Construction employment declined for the third time in the past four months in May as nonresidential contractors coped with lengthening and unpredictable delivery times that limited their ability to start or complete projects, according to an analysis by the Associated General Contractors of America of government data released today. Association officials added that many contractors report they are having a hard time finding qualified workers to hire as some people remain reluctant to return to work while their children are learning from home, or they are collecting elevated unemployment supplements.

“Steadily worsening production and delivery delays have exceeded even the record cost increases for numerous materials as the biggest headache for many nonresidential contractors,” said Ken Simonson, the association’s chief economist. “If they can’t get the materials, they can’t put employees to work.”

Seasonally adjusted construction employment in May totaled 7,423,000, a drop of 20,000 from the downwardly revised April total. Industry employment declined as well in April and February. The total in May remained 225,000 less than in February 2020, the high point before the pandemic drove construction employment down by more than a million jobs.

The gap widened in May between residential construction, which has experienced feverish demand for new and remodeled housing, and nonresidential construction, which has been declining, aside from a few niches. Residential construction firms—contractors working on new housing, additions, and remodeling—gained 1,900 employees during the month and employed 35,000 more workers (1.2%) in May than in the pre-pandemic peak month of February 2020. In contrast, the nonresidential sector—comprising nonresidential building, specialty trades, and heavy and civil engineering contractors—shed 21,800 jobs in May and employed 260,000 fewer workers or 5.6% less than in February 2020.

“Contractors are being told they must wait nearly a year to receive shipments of steel and 4-6 months for roofing materials,” Simonson noted. “These delays make it impossible to start some projects and to complete others, leaving contractors unable to keep workers employed. In addition, soaring prices for steel, lumber, and other materials are deterring owners from committing to going ahead with projects.”

Association officials urged Congress and the Biden administration to take steps to address the record materials price increases and supply chain bottlenecks. They said the President should end tariffs on key materials like lumber, steel, and aluminum. They added that Washington officials should look at ways to ease manufacturing and shipping backups. And they urged Congress to allow unemployment supplements to expire, as planned, after Labor Day.

“The decline in construction employment is likely less about a lack of demand as it is about the challenges contractors are facing in meeting that demand,” said Stephen E. Sandherr, the association’s chief executive officer. “Supply-chain problems and labor shortages are holding back what should otherwise be a much stronger recovery for the construction sector.”

Related Stories

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Multifamily Housing | Nov 28, 2016

Axiometrics predicts apartment deliveries will peak by mid 2017

New York is projected to lead the nation next year, thanks to construction delays in 2016

Market Data | Nov 22, 2016

Construction activity will slow next year: JLL

Risk, labor, and technology are impacting what gets built.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Nov 11, 2016

Brand marketing: Why the B2B world needs to embrace consumers

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.

Market Data | Nov 2, 2016

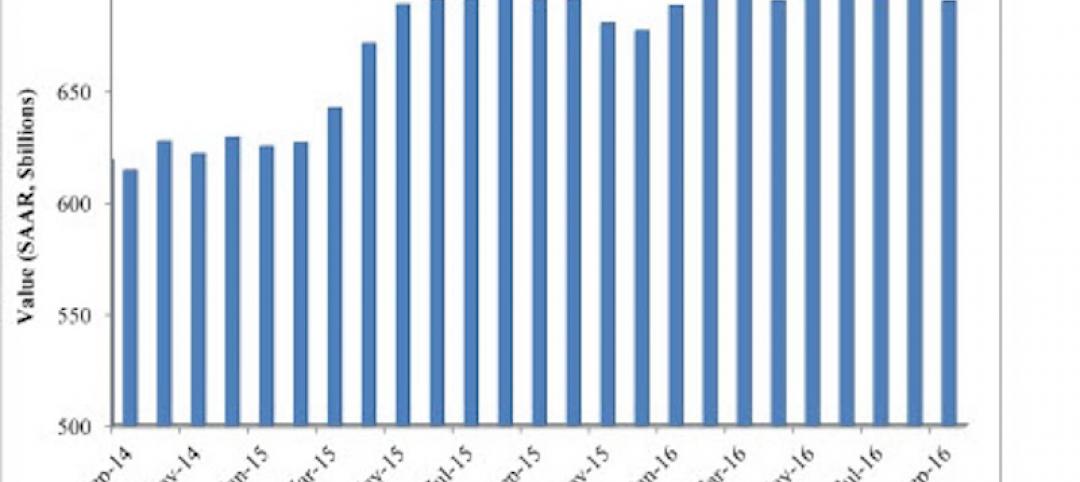

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.

Market Data | Oct 31, 2016

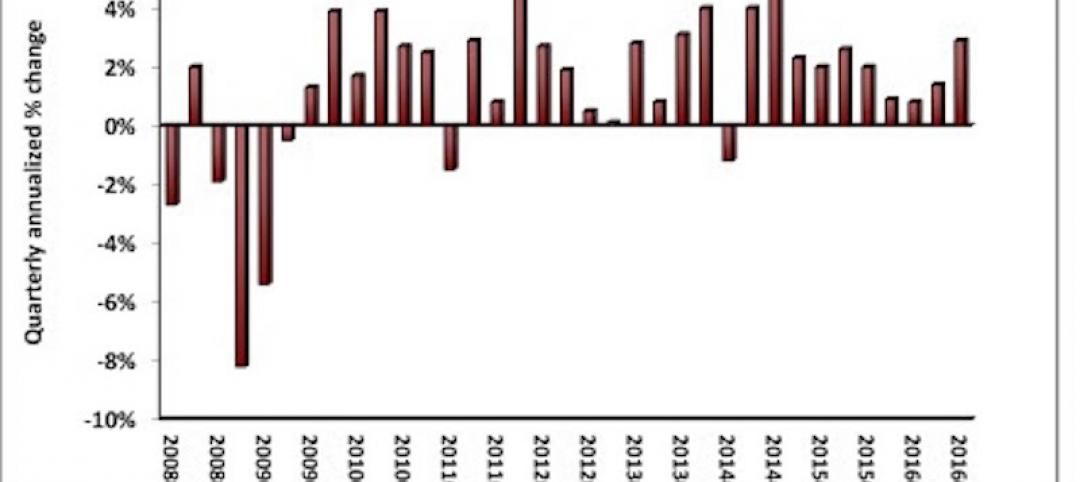

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.