Construction employment in January remained below pre-pandemic levels in all but eight states, according to an analysis by the Associated General Contractors of America of government employment data released today, while more firms have reduced headcount than have added to it in the past year, the association’s recent survey shows. Association officials said the jobs figures and survey results underscore the need for federal measures to stem future sector job losses.

“Despite improvement in many sectors of the economy, nonresidential contractors are coping with widespread project cancellations and postponements, soaring materials costs, and lengthening delivery times,” said Ken Simonson, the association’s chief economist. “That combination makes further job cuts likely in many states.”

The survey, which included responses from nearly 1500 firms, found 34% had reduced their employee count in the past year, compared to just 20% that had added employees. More than three-fourths of the firms had experienced project cancellations or deferrals, while only 21% reported winning new projects or add-ons to existing projects in the past two months.

Seasonally adjusted construction employment in January 2021 was lower than in February 2020—the last month before the pandemic forced many contractors to suspend work—in 42 states and was unchanged in the District of Columbia. Texas lost the most construction jobs over the period (-51,900 jobs or -6.6%), followed by California (-36,200 jobs, -4.0%), and New York (-26,000 jobs, -6.4%). Louisiana experienced the largest percentage loss (-14.0%, -19,200 jobs), followed by Wyoming (-9.6%, -2,200 jobs).

Only eight states added construction jobs from February 2020 to January 2021. Idaho added the most jobs (4,500 jobs, 8.2%), trailed by Utah (3,300 jobs, 2.9%), Alabama (6,100 jobs, 6.4%) and Arkansas (1,900 jobs, 3.6%,). Idaho added the highest percentage, followed by Arkansas and Alaska (3.0%, 500 jobs).

From December to January,19 states and D.C. lost construction jobs, 27 states added jobs, and there was no change in Alaska, North and South Dakota, and Wyoming. California had the largest loss of construction jobs for the month (-4,000 jobs or -0.5%), followed by South Carolina (-3,200 jobs, -3.0%) and Illinois (-3,200 jobs, -1.4%). South Carolina had the largest percentage decline, followed by Wisconsin (-2.4%, -3,000 jobs).

Florida added the most construction jobs over the month (3,500 jobs, 0.6%), followed by Texas (0.4%). Vermont had the largest monthly percentage gain (3.4%, 500 jobs), trailed by Idaho (3.3%, 1,900 jobs).

Association officials said demand for construction will continue to suffer amid pandemic-induced economic uncertainty and urged federal officials to enact measures to help stem additional job losses in the sector. These new measures should include new federal investments in infrastructure, ending tariffs on key construction materials, addressing supply chain backups and avoiding costly and unneeded new regulatory burdens.

“The pandemic is driving away projects, contributing to spiking materials prices and helping make delivery schedules unreliable,” said Stephen E. Sandherr, the association’s chief executive officer. “Contractors will not be able to build back better if they have to keep paying higher prices for materials that rarely arrive on time.”

View state February 2020-January 2021 data and rankings and December-January rankings. View AGC’s survey.

Related Stories

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.

Contractors | Mar 14, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of February 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 9.2 months in February, according to an ABC member survey conducted Feb. 20 to March 6. The reading is 1.2 months higher than in February 2022.

Industry Research | Mar 9, 2023

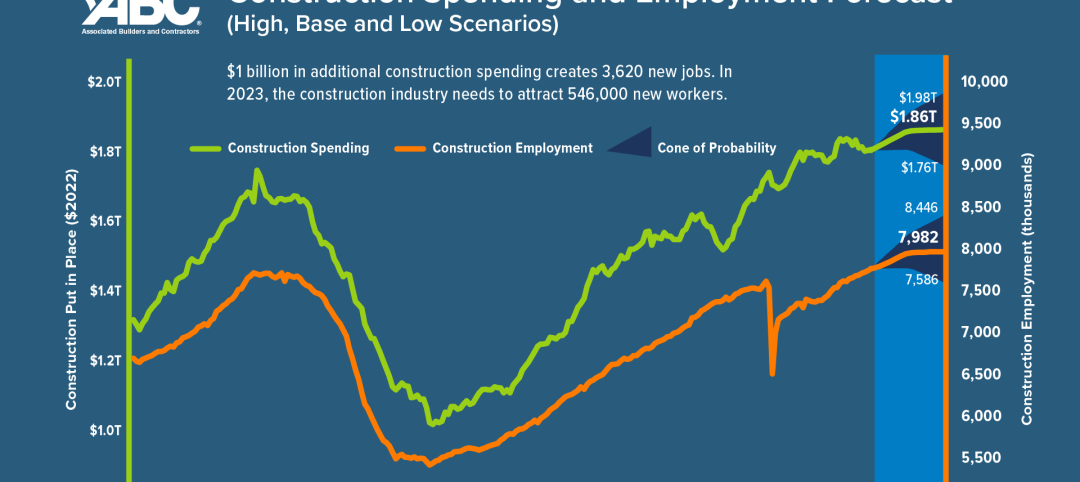

Construction labor gap worsens amid more funding for new infrastructure, commercial projects

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors. The construction industry averaged more than 390,000 job openings per month in 2022.

Market Data | Mar 7, 2023

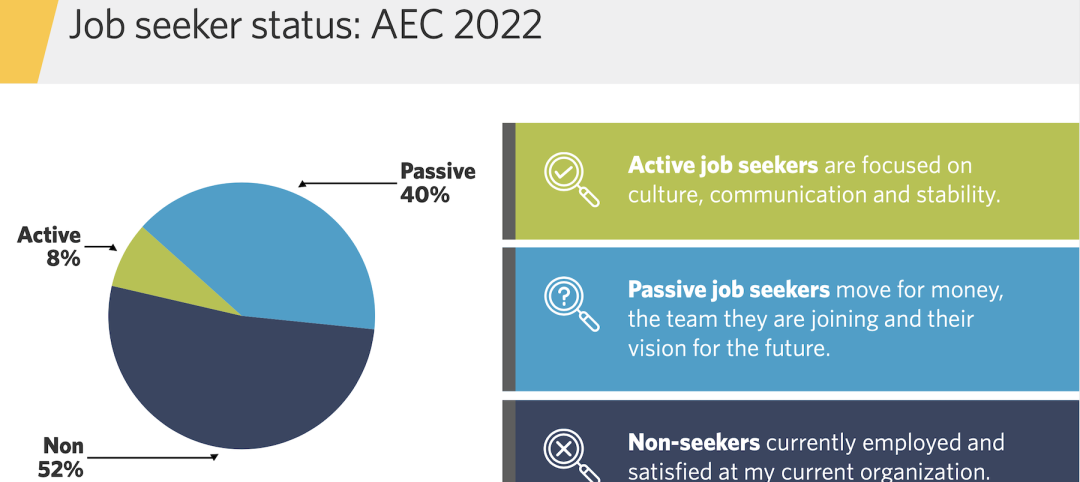

AEC employees are staying with firms that invest in their brand

Hinge Marketing’s latest survey explores workers’ reasons for leaving, and offers strategies to keep them in the fold.

Multifamily Housing | Feb 21, 2023

Multifamily housing investors favoring properties in the Sun Belt

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix. Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever.

Contractors | Feb 14, 2023

The average U.S. contractor has nine months worth of construction work in the pipeline

Associated Builders and Contractors reports today that its Construction Backlog Indicator declined 0.2 months to 9.0 in January, according to an ABC member survey conducted Jan. 20 to Feb. 3. The reading is 1.0 month higher than in January 2022.

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.