Construction industry leaders remained confident regarding the nonresidential construction sector’s prospects during January 2019, according to the latest Construction Confidence Index recently released by Associated Builders and Contractors.

Expectations for sales during the coming six-month period remained especially upbeat in January, with nearly 70% of respondents anticipating an increase in sales levels. A similar level of confidence characterizes contractors expectations on future staffing levels, with fewer than 7% of contractors indicating expectations of shrinking workforces.

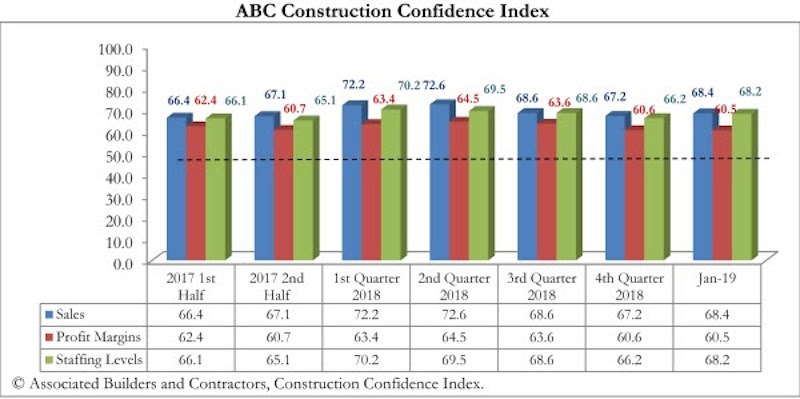

While contractors became fractionally less confident regarding profit margins, more than half of respondents still expect their margins to increase in coming months, while less than 13% expect margins to shrink. All three principal components measured by the survey—sales, profit margins, and staffing levels—remain well above the diffusion index threshold of 50, signaling ongoing expansion in construction activity.

– The CCI for sales expectations increased from 67.2 to 68.4 in January.

– The CCI for profit margin expectations fell from 60.6 to 60.5.

– The CCI for staffing levels increased from 66.2 to 68.2.

“Indications of ongoing confidence in the construction sector have become more important," said ABC Chief Economist Anirban Basu. “Recent dips in consumer and small-business confidence have become a source of concern, as have weak reports regarding employment growth and retail sales. Thankfully, contractors continue to exhibit elevated levels of confidence regarding the near-term trajectory of the economy despite ongoing workforce shortages. Not only do contractors expect to further expand staffing levels, many continue to expect rising profit margins despite rapidly expanding payroll expenses.

“One source of relief has been a recent moderation in construction materials prices,” said Basu. “With the global economy continuing to soften, materials prices should remain well-behaved over the months to come. Investors continue to aggressively seek ways to deploy capital, including on new commercial construction. This helps explain a recent surge in the Architecture Billings Index, another leading indicator that, along with CCI, suggests ongoing economic momentum throughout the first half of 2019.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

[Editor’s note: ABC’s Construction Confidence Index will be reported monthly beginning with January 2019 data. This is the first monthly CCI release.]

Related Stories

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Market Data | Jan 6, 2016

Census Bureau revises 10 years’ worth of construction spending figures

The largest revisions came in the last two years and were largely upward.

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.