Construction employment in January remained below pre-pandemic levels in all but eight states, according to an analysis by the Associated General Contractors of America of government employment data released today, while more firms have reduced headcount than have added to it in the past year, the association’s recent survey shows. Association officials said the jobs figures and survey results underscore the need for federal measures to stem future sector job losses.

“Despite improvement in many sectors of the economy, nonresidential contractors are coping with widespread project cancellations and postponements, soaring materials costs, and lengthening delivery times,” said Ken Simonson, the association’s chief economist. “That combination makes further job cuts likely in many states.”

The survey, which included responses from nearly 1500 firms, found 34% had reduced their employee count in the past year, compared to just 20% that had added employees. More than three-fourths of the firms had experienced project cancellations or deferrals, while only 21% reported winning new projects or add-ons to existing projects in the past two months.

Seasonally adjusted construction employment in January 2021 was lower than in February 2020—the last month before the pandemic forced many contractors to suspend work—in 42 states and was unchanged in the District of Columbia. Texas lost the most construction jobs over the period (-51,900 jobs or -6.6%), followed by California (-36,200 jobs, -4.0%), and New York (-26,000 jobs, -6.4%). Louisiana experienced the largest percentage loss (-14.0%, -19,200 jobs), followed by Wyoming (-9.6%, -2,200 jobs).

Only eight states added construction jobs from February 2020 to January 2021. Idaho added the most jobs (4,500 jobs, 8.2%), trailed by Utah (3,300 jobs, 2.9%), Alabama (6,100 jobs, 6.4%) and Arkansas (1,900 jobs, 3.6%,). Idaho added the highest percentage, followed by Arkansas and Alaska (3.0%, 500 jobs).

From December to January,19 states and D.C. lost construction jobs, 27 states added jobs, and there was no change in Alaska, North and South Dakota, and Wyoming. California had the largest loss of construction jobs for the month (-4,000 jobs or -0.5%), followed by South Carolina (-3,200 jobs, -3.0%) and Illinois (-3,200 jobs, -1.4%). South Carolina had the largest percentage decline, followed by Wisconsin (-2.4%, -3,000 jobs).

Florida added the most construction jobs over the month (3,500 jobs, 0.6%), followed by Texas (0.4%). Vermont had the largest monthly percentage gain (3.4%, 500 jobs), trailed by Idaho (3.3%, 1,900 jobs).

Association officials said demand for construction will continue to suffer amid pandemic-induced economic uncertainty and urged federal officials to enact measures to help stem additional job losses in the sector. These new measures should include new federal investments in infrastructure, ending tariffs on key construction materials, addressing supply chain backups and avoiding costly and unneeded new regulatory burdens.

“The pandemic is driving away projects, contributing to spiking materials prices and helping make delivery schedules unreliable,” said Stephen E. Sandherr, the association’s chief executive officer. “Contractors will not be able to build back better if they have to keep paying higher prices for materials that rarely arrive on time.”

View state February 2020-January 2021 data and rankings and December-January rankings. View AGC’s survey.

Related Stories

Contractors | Apr 19, 2023

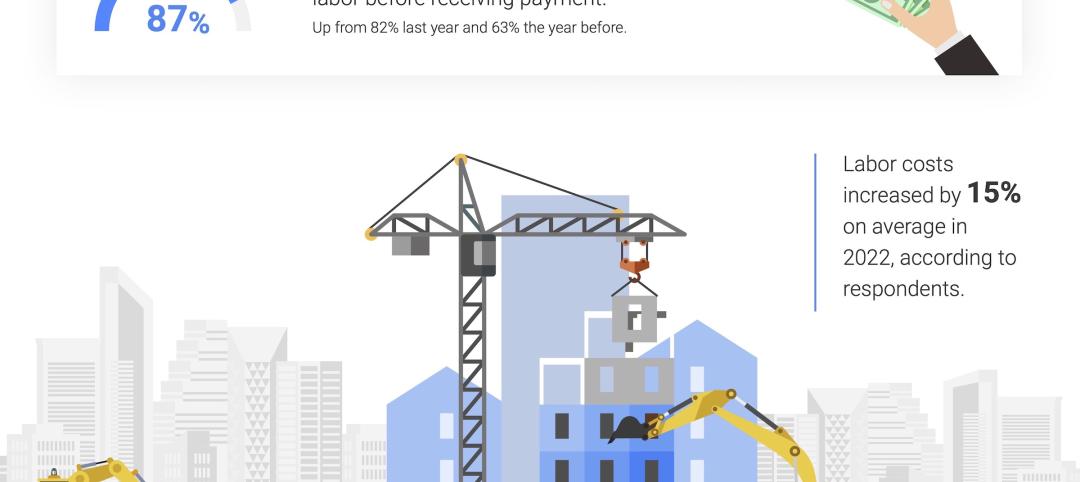

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

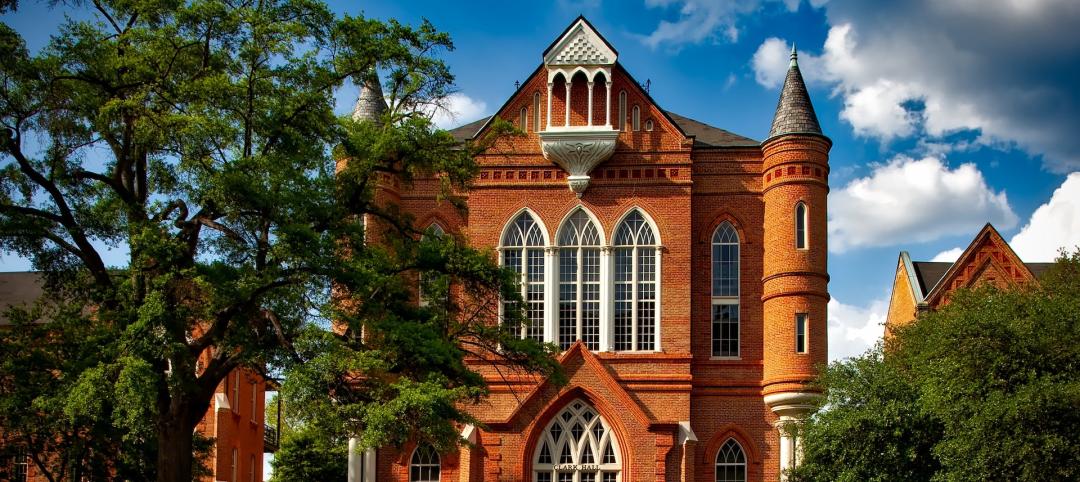

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.

Market Data | Apr 11, 2023

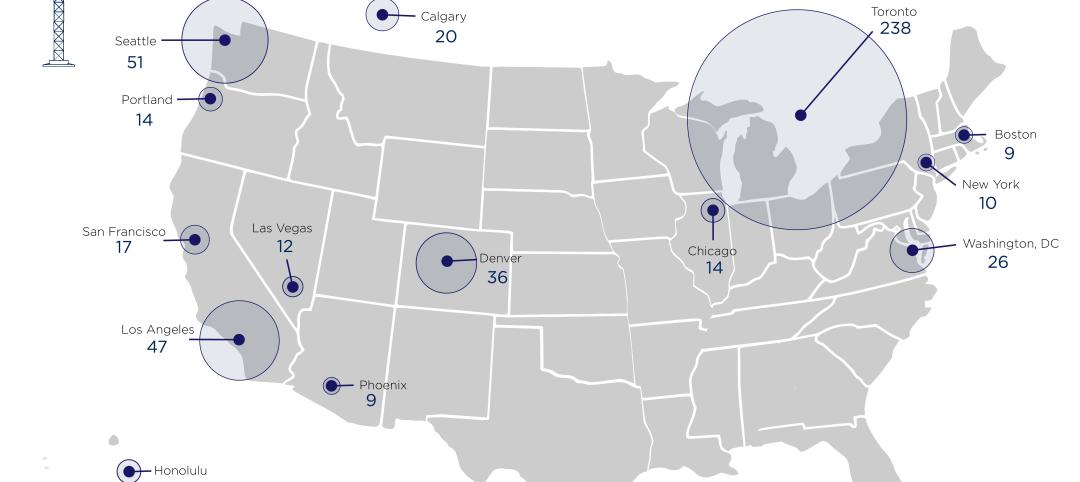

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.