The Tax Cuts and Jobs Act of 2017 created the designation “Opportunity Zone,” for which the Internal Revenue Service will allow tax advantages for certain investments in lower-income areas when an Opportunity Fund invests more than 90% of its assets in a zoned property.

As of last December, there were nearly 8,800 Opportunity Zones in the U.S. and its five possessions, according to the Treasury Department. Developers must invest in Qualified Opportunity Zones by the end of this year to meet a seven-year holding period that allows them to exclude 15% of the deferred capital gain. The IRS is in the final stages of finalizing this program’s regulatory framework.

One such investment entity is Chicago-based Decennial Group, which is targeting investment of $1 billion in development projects to leverage the tax incentives created by the 2017 law. Over the next decade the JV could look to invest up to $20 billion for new projects, according to The Real Deal, which also reports that Decennial Group is exploring 250 potential projects in Opportunity Zones around the country, and is in advanced negotiations on at least three projects.

Decennial Group is a joint venture comprised of Scott Goodman, the founding principal of Farpoint Development, a real estate development company; Bob Clark, founder and CEO of Clayco, the full-service development, planning, architecture, engineering, and construction firm; and Shawn Clark, president of CRG, Clayco’s real estate and development company.

According to a prepared statement, Decennial Group will focus on commercial, industrial, multifamily, and energy projects located in Opportunity Zones, and especially in America’s heartland region.

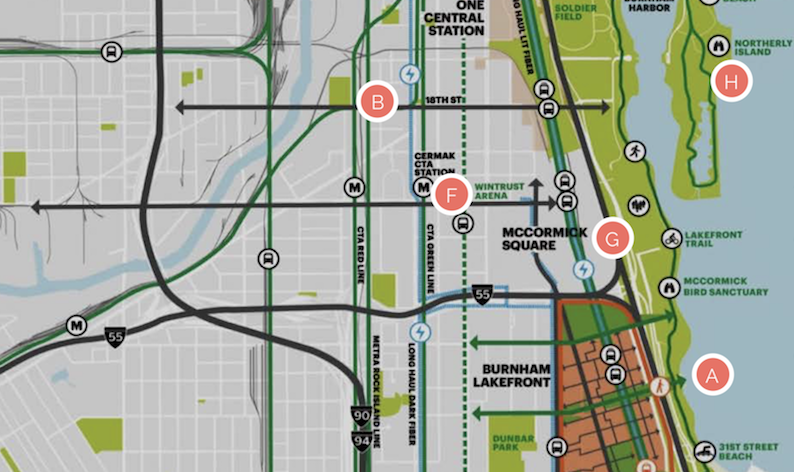

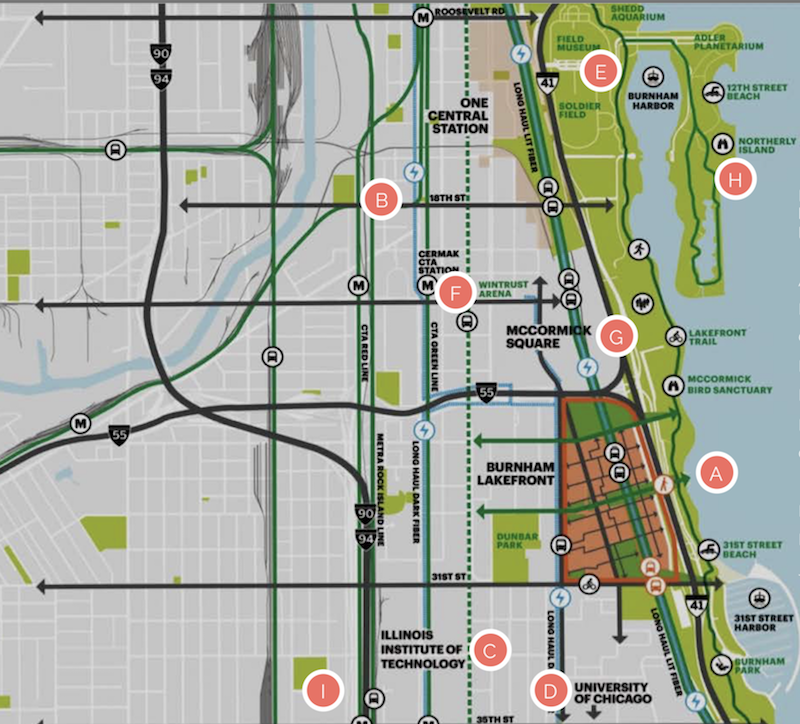

One of Farpoint Development's investments is Burnham Lakefront, located within an Opportunity Zone on Chicago's South Side. Image: Farpoint Development

Among Goodman’s development projects is Burnham Lakefront, a 100-acre campus within a recently designated Opportunity Zone that’s the former site of Michael Reese Hospital near the McCormick Place Marshalling Yard on Chicago South Side. The developer is planning 12 million sf of vertical construction along two miles of lakefront.

“Decennial will make smart, long-term investments throughout the country, but we will begin by capitalizing on deep relationships and an already strong pipeline of deals in the Heartland, where we have unparalleled investing experience,” says Goodman.

Bob Clark adds that CRG will provide development and site selection expertise as well as design-build services so that Decennial Group can “act quickly on great OZ opportunities around the country.”

Decennial Group is distinguishing itself from other OZ funds with a renewable energy strategy that’s being led by David Pavlik, cofounder and principal with 11 Million Acres, a leading energy real estate development platform that has structured over $2 billion in renewable energy and infrastructure projects.

The joint venture has tapped Steve Glickman, founder and CEO of Washington D.C.-based Develop LLC, as a senior advisor to the management team. Glickman is cofounder and former CEO of the economic Innovation Group, which was an architect of the Opportunity Zone program.

Related Stories

Sustainability | Mar 13, 2024

Trends to watch shaping the future of ESG

Gensler’s Climate Action & Sustainability Services Leaders Anthony Brower, Juliette Morgan, and Kirsten Ritchie discuss trends shaping the future of environmental, social, and governance (ESG).

MFPRO+ Special Reports | Feb 22, 2024

Crystal Lagoons: A deep dive into real estate's most extreme guest amenity

These year-round, manmade, crystal clear blue lagoons offer a groundbreaking technology with immense potential to redefine the concept of water amenities. However, navigating regulatory challenges and ensuring long-term sustainability are crucial to success with Crystal Lagoons.

Products and Materials | Jan 31, 2024

Top building products for January 2024

BD+C Editors break down January's top 15 building products, from SloanStone Quartz Molded Sinks to InvisiWrap SA housewrap.

Mixed-Use | Jan 29, 2024

12 U.S. markets where entertainment districts are under consideration or construction

The Pomp, a 223-acre district located 10 miles north of Fort Lauderdale, Fla., and The Armory, a 225,000-sf dining and entertainment venue on six acres in St Louis, are among the top entertainment districts in the works across the U.S.

Mixed-Use | Jan 26, 2024

Entertainment districts are no longer just about sports, dining, and music

Diversity of experiences is what makes entertainment districts tick these days. That’s one reason why offices continue to be included in district proposals. And in their efforts to emerge as year-round destinations, more districts are either including residential in their proposals or supporting existing districts with housing.

Mixed-Use | Jan 19, 2024

Trademark secures financing to develop Fort Worth multifamily community

National real estate developer, investor, and operator, Trademark Property Company, has closed on the land and secured the financing for The Vickery, a multifamily-led mixed-use community located on five acres at W. Vickery Boulevard and Hemphill Street overlooking Downtown Fort Worth.

Affordable Housing | Jan 18, 2024

Habitat tops off second apartment building at 43 Green

The co-developers of 43 Green celebrate the latest milestone for the $100 million, mixed-income, mixed-use project in Bronzeville: topping off Phase 2 while reaching full lease-up of the Phase 1 apartment building.

Adaptive Reuse | Jan 18, 2024

Coca-Cola packaging warehouse transformed into mixed-use complex

The 250,000-sf structure is located along a now defunct railroad line that forms the footprint for the city’s multi-phase Beltline pedestrian/bike path that will eventually loop around the city.

Sponsored | BD+C University Course | Jan 17, 2024

Waterproofing deep foundations for new construction

This continuing education course, by Walter P Moore's Amos Chan, P.E., BECxP, CxA+BE, covers design considerations for below-grade waterproofing for new construction, the types of below-grade systems available, and specific concerns associated with waterproofing deep foundations.

Sustainability | Jan 10, 2024

New passive house partnership allows lower cost financing for developers

The new partnership between PACE Equity and Phius allows commercial passive house projects to be automatically eligible for CIRRUS Low Carbon financing.