Retailers went through another tough year in 2017, during which store closings included 1,430 Radio Shacks, 808 Payless ShoeSource outlets, 667 Ascentas (which sell nutritional supplements), and 600 Walgreens.

That brick-and-mortar attrition continued in the first month of 2018, when Sears announced it would close another 103 Sears and Kmart outlets, and Toys ‘R’ Us—whose debt now totals about $5 billion—said it would close up to 182 units, reducing its total in the U.S. by one fifth. The carnage this year will also eliminate 379 Teavanas (Starbucks’ struggling tea retail outlets), 200 Gaps and Banana Republics, 63 Sam’s Clubs, 11 Macy’s, 40 Bon-Tons, 50 J. Crews, and between 100 and 150 Michael Kors boutiques.

Physical stores continue to get hammered by online shopping that accounted for more than 9% of total U.S. retail sales last year. However, not every physical vestige of retailing is collapsing under the pressure from eCommerce. 7-Eleven this month made the biggest acquisition in its history when it paid $3.2 billion to buy 1,030 convenience stores in 17 states owned by Sunoco LP, raising its total store count in North America to close to 9,700.

Earlier this month, the New York Post ran an article under the headline “There’s never been a better time to open retail stores in NYC.” The story pointed out how retailers from several countries are scouring New York for real estate. Levi’s will soon relocate its flagship store into a larger, 17,250-sf space in Vornado Realty Trust’s 1535 Broadway. Other retail chains looking for more space in the Big Apple include Target and Lord & Taylor.

That retailers come and go is hardly news to anyone who follows this sector or, for that matter, shops. But the constant drumbeat about a “retail apocalypse” is still premature, according to a report released this month by the research and consulting firm Fung Global Retailing & Technology (FGRT).

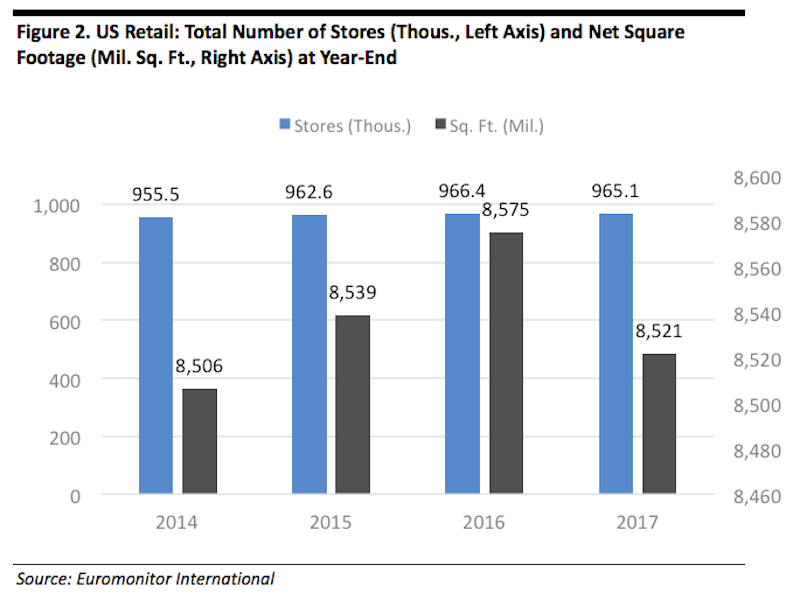

Despite weaker foot traffic, there was only a slight net decline in total U.S. retail stores last year, the first dropoff since 2009.

The report acknowledges that shopper traffic dropped off by 7.9% last year. And 6,995 stores closed in the U.S. in 2017 representing a net decline of 0.1%, according to Euromonitor International, which also estimated a 0.6% decrease in total retail selling space to 8.52 billion sf.

But the store-count reduction was the first since 2009, and it seemed to hit the apparel, mass merchant, and electronics and appliance sectors the hardest.

The grocery and dollar-store sectors, on the other hand, expanded “significantly” last year, with major dealers in those sectors opening a net 1,785 outlets. Other retailers, like the supermarket chain Aldi and the department store T. J. Maxx, are actively opening stores in off-mall and strip-mall locations.

Indeed, selling space for variety stores rose by 4.4% last year, by 1.3% for grocery stores, and by 1% for warehouse clubs.

FGRT points out that while brick-and-mortar retailers are getting more business from online sales, their in-store business continued to expand last year. Nearly 88% of all U.S. retail sales were transacted in physical stores in 2017, according the Census Bureau data. Offline retail sales grew by about 2.5%, and contributed to total U.S. retail sales increasing by 4%.

The study also notes that if online sales were taken out of the equation, the average sales per retail store rose 2.4% to $3.13 million, and average sales per square foot increased by 2.6% to $353.

It’s been conventional wisdom for a while that regional malls have been fast approaching their expiration dates. But FGRT states that superregional malls—defined by having at least 800,000 sf of selling space—were the only major shopping-center segment to grow its occupancy rates last year. FGRT also notes that open-air centers have proven to be a resilient real-estate segment, primarily because they typically have few apparel tenants and often include a strong grocery component.

Mall owners in general are diversifying their mix to incorporate more centers with premium tenants like Apple and even Tesla (which currently operates 109 retail showrooms nationwide). David Simon, CEO and Chairman of Simon Property Group, the country’s largest retail developer, says his company sees “significant opportunity” in densification of its shopping centers with the addition of mixed-use elements such as hotels, multifamily, and offices.

Another developer, Kimco, which was negatively affected by Sports Authority’s liquidation, sees future tenant mixes including more nascent retail chains such as Lidl and HomeSense from TJX. “Kimco is adapting to [the] evolving landscape by working hard to deliver both the product and an experience to tenants and shoppers commensurate with this new world order,” says CEO Conor Flynn. “That is why at many of [our] sites, you’ll see more health and wellness, more service providers, more food and restaurants, more entertainment and more experiential retailing.”

Related Stories

| May 17, 2011

Redesigning, redefining the grocery shopping experience

The traditional 40,000- to 60,000-sf grocery store is disappearing and much of the change is happening in the city. Urban infill sites and mixed-use projects offer grocers a rare opportunity to repackage themselves into smaller, more efficient, and more convenient retail outlets. And the AEC community will have a hand in developing how these facilities will look and operate.

| Apr 12, 2011

Retail complex enjoys prime Abu Dhabi location

The Galleria at Sowwah Square in Abu Dhabi will be built in a prime location within Sowwah Island that also includes a five-star Four Seasons Hotel, the healthcare facility Cleveland Clinic Abu Dhabi, and nearly two million sf of Class A office space.

| Mar 30, 2011

Big-box giants downsize, open smaller, urban stores

As U.S. chain retailers absorb the lessons of the Great Recession, many big-box chains have started to shrink average store footprints to reflect the growing importance of multi-channel shopping, adapt to urban settings, and recognize the need to optimize portfolios. Wal-Mart, Target, Best Buy, and the Gap, among others, all have small concepts in the works or are adapting existing ones. These smaller store formats should allow the retailers to maximize profitability and open more stores in closer proximity to each other.

| Mar 22, 2011

Mayor Bloomberg unveils plans for New York City’s largest new affordable housing complex since the ’70s

Plans for Hunter’s Point South, the largest new affordable housing complex to be built in New York City since the 1970s, include new residences for 5,000 families, with more than 900 in this first phase. A development team consisting of Phipps Houses, Related Companies, and Monadnock Construction has been selected to build the residential portion of the first phase of the Queens waterfront complex, which includes two mixed-use buildings comprising more than 900 housing units and roughly 20,000 square feet of new retail space.

| Feb 23, 2011

Unprecedented green building dispute could cost developer $122.3 Million

A massive 4.5 million-sf expansion of the Carousel Center shopping complex in Syracuse, N.Y., a project called Destiny USA, allegedly failed to incorporate green building components that developers had promised the federal government—including LEED certification. As a result, the project could lose its tax-exempt status, which reportedly saved developer The Pyramid Cos. $120 million, and the firm could be penalized $2.3 million by the IRS.

| Feb 11, 2011

Chicago high-rise mixes condos with classrooms for Art Institute students

The Legacy at Millennium Park is a 72-story, mixed-use complex that rises high above Chicago’s Michigan Avenue. The glass tower, designed by Solomon Cordwell Buenz, is mostly residential, but also includes 41,000 sf of classroom space for the School of the Art Institute of Chicago and another 7,400 sf of retail space. The building’s 355 one-, two-, three-, and four-bedroom condominiums range from 875 sf to 9,300 sf, and there are seven levels of parking. Sky patios on the 15th, 42nd, and 60th floors give owners outdoor access and views of Lake Michigan.

| Feb 11, 2011

Grocery store anchors shopping center in Miami arts/entertainment district

18Biscayne is a 57,200-sf urban retail center being developed in downtown Miami by commercial real estate firm Stiles. Construction on the three-story center is being fast-tracked for completion in early 2012. The project is anchored by a 49,200-sf Publix market with bakery, pharmacy, and café with outdoor seating. An additional 8,000 sf of retail space will front Biscayne Boulevard. The complex is in close proximity to the Adrienne Arsht Center for the Performing Arts, the downtown Miami entertainment district, and the Omni neighborhood, one of the city’s fast-growing residential areas.

| Feb 11, 2011

Apartment complex caters to University of Minnesota students

Twin Cities firm Elness Swenson Graham Architects designed the new Stadium Village Flats, in the University of Minnesota’s East Bank Campus, with students in mind. The $30 million, six-story residential/retail complex will include 120 furnished apartments with fitness rooms and lounges on each floor. More than 5,000 sf of first-floor retail space and two levels of below-ground parking will complete the complex. Opus AE Group Inc., based in Minneapolis, will provide structural engineering services.

| Feb 11, 2011

Green design, white snow at Egyptian desert retail complex

The Mall of Egypt will be a 135,000-sm retail and entertainment complex in Cairo’s modern 6th of October district. The two-story center is divided into three themed zones—The City, which is arranged as a series of streets lined with retail and public spaces; The Desert Valley, which contains upscale department stores, international retailers, and a central courtyard for music and other cultural events; and The Crystal, which will include leisure and entertainment venues, including a cinema and indoor snow park. RTKL is designing the massive complex to LEED Silver standards.