Construction spending declined for the fourth consecutive month in June as decreases in single-family, highway and educational projects outweighed increases in several private nonresidential categories, according to an analysis by the Associated General Contractors of America of government data released today. As state and local government face budget deficits, association officials cautioned that investments in infrastructure and other construction projects are likely to continue falling unless Congress and the Trump administration provide additional, targeted and dedicated infrastructure funding.

“Regrettably, the overall downward trend in spending is likely to continue and to spread to more project types as work that began before the pandemic hit finishes up,” said Ken Simonson, the association’s chief economist. “Unless the federal government invests heavily—and promptly—in infrastructure projects, both public and private nonresidential investment are likely to shrink further.”

Construction spending in June totaled $1.36 trillion at a seasonally adjusted annual rate, a decline of 0.7% from May and the lowest total in a year. After reaching a record high in February of $1.44 trillion, total spending has slumped by 6.0%, the steepest four-month contraction in a decade, the economist noted.

Public construction spending decreased by 0.7% in June, dragged down by a 1.7% drop in highway and street construction spending and a 2.7% decline in educational construction spending, the two largest public segments. The next-largest segment, transportation facilities, also contracted, by 0.6%.

Private nonresidential construction spending inched up 0.2% from May to June, led by a gain of 0.7% in the largest segment, power construction. Among other large private spending categories, commercial construction—comprising retail, warehouse and farm structures—slumped 1.3%, while manufacturing construction rose 1.7% and office construction edged up 0.3%.

Private residential construction spending shrank by 1.5% in June as spending on single-family homebuilding plunged 3.6% to its lowest level since late 2016. In contrast, new multifamily construction spending climbed for the third month in a row, posting a 3.0% increase from May.

Association officials said that state and local budgets are getting hammered by declining economic activity related to the ongoing pandemic. They urged Congress and the administration to quickly pass new infrastructure and recovery measures to help reverse the declines in public spending. They added that those new investments would help put many people back to work in good-paying construction careers.

“It will be hard to rebuild the economy if state and local governments lack the resources needed to improve roads, retrofit schools and keep drinking water safe,” said Stephen E. Sandherr, the association’s chief executive officer. “Instead of letting people languish in unemployment, Washington can put people back to work simply by boosting investments in needed infrastructure and other construction projects.”

Related Stories

Market Data | Jun 7, 2016

Global construction disputes took longer to resolve in 2015

The good news: the length and value of disputes in the U.S. fell last year, according to latest Arcadis report.

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

A nascent commercial wireless sensor market is poised to ascend in the next decade

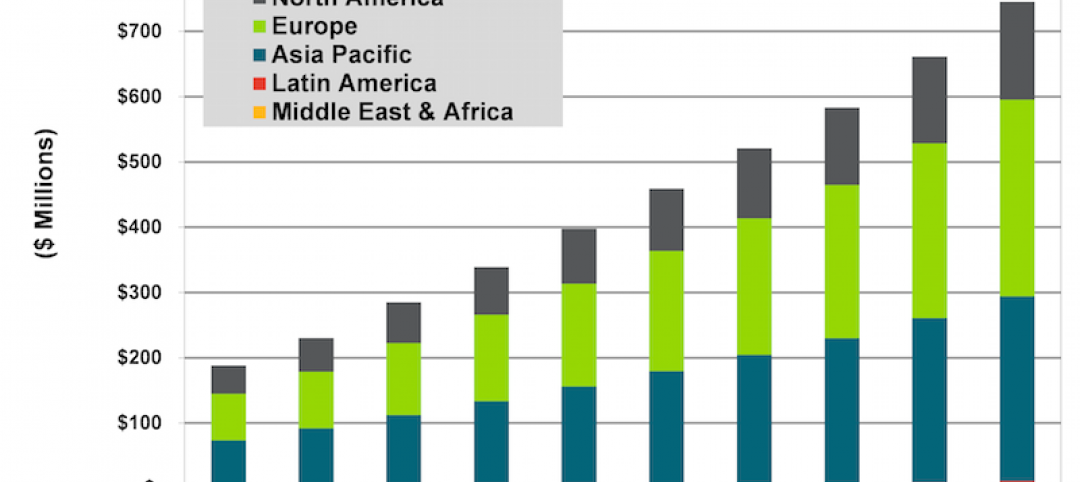

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.