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Multifamily Housing | Nov 28, 2016

Axiometrics predicts apartment deliveries will peak by mid 2017

New York is projected to lead the nation next year, thanks to construction delays in 2016

Market Data | Nov 22, 2016

Construction activity will slow next year: JLL

Risk, labor, and technology are impacting what gets built.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Nov 11, 2016

Brand marketing: Why the B2B world needs to embrace consumers

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.

Market Data | Nov 2, 2016

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.