Construction employment decreased from January 2020 to January 2021 in nearly two-thirds of the nation’s metro areas, according to an analysis by the Associated General Contractors of America of government employment data released today, as project cancellations and a lack of new orders have forced firms to reduce their headcount, the association’s latest contractor survey shows. Association officials said more layoffs are likely for the industry amid spiking materials prices and uncertain demand for new projects.

“More contractors are telling us they are cutting headcount than adding workers, which is consistent with the new data showing the industry is shrinking in many parts of the country,” said Ken Simonson, the association’s chief economist. “More than three-fourth of the firms said projects had been postponed or canceled, while only one out of five reported winning new work or an add-on to an existing project in the previous two months as a result of the pandemic. That imbalance makes further job losses likely in many metros.”

Construction employment fell in 225, or 63%, of 358 metro areas between January 2020 and January 2021. Industry employment was stagnant in 41 additional metro areas, while only 92 metro areas—26%—added construction jobs.

Houston-The Woodlands-Sugar Land, Texas lost the largest number of construction jobs over the 12-month period (-32,900 jobs, -14%), followed by New York City (-23,000 jobs, -15%); Midland, Texas (-11,100 jobs, -29%); and Chicago-Naperville-Arlington Heights, Ill. (-10,400 jobs, -9%). Lake Charles, La. had the largest percentage decline (-40%, -8,100 jobs), followed by Odessa, Texas (-37%, -7,600 jobs); Midland; and Laredo, Texas (-27%, -1,100 jobs).

Sacramento--Roseville--Arden-

Association officials are urging Congress and the Biden administration to work together to address rising materials prices, supply chain backups and invest in infrastructure. They are asking the administration to end tariffs on key construction materials, including steel and lumber, work with shippers to get deliveries back on track and pass the significant new infrastructure investments the president has promised.

“The construction industry won’t be able to fully recover and start adding jobs in significant numbers as long as materials prices continue to spike, deliveries remain unreliable and demand remains uncertain,” said Stephen E. Sandherr, the association’s chief executive officer. “Federal officials can’t fix every problem, but they can help by removing tariffs, helping hard-hit shippers and boosting investments in the nation’s infrastructure.”

View the metro employment 12-month data, rankings, top 10, multi-division metros. View AGC’s survey.

Related Stories

Market Data | Sep 22, 2016

Architecture Billings Index slips, overall outlook remains positive

Business conditions are slumping in the Northeast.

Market Data | Sep 20, 2016

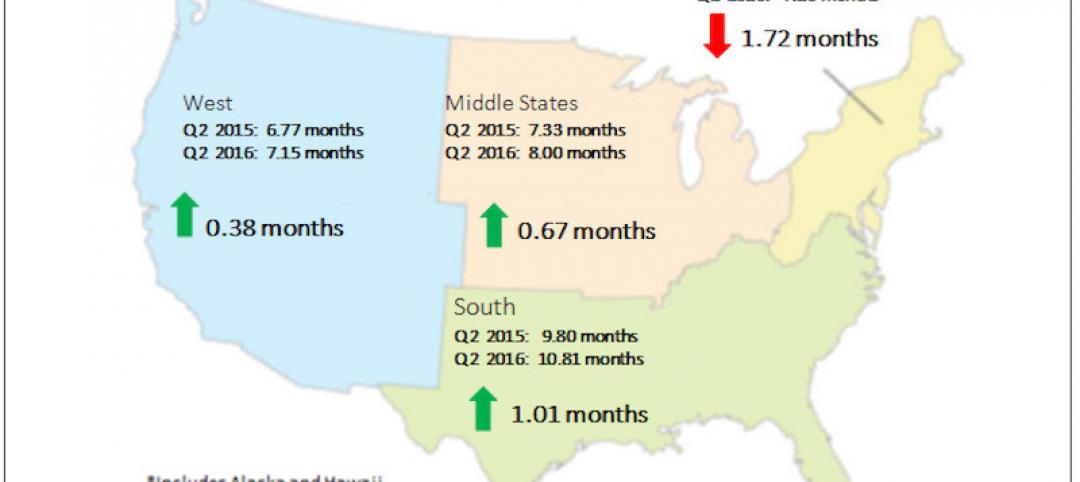

Backlog skyrockets for largest firms during second quarter, but falls to 8.5 months overall

While a handful of commercial construction segments continue to be associated with expanding volumes, for the most part, the average contractor is no longer getting busier, says ABC Chief Economist Anirban Basu.

Designers | Sep 13, 2016

5 trends propelling a new era of food halls

Food halls have not only become an economical solution for restauranteurs and chefs experiencing skyrocketing retail prices and rents in large cities, but they also tap into our increased interest in gourmet locally sourced food, writes Gensler's Toshi Kasai.

Building Team | Sep 6, 2016

Letting your resource take center stage: A guide to thoughtful site selection for interpretive centers

Thoughtful site selection is never about one factor, but rather a confluence of several components that ultimately present trade-offs for the owner.

Market Data | Sep 2, 2016

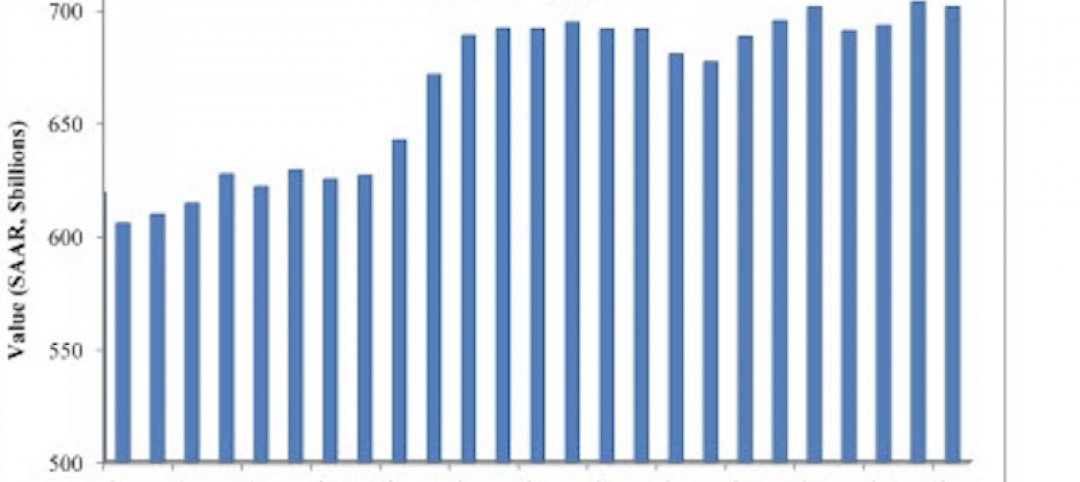

Nonresidential spending inches lower in July while June data is upwardly revised to eight-year record

Nonresidential construction spending has been suppressed over the last year or so with the primary factor being the lack of momentum in public spending.

Industry Research | Sep 1, 2016

CannonDesign releases infographic to better help universities obtain more R&D funding

CannonDesign releases infographic to better help universities obtain more R&D funding.

Industry Research | Aug 25, 2016

Building bonds: The role of 'trusted advisor' is earned not acquired

A trusted advisor acts as a guiding partner over the full course of a professional relationship.

Multifamily Housing | Aug 17, 2016

A new research platform launches for a data-deprived multifamily sector

The list of leading developers, owners, and property managers that are funding the NMHC Research Foundation speaks to the information gap it hopes to fill.

Hotel Facilities | Aug 17, 2016

Hotel construction continues to flourish in major cities

But concerns about overbuilding persist.

Market Data | Aug 16, 2016

Leading economists predict construction industry growth through 2017

The Chief Economists for ABC, AIA, and NAHB all see the construction industry continuing to expand over the next year and a half.