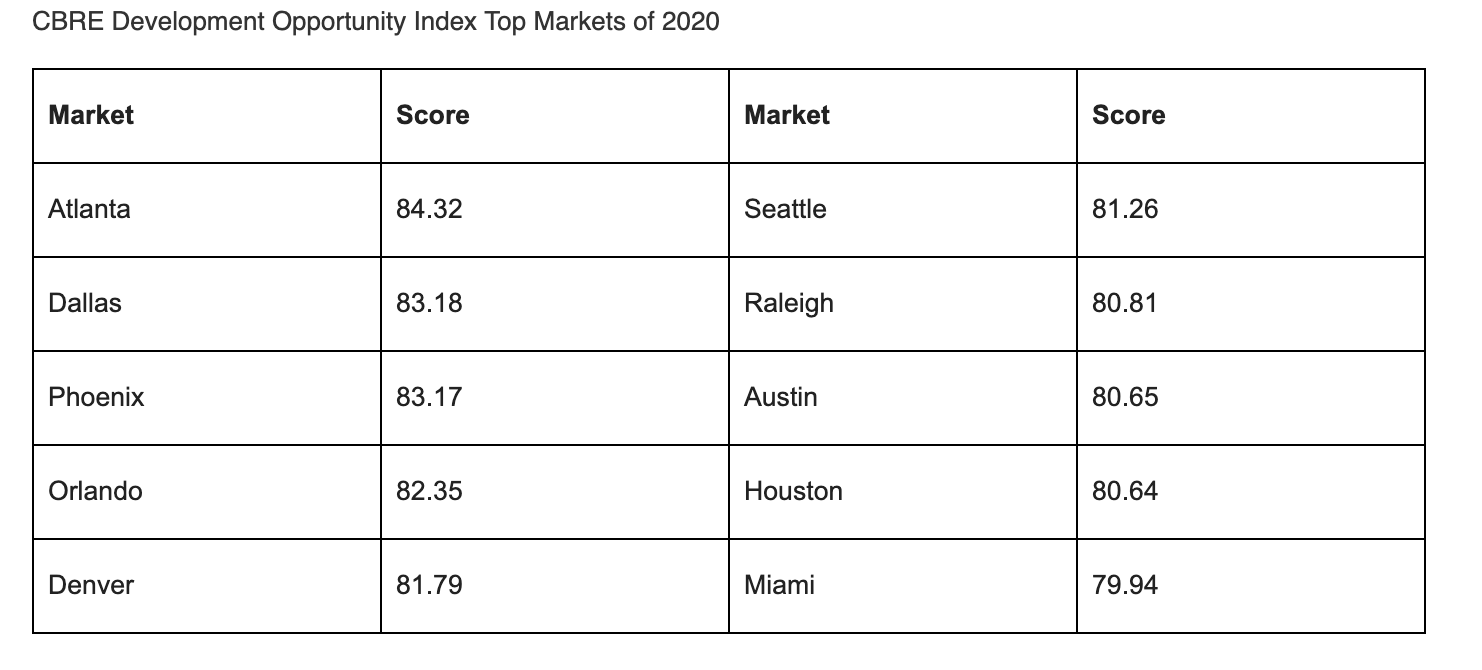

The Southeast and Texas offer the most favorable conditions for commercial construction, claiming seven of the top 10 markets in CBRE’s inaugural Development Opportunity Index. CBRE’s Index analyzes a spectrum of variables in the 50 largest U.S. markets to determine rate the highest for development opportunities across various asset classes.

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19, including temporary work stoppages and difficulty sourcing various materials from abroad. Since the start of the pandemic, momentum has varied across commercial real estate sectors – development largely progressed in the multifamily and industrial & logistics sectors, but activity slowed—and in some cases stalled—for retail, hotels and speculative office development.

“We expect to see an uptick tenant fit-out projects in 2021 as employers redesign and reconfigure spaces to accommodate new standards in health, wellness and safety,” said Jim Dobleske, CBRE Global President of Project Management. “Costs, however, aren’t likely to change much; markets with high costs of land and labor won’t get much cheaper, if at all.”

CBRE’s Development Opportunity Index ranks markets based on development conditions including property performance across each of the major commercial real estate asset classes, construction costs, strength of supply, prior and forecast performance.

“Southern states continue to rate highly for development and construction conditions, though investors looking for development opportunities can find them in every market,” said James Millon, a Vice Chairman in CBRE’s Debt & Structured Finance practice. “Southern states often have job growth, in-migration and cost advantages that drive high volumes of construction activity.”

An overall top-10 ranking doesn’t necessarily mean that market is among the best for every asset class.

For example, CBRE’s analysts ranked San Jose as the best positioned market for office construction due to its supply growth and strong absorption. Phoenix – reflecting its shrinking vacancy and strong absorption -- and San Francisco – with strong rent growth – also are attractive office markets for development.

For industrial & logistics construction, Atlanta ranks highest due to its balance of strong inventory growth and net absorption. Also ranking well are Phoenix because of its affordable land and labor, and Dallas due to its relatively low costs and strong population growth.

Houston tops the index of ideal markets for retail construction due to that market’s strong consumer spending and sustained absorption of retail space. Next are Dallas and Atlanta, which both offer stable costs and good absorption of retail space.

For multifamily construction, the top markets are Orlando, Phoenix and Denver. Each offers strong population growth, job gains and relatively low costs.

To download the report, click here.

Related Stories

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Market Data | Oct 23, 2023

New data finds that the majority of renters are cost-burdened

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic.

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.

Market Data | Oct 2, 2023

Nonresidential construction spending rises 0.4% in August 2023, led by manufacturing and public works sectors

National nonresidential construction spending increased 0.4% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.09 trillion.

Giants 400 | Sep 28, 2023

Top 100 University Building Construction Firms for 2023

Turner Construction, Whiting-Turner Contracting Co., STO Building Group, Suffolk Construction, and Skanska USA top BD+C's ranking of the nation's largest university sector contractors and construction management firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all university/college-related buildings except student residence halls, sports/recreation facilities, laboratories, S+T-related buildings, parking facilities, and performing arts centers (revenue for those buildings are reported in their respective Giants 400 ranking).

Construction Costs | Sep 28, 2023

U.S. construction market moves toward building material price stabilization

The newly released Quarterly Construction Cost Insights Report for Q3 2023 from Gordian reveals material costs remain high compared to prior years, but there is a move towards price stabilization for building and construction materials after years of significant fluctuations. In this report, top industry experts from Gordian, as well as from Gilbane, McCarthy Building Companies, and DPR Construction weigh in on the overall trends seen for construction material costs, and offer innovative solutions to navigate this terrain.

Data Centers | Sep 21, 2023

North American data center construction rises 25% to record high in first half of 2023, driven by growth of artificial intelligence

CBRE’s latest North American Data Center Trends Report found there is 2,287.6 megawatts (MW) of data center supply currently under construction in primary markets, reaching a new all-time high with more than 70% already preleased.

Contractors | Sep 12, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of August 2023

Associated Builders and Contractors' Construction Backlog Indicator declined to 9.2 months in August, down 0.1 month, according to an ABC member survey conducted from Aug. 21 to Sept. 6. The reading is 0.5 months above the August 2022 level.

Contractors | Sep 11, 2023

Construction industry skills shortage is contributing to project delays

Relatively few candidates looking for work in the construction industry have the necessary skills to do the job well, according to a survey of construction industry managers by the Associated General Contractors of America (AGC) and Autodesk.

Market Data | Sep 6, 2023

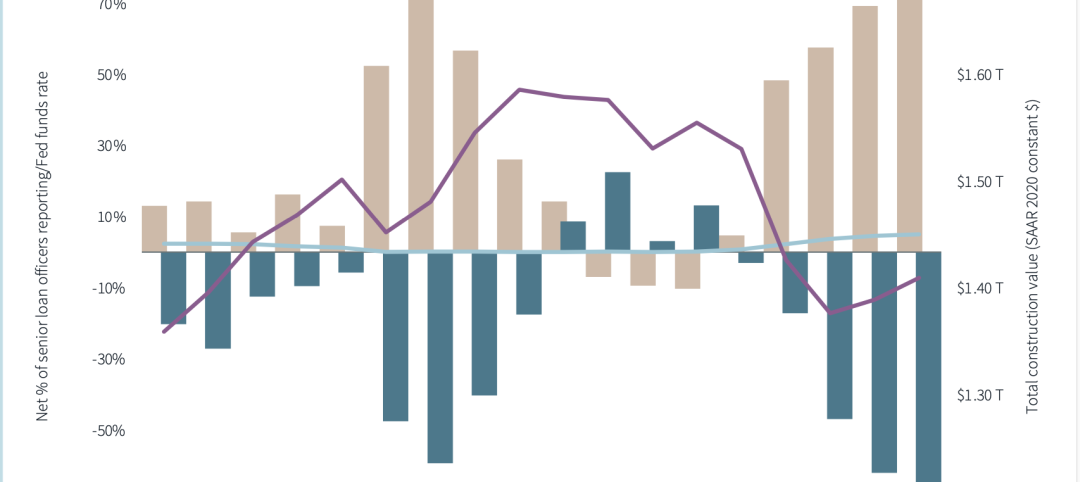

Far slower construction activity forecast in JLL’s Midyear update

The good news is that market data indicate total construction costs are leveling off.