Overcapacity in global iron ore production was a major factor in keeping construction costs low through the first four months of 2015. And for the first time in years, subcontractor labor costs showed signs of softening.

Those are two key findings in the latest assessment of current and future pricing from IHS, the Englewood, Colo.-based market analysis firm.

IHS derives its monthly Cost Index from information it receives from member procurement executives working for several of the world’s largest construction and engineering companies, including AECOM and Bechtel. It breaks down those data into current pricing trends and projections for six months forward.

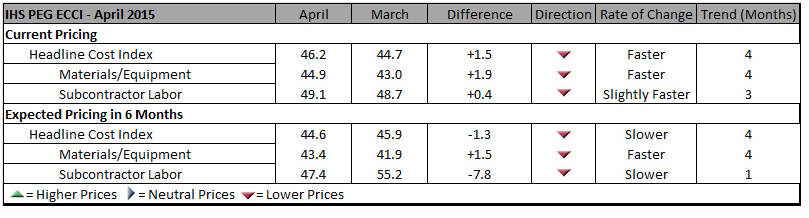

In April, its Cost Index was 46.2, a bit higher than 44.7 in March, but still below what IHS would consider a “neutral” reading. Its sub index for Materials/Equipment costs in April was 44.9 compared to 43.0 in March. And the April sub index for Subcontractor Labor costs stood at 49.1, compared to 48.7 in March.

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

IHS notes that eight of 12 construction components it tracks registered falling prices in April, led by carbon steel pipe and fabricated structural steel. Both are victims of “bloated capacity, weak profit growth, and lackluster demand,” explains John Anton, IHS’s Director of Steel Services. Iron ore companies that, in response to demand from China’s steel industry, have initiated massive projects whose capacity, so far, “is far ahead of demand,” and is holding prices down.

Anton adds that while the iron ore market may have some ostensible similarities to the recent decline of crude oil prices, what’s different is that iron ore producers have shown no inclinations toward cutting production to match demand. (IHS points out that three quarters of China’s mines are losing money.)

IHS also notes that several global construction and engineering firms, particularly those in the oil and gas sectors, have been taking a “wait and see” approach to investing in larger capital projects. “The capex environment has yet to thaw,” asserts Mark Eisinger, IHS’s senior economist.

While some markets, like the U.S. South, are still experiencing shortages in skilled subcontractor labor, manpower costs have been receding. For the third consecutive month, the U.S. did not register higher month-to-month labor costs in April. And for the first time in this survey’s history, projections about labor costs over the next six months are below the neutral mark. The six-month cost index for subcontractor labor fell to 47.4 in April, compared to 55.2 in March.

The forward-looking index for materials and equipment, at 43.4 April, rose from March’s record low of 41.9, even as 10 of 12 components showed falling price expectations.

Related Stories

Giants 400 | Feb 6, 2023

2022 Transit Facility Giants: Top architecture, engineering, and construction firms in the U.S. transit facility sector

Walsh Group, Skanska USA, HDR, Perkins and Will, and AECOM top BD+C's rankings of the nation's largest transit facility sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Telecommunications Facility Sector Giants: Top architecture, engineering, and construction firms in the U.S. telecommunications facility sector

AECOM, Alfa Tech, Kraus-Anderson, and Stantec head BD+C's rankings of the nation's largest telecommunications facility sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Religious Sector Giants: Top architecture, engineering, and construction firms in the U.S. religious facility construction sector

HOK, Parkhill, KPFF, Shawmut Design and Construction, and Wiss, Janney, Elstner head BD+C's rankings of the nation's largest religious facility sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Justice Facility Sector Giants: Top architecture, engineering, and construction firms in the U.S. justice facility/public safety sector

Stantec, DLR Group, Turner Construction, STO Building Group, AECOM, and Dewberry top BD+C's rankings of the nation's largest architecture, engineering, and construction firms for justice facility/public safety buildings work, including correctional facilities, fire stations, jails, police stations, and prisons, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Parking Structure Giants: Top architecture, engineering, and construction firms in the U.S. parking structure sector

Choate Parking Consultants, Walker Consultants, Kimley-Horn, PCL, and Balfour Beatty top BD+C's rankings of the nation's largest parking structure sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Market Data | Feb 6, 2023

Nonresidential construction spending dips 0.5% in December 2022

National nonresidential construction spending decreased by 0.5% in December, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $943.5 billion for the month.

Giants 400 | Feb 3, 2023

Top Workplace/Interior Fitout Architecture, Engineering, and Construction Firms for 2022

Gensler, Interior Architects, AECOM, STO Building Group, and CBRE top the ranking of the nation's largest workplace/interior fitout architecture, engineering, and construction firms, as reported in Building Design+Construction's 2022 Giants 400 Report.

Multifamily Housing | Feb 3, 2023

HUD unveils report to help multifamily housing developers overcome barriers to offsite construction

The U.S. Department of Housing and Urban Development, in partnership with the National Institute of Building Sciences and MOD X, has released the Offsite Construction for Housing: Research Roadmap, a strategic report that presents the key knowledge gaps and research needs to overcome the barriers and challenges to offsite construction.

Steel Buildings | Feb 3, 2023

Top 10 structural steel building projects for 2023

A Mies van der Rohe-designed art and architecture school at Indiana University and Morphosis Architects' Orange County Museum of Art in Costa Mesa, Calif., are among 10 projects to win IDEAS² Awards from the American Institute of Steel Construction.

Multifamily Housing | Feb 2, 2023

St. Louis’s first transit-oriented multifamily development opens in historic Skinker DeBaliviere neighborhood

St. Louis’s first major transit-oriented, multi-family development recently opened with 287 apartments available for rent. The $71 million Expo at Forest Park project includes a network of pathways to accommodate many modes of transportation including ride share, the region’s Metro Transit system, a trolley line, pedestrian traffic, automobiles, and bike traffic on the 7-mile St. Vincent Greenway Trail.