Construction material prices fell for the sixth consecutive month in December, losing 1.2% on a monthly basis and 4% on a yearly basis according to an analysis of the Bureau of Labor Statistics Producer Price Index released by Associated Builders and Contractors (ABC).

Construction input prices have fallen 7.2% since peaking in August 2014, and have fallen in 11 of the previous 16 months. Nonresidential construction input prices exhibited similar declines, falling 1.1% for the month and 4% for the year.

"Construction input prices continued to sink to the end of 2015, due in large measure to global deflationary forces that have become increasingly apparent," said ABC Chief Economist Anirban Basu. "The World Bank predicts that the global economy will expand by less than 3% in 2016, very limited growth by historic standards. Last year, the global economy expanded by just 2.4%, with significant weakness recorded in much of the emerging world. Like last year, major emerging nations like Russia and Brazil are anticipated to be in recession.

"In addition, the U.S. dollar remains strong," Basu said. "With only a couple of exceptions, the U.S. is the only major nation to increase interest rates. If interest rates rise as anticipated, the dollar will strengthen further in 2016, placing additional downward pressure on input prices. Even significant geopolitical events involving oil producing nations has not been enough to stem the decline in oil or other commodity prices."

Only four key input prices expanded in December on a monthly basis:

- Natural gas prices expanded 5.2% month-over-month but are down 46.5% year-over-year.

- Prices for prepared asphalt and tar roofing and siding products rose 1% on a monthly basis but are down 2% on a yearly basis.

- Concrete product prices ticked 0.3% higher from November and are up 3% from the same time one year ago.

- Fabricated structural metal product prices inched 0.1% higher for the month but are 0.9% lower than at the same time one year ago.

Seven key input prices fell in December on a monthly basis:

- Crude petroleum prices plunged 16% month-over-month and are 43.3% lower year-over-year.

- Crude energy materials prices fell 5.7% for the month and are down 35.8% for the year.

- Softwood lumber prices shed 2.9% from November and are 6.8% lower than at the same time one year ago.

- Steel mill product prices dipped 2.7% for the month and 19.8% for the year.

- Prices for nonferrous wire and cable fell 2.7% on a monthly basis and are down 9.9% on a yearly basis.

- Iron and steel prices are down 2.2% for the month and 23.7% for the year.

- Prices for plumbing fixtures and fittings fell 0.5% month-over-month but expanded 1.3% year-over-year.

Related Stories

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.

Market Data | Sep 22, 2016

Architecture Billings Index slips, overall outlook remains positive

Business conditions are slumping in the Northeast.

Market Data | Sep 20, 2016

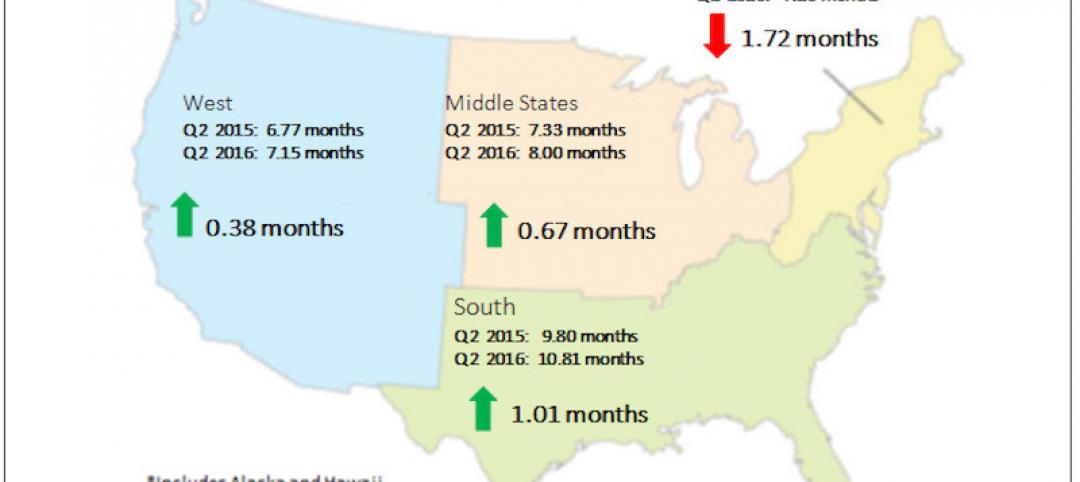

Backlog skyrockets for largest firms during second quarter, but falls to 8.5 months overall

While a handful of commercial construction segments continue to be associated with expanding volumes, for the most part, the average contractor is no longer getting busier, says ABC Chief Economist Anirban Basu.

Designers | Sep 13, 2016

5 trends propelling a new era of food halls

Food halls have not only become an economical solution for restauranteurs and chefs experiencing skyrocketing retail prices and rents in large cities, but they also tap into our increased interest in gourmet locally sourced food, writes Gensler's Toshi Kasai.

Building Team | Sep 6, 2016

Letting your resource take center stage: A guide to thoughtful site selection for interpretive centers

Thoughtful site selection is never about one factor, but rather a confluence of several components that ultimately present trade-offs for the owner.

Market Data | Sep 2, 2016

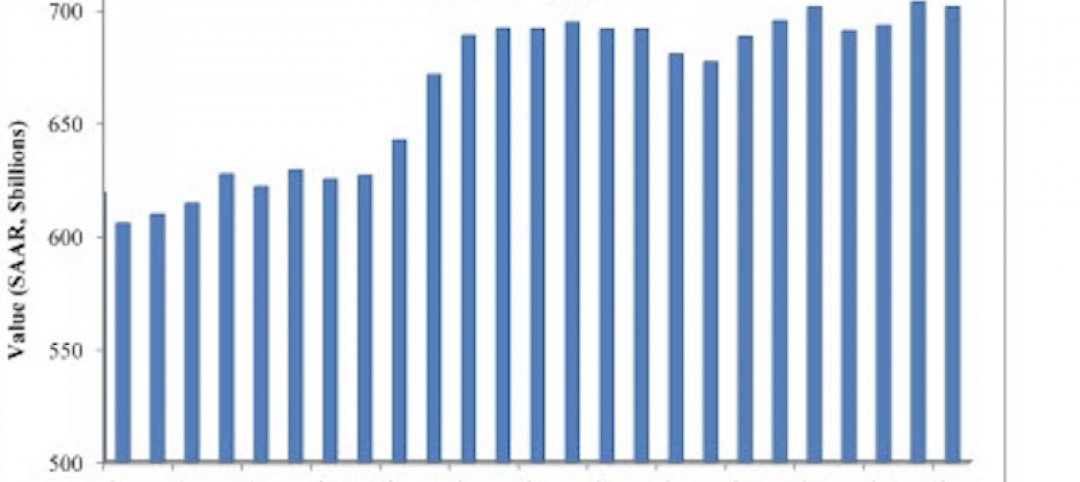

Nonresidential spending inches lower in July while June data is upwardly revised to eight-year record

Nonresidential construction spending has been suppressed over the last year or so with the primary factor being the lack of momentum in public spending.

Industry Research | Sep 1, 2016

CannonDesign releases infographic to better help universities obtain more R&D funding

CannonDesign releases infographic to better help universities obtain more R&D funding.

Industry Research | Aug 25, 2016

Building bonds: The role of 'trusted advisor' is earned not acquired

A trusted advisor acts as a guiding partner over the full course of a professional relationship.

Multifamily Housing | Aug 17, 2016

A new research platform launches for a data-deprived multifamily sector

The list of leading developers, owners, and property managers that are funding the NMHC Research Foundation speaks to the information gap it hopes to fill.

Hotel Facilities | Aug 17, 2016

Hotel construction continues to flourish in major cities

But concerns about overbuilding persist.