Total Cost of Ownership Model Informs Future-Focused Facility Planning

What construction manager, property owner, or facilities executive wouldn’t welcome the benefits of a dynamic multifaceted financial model to inform decision making?

Are you feeling overwhelmed by the number of buildings in your portfolio? Is your portfolio aging without proactive reinvestment, leading to a constant battle with deferred maintenance? Are your estimates out of date or reflective of past conditions? Are you always scrambling to cover annual funding shortfalls? The Total Cost of Ownership (TCO) model could be the relief you’ve been searching for, providing a comprehensive solution to your portfolio management challenges.

Reap the Benefit of Long-Term Financial Forecasting

What if you could predict the financial journey of your asset, equipment, or investment from the moment it enters your possession to the end of its lifecycle? This is the power of TCO, a financial model that tracks and forecasts the varied costs of owning and operating an asset throughout its entire useful life.

Imagine the confidence that comes with making informed choices in facility management and equipment purchase decisions. This is the advantage that the TCO model can give you, empowering you to make data-informed decisions that align with your long-term goals and financial mission.

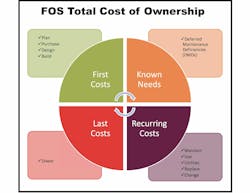

A typical TCO model includes:

- First costs – such as planning, purchase, design, and build

- Known needs – like deferred maintenance

- Recurring costs – including maintenance, day-to-day use, utilities, replacement, and renovations

- Last Costs – for example, divestment

Another factor overarching all of these costs is escalation, the increase in the price of a product, service, or commodity over time. In construction and facility management, escalation should accurately represent the expected rise in building materials and labor costs, which may be substantially higher or lower than the economy’s inflation rate. A successful TCO model will incorporate the ability to track and adjust for escalation.

An illustration of the impact of escalation is the unprecedented cost increases that the world experienced post-COVID. Supply chain shortages and labor shutdowns left an indelible mark on the near future of construction and facility management. The ability to track and project costs with a model that accounts for inflation, escalation, and location-specific factors further supports the value of a comprehensive tool to balance funding needs against changing real-world financial conditions.

Large Portfolios Require Big Picture Thinking

The TCO model is especially relevant to higher education institutions and municipalities, which face significant cyclical capital investment needs throughout the life of their facilities. Storied, architecturally significant buildings might sit alongside ‘temporary’ structures built with a singular purpose in mind that long ago exceeded their intended use. Balancing the needs of renewal and new construction against repurposing or divestment requires a strategic outlook that considers not only the cost of design and construction but also deferred maintenance backlogs, routine operating costs, and other building-related expenses.

Combined with ongoing scheduling and space needs, balancing new construction and investments in existing infrastructure represents a significant challenge. Integrating TCO with decision-making allows organizations to predict capital investment plan outcomes and intelligently target, prioritize, and optimize annual spending.

Making smart decisions for your facilities should be grounded in data-driven insights.

Ideally, adoption of a TCO strategy would follow a comprehensive facilities condition assessment (FCA), including suitability, adaptability, energy, accessibility, routine maintenance, and other enhanced data points. This comprehensive approach ensures that you have all the necessary information to make strategic decisions about your facilities.

Stacking TCO values over time for multiple assets can be very revealing. For example, as determined by a 10-year facility assessment, there might be spikes in action years 3 and 6. Knowing this allows time to plan. This might mean saving or developing a funding plan based upon priorities and available funding sources and limits.

Now that we have explored the value of the data-informed, future-focused TCO model of property design, construction, and maintenance, in upcoming posts we will look at discreet phases of the design/build/maintain/repurpose/divest process of ownership that can benefit from integrated technology solutions along with way.

Based on standards published by APPA in 2020, the FOScore® TCO module, featured this year in BD+C’s 2024 Great Solutions Roundup as one of the “Top 40 Biggest Innovations,” is one of many products offered by FOS that provides real-time, actionable data for architects, designers, builders, owners, and contractors. The FOScore® TCO module helps organizations gather and analyze facility data to make informed choices – all in the palm of their hand.

For more information on ways FOS can assist you, reach out to: [email protected].

About the Author

Facility Optimization Solutions

Recognizing the prevalence and gravity of challenges facility managers and owners face, FOS of CannonDesign was born out of CannonDesign’s education studio in 2009 as a solutions-driven practice with the core belief that our clients are our most important partners. FOS, short for Facility Optimization Solutions, LLC, is a multidisciplinary professional service and software consultancy that provides facility condition assessments, capital planning, asset tagging, cost estimating, job order contracting, and more to propel data-informed decision making. Since 2021, FOS has been ranked #1 worldwide for facility management services by World Architecture 100.