Construction employment increased by 27,000 jobs in November, as continuing robust gains in residential categories masked more sluggish increases in nonresidential jobs, according to an analysis by the Associated General Contractors of America of government data released today. Association officials cautioned, however, that pandemic-induced project cancellations and looming tax bills for firms that used Paycheck Protection Program loans to save jobs threaten to undermine future job growth in the sector.

“The construction industry recovered a bit in November, but the future is far from certain for the industry,” said Ken Simonson, the association’s chief economist. “The nonresidential building and infrastructure segments are likely to shed jobs again amid an increase in coronavirus case counts unless Congress acts quickly to provide needed relief.”

Construction employment climbed to 7,360,000 in November, an increase of 0.4% compared to October. However, employment in the sector remains down by 279,000 or 3.7% since the most recent peak in February. The pandemic initially triggered widespread project cancellations and interruptions that resulted in the loss of 1.1 million construction jobs in March and April.

The disparity between residential and nonresidential construction widened in November, Simonson noted. Residential building and specialty trade contractors added 15,4000 jobs in November and have now recouped 96% of the employment losses they incurred in March and April. In contrast, nonresidential construction employment—comprising nonresidential building, specialty trades, and heavy and civil engineering construction—increased by only 11,900 jobs in November and has recovered only 56% of the jobs lost in March and April.

The industry’s unemployment rate in November was 7.3%, compared to 4.4% in November 2019. A total of 732,000 former construction workers were unemployed, up from 428,000 a year earlier and the highest November total since 2012.

Association officials warned that more projects are likely to be canceled amid a new surge in the pandemic. In addition, firms that used Paycheck Protection Program loans to save jobs face an unexpected tax hit because the Trump administration is defying Congressional intent and opting to tax forgiven loans as income. Without tax relief and other needed recovery measures, the officials warned that November’s modest job gains are likely to be fleeting.

“The Trump administration is seeking to undermine the benefits of the Paycheck Protection Program by rewarding firms that saved jobs with a massive tax increase,” said Stephen E. Sandherr, the association’s chief executive officer. “These new taxes, coming on top of greater market uncertainty as coronavirus cases surge, will make it hard for many construction firms to retain current workers, not to mention add new ones.”

Related Stories

Industry Research | Apr 25, 2023

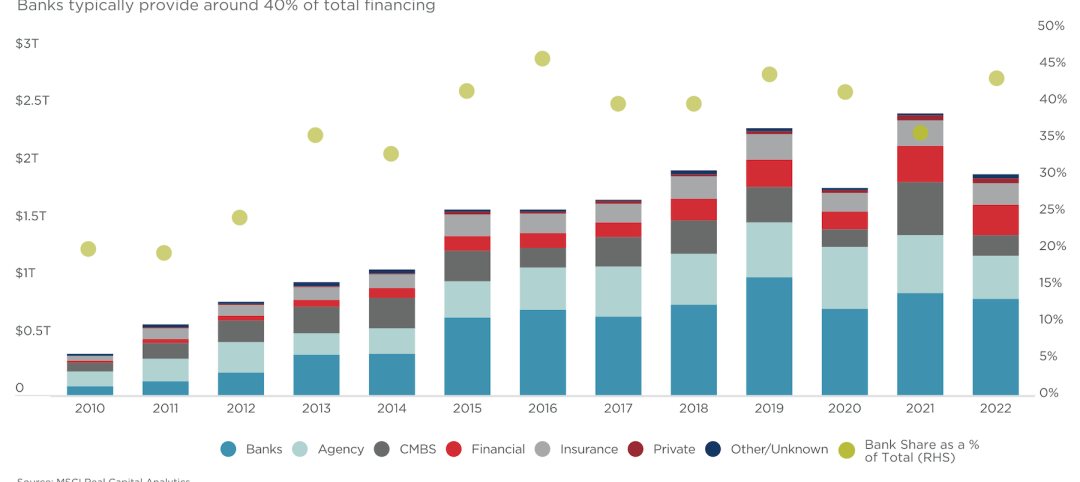

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

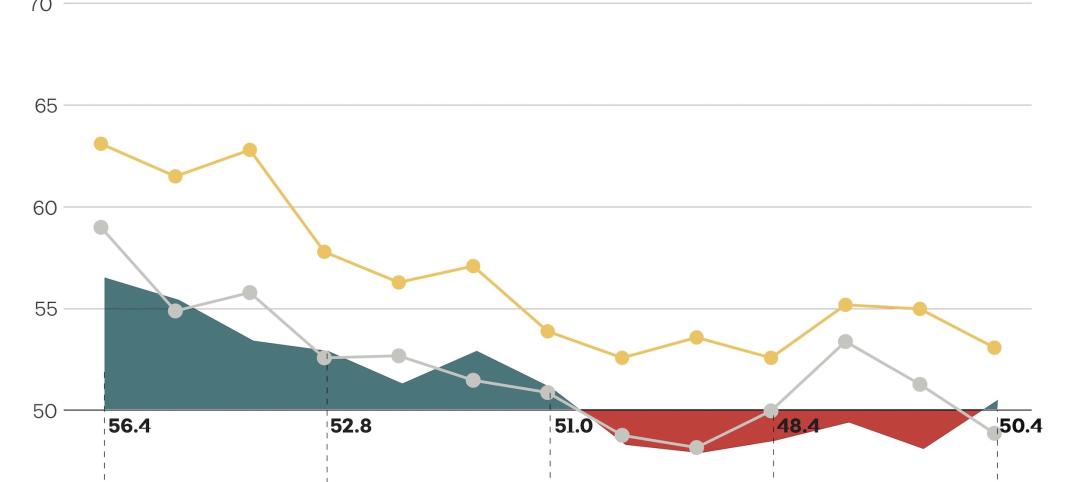

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

Contractors | Apr 19, 2023

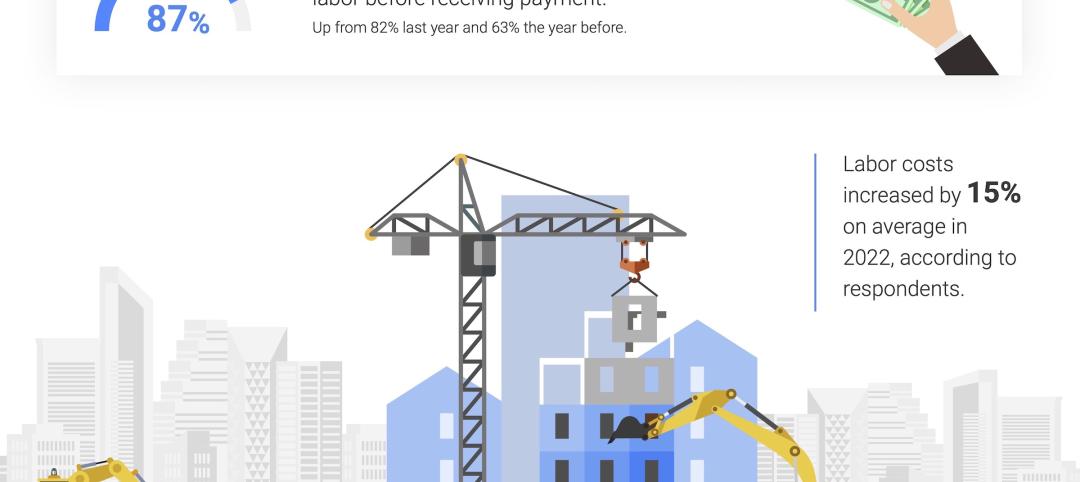

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.

Market Data | Apr 11, 2023

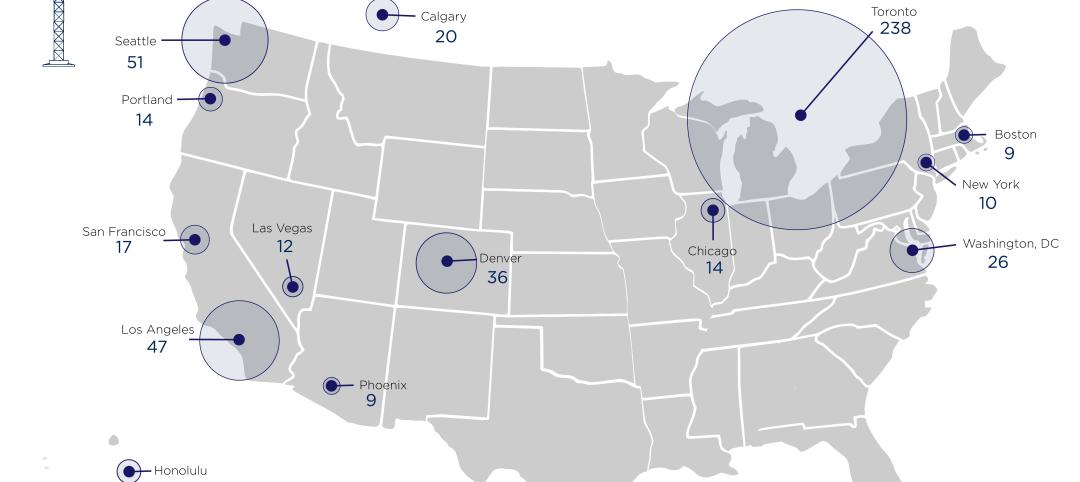

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.