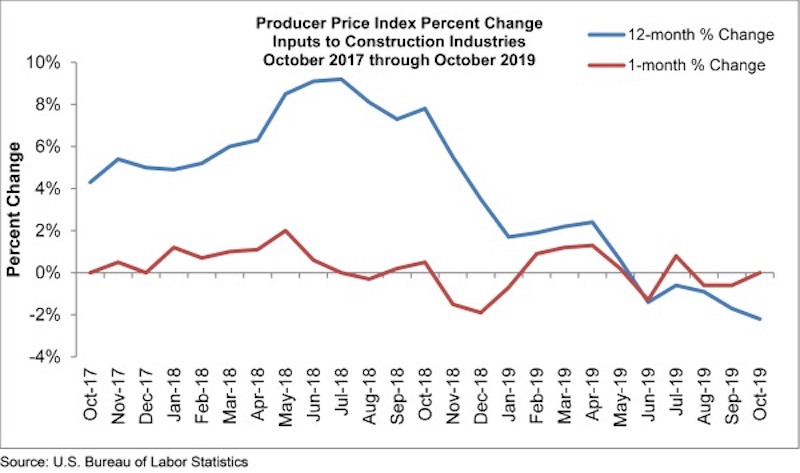

Construction input prices remained unchanged on a monthly basis in October but are down 2.2% year-over-year, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Falling energy prices accounted for much of the year-over-year price decline. Among the eight subcategories that decreased, the most significant were in natural gas (-31.8%), crude petroleum (-29.8%) and unprocessed energy materials (-26.3%). Monthly natural gas prices, however, were up 7.7% from September, likely due in part to seasonal factors. Two other subcategories had year-over-year decreases greater than 10%: iron and steel (-16.1%) and steel mill products (-13.1%).

“New month, same story on materials prices,” said ABC Chief Economist Anirban Basu. “While the decline in crude petroleum prices in October may have been caused by a spike in oil prices in September due to an assault on Saudi facilities, price weakness was apparent in several other materials categories as well. Many categories experienced effectively no change in price whatsoever on a monthly basis, including key materials such as softwood lumber, concrete, plumbing fixtures and the segment that includes prepared asphalt.

“While the U.S. nonresidential construction sector remains busy and a majority of contractors expect to see an increase in sales over the next few months, according to ABC’s Construction Confidence Indicator, materials prices continue to languish due to a combination of a weakening global economy, a sturdy U.S. dollar and recently observed declines in investment in structures. The lifting of tariffs on certain producers of steel and aluminum earlier this year may also be playing a factor, with iron and steel prices down approximately 16% compared to one year ago and the price of steel mill products down more than 13%.

“Contractors can expect more seesawing in materials prices going forward as opposed to smooth declines,” said Basu. “There is evidence that certain parts of the global economy are firming, which will help stabilize the demand for certain materials. The U.S. dollar is no longer strengthening as it had been, in part because the Federal Reserve has pursued an easier money policy this year. That said, there could be a dip in oil prices next year as more supply comes online from nations such as Canada, Norway, Brazil and Guyana.”

Related Stories

Market Data | Nov 30, 2016

Marcum Commercial Construction Index reports industry outlook has shifted; more change expected

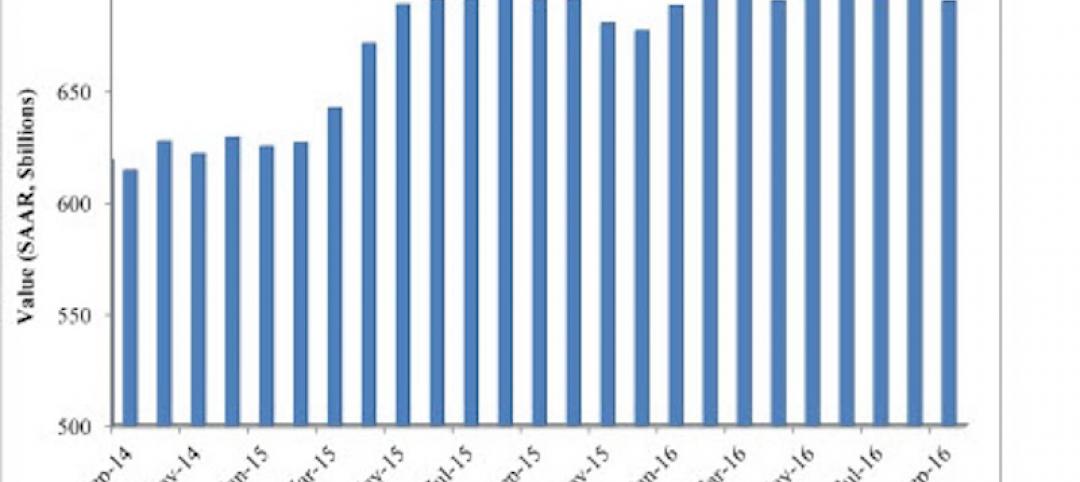

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier.

Industry Research | Nov 30, 2016

Multifamily millennials: Here is what millennial renters want in 2017

It’s all about technology and convenience when it comes to the things millennial renters value most in a multifamily facility.

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Multifamily Housing | Nov 28, 2016

Axiometrics predicts apartment deliveries will peak by mid 2017

New York is projected to lead the nation next year, thanks to construction delays in 2016

Market Data | Nov 22, 2016

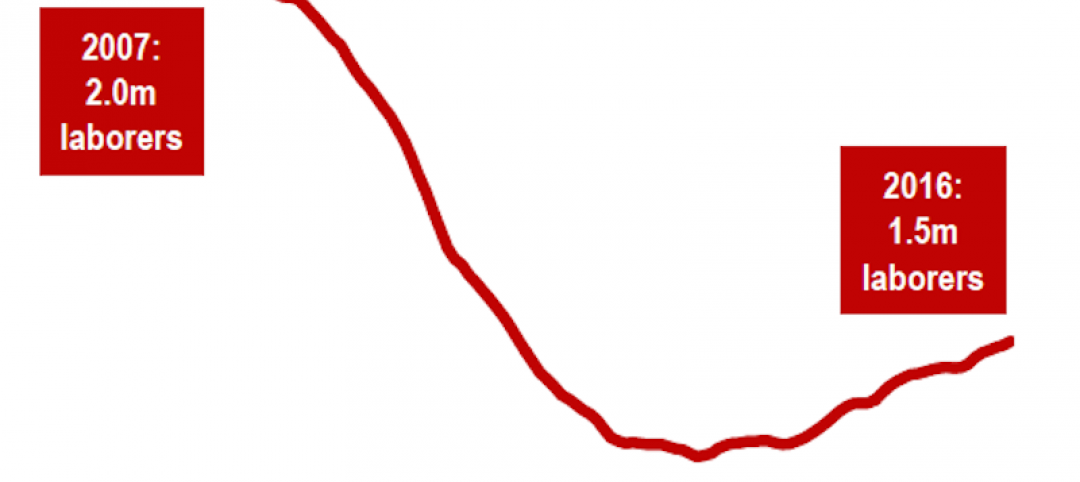

Construction activity will slow next year: JLL

Risk, labor, and technology are impacting what gets built.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Nov 11, 2016

Brand marketing: Why the B2B world needs to embrace consumers

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.

Market Data | Nov 2, 2016

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.