S&P Global: U.S. construction costs rise amid tariff and labor pressures in October 2025

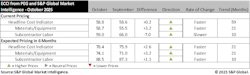

Engineering and construction costs continued to show gains in October, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector saw gains to 58.8 this month, from 58.6 in September, continuing to represent upward pricing pressure.

The sub-indicator for materials and equipment costs increased by 3.2-points to 58.7 while the sub-indicator for subcontractor labor costs decreased to 59.0 in October from 66.0 in September.

Material and Equipment Costs Rebound in October

The materials and equipment indicator rebounded in October after establishing its lowest reading in 2025 in the September report. Seven of the twelve components increased compared to last month, partially offset by decreases in three components, alongside two that remained unchanged. Although a few categories notable changes, most increases in October were relatively mild compared to what has been seen in recent months.

Electrical equipment saw the largest increase, surging 18.8-points. This was accompanied by milder gains seen from alloy steel pipe, carbon steel pipe, copper-based wire and cable, transformers and ocean freight. These increases were partially offset by pullbacks seen in fabricated structural steel, gas/steam turbines and ANSI pumps and compressors. Unchanged readings were seen from redi-mix concrete and shell and tube heat exchangers.

Tariff Policy and Labor Market Pressures Impact Costs

“In the near-term, US tariff policy is softening demand across two levers. Price passthrough is keeping interest rates higher for longer whilst policy uncertainty is discouraging hiring,” said Lauren Ottley, Research Economist, S&P Global Market Intelligence. “In the longer-run, expected labor cost are rising, reflecting potential supply side risks.”

Subcontractor Labor Costs Decline Across U.S. Regions

The sub-indicator for current subcontractor labor costs experienced a further pullback in October, decreasing to 59.0 after a reading of 66.0 last month.

Alongside declines registered in the U.S. Northeast, widespread decreases were seen in the U.S. Midwest, U.S. West and the U.S. South. Meanwhile, upward pressure was seen in Western Canada, alongside no change in Eastern Canada.

Future Cost Expectations Remain Elevated

The six-month headline expectations for future construction costs indicators increased further to 78.4 in October. The six-month expectations indicator for materials and equipment came in at 74.1, which is 3.1-points higher than last month’s figure. Six of the twelve categories saw increases in October, highlighted by a 13.2-point increase from carbon steel pipe, alongside milder gains seen from fabricated structural steel, turbines, electrical equipment and alloy steel pipe.

Providing limited sources of downward pressure were declines seen from redi-mix concrete and transformers, accompanied by unchanged readings seen from copper-based wire and cable and ANSI pumps and compressors.

Meanwhile, the six-month expectations indicator for subcontractor labor saw supportive results in October with the only contraction being seen in the U.S. South. Meanwhile, upward pressure was seen from the U.S. Northeast, Midwest and West, alongside both the Eastern and Western regions of Canada.

On balance, despite weaker near-term readings, the overall sub-contractor labor outlook reading pushed higher to 88.5 in October.

Skilled Labor Shortages Persist Despite Active Market

Respondents reported few shortages this month, largely confined to electrical workers and pipe fabrication welders. Market commentary is noting an increase in service RFPs and that the U.S. market appears to be more active lately.

To learn more about the Engineering and Construction Cost Indicator or to obtain the latest published insight, please click here.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.