AEC employees are staying with firms that invest in their brand

Between January 2021 and February 2022, nearly 57 million people in the U.S quit their jobs. The average quit rate between August and December of last year was 4-4.1 million per month. In the construction sector alone, the quit rate during those five months ranged from 138,000 to 208,000 per month, according to Census Bureau estimates.

The so-called Great Resignation “was a wakeup call, in one sense” for America’s businesses and economy that continues to resonate. However, AEC firms have tended to respond to this phenomenon instead of measuring its impact.

That’s the assessment of Karl Feldman, a partner with Hinge Marketing, a research-based branding and marketing firm headquartered in Reston, Va. Hinge has been tracking employee satisfaction, and its latest study explores why people leave their jobs, based on responses to a poll of AEC workers at different career levels from 120 firms with combined revenue of over $8 billion. The polling was conducted between late August and late November 2022.

Forty-four percent of respondents were “mid career,” and another 28 percent were at “leadership” levels, such as directors or vice presidents. More than half of the respondents worked for firms with at least 200 employees each.

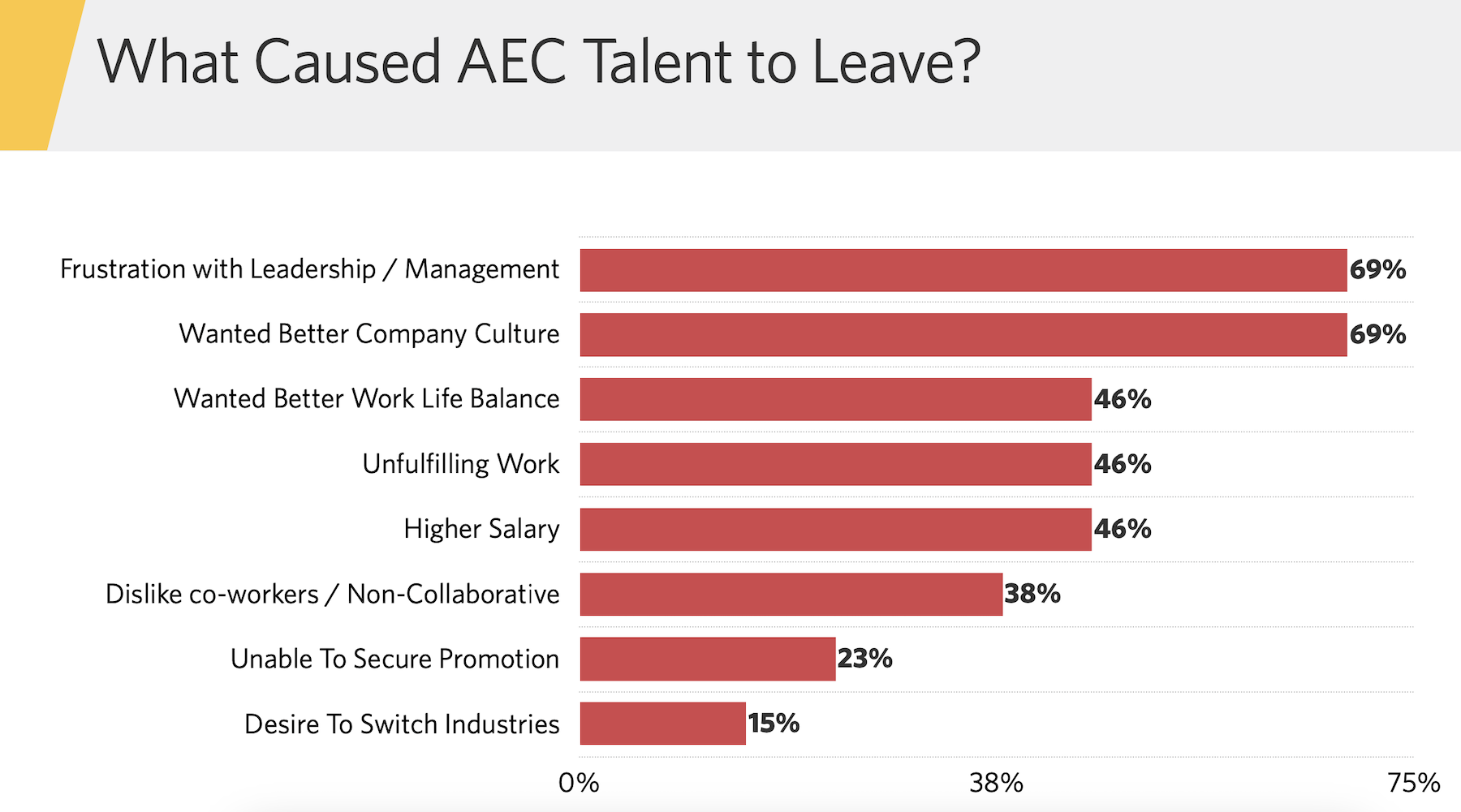

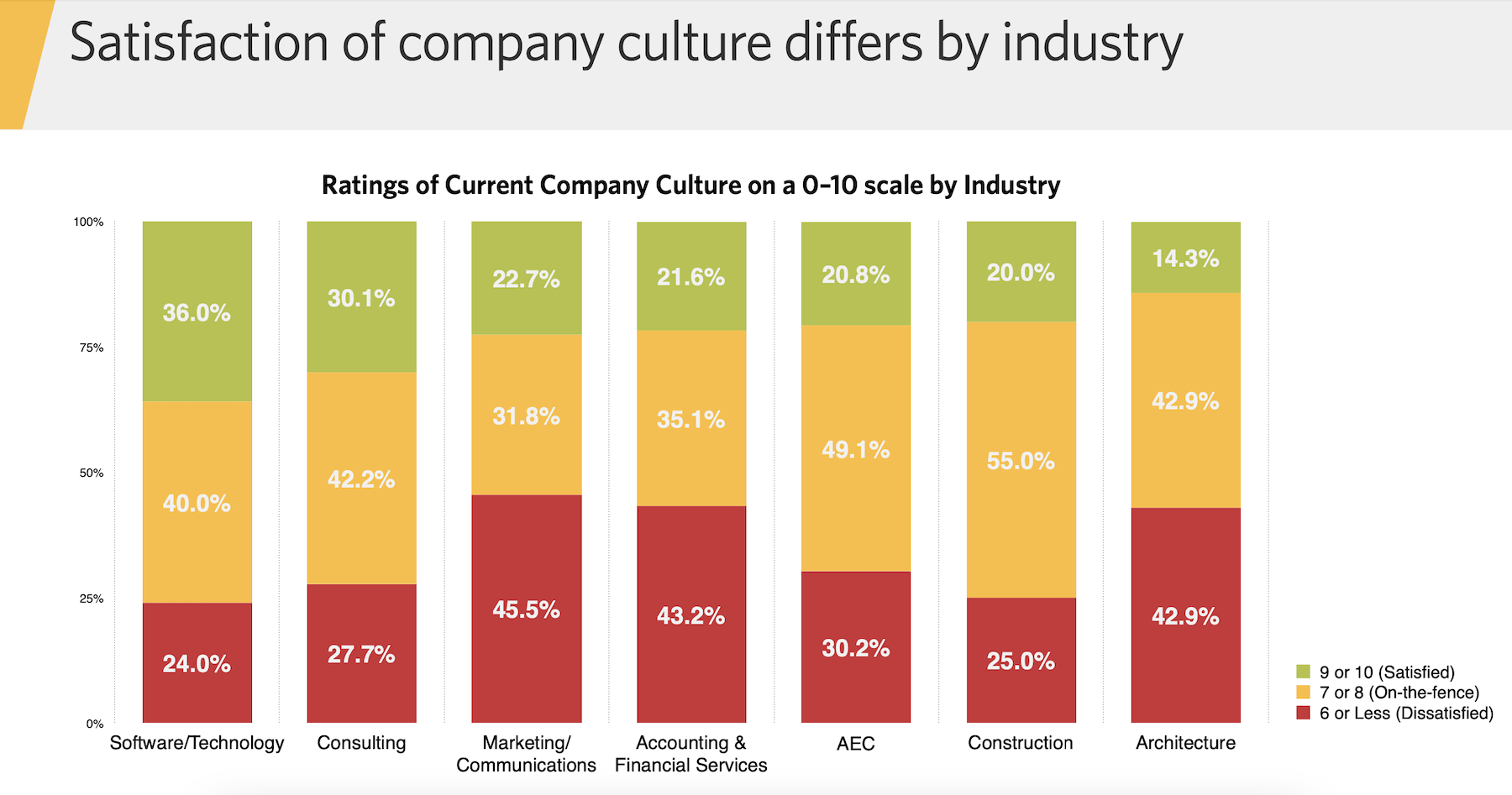

The survey found that only a relatively small percentage of workers is actively looking for a new job. But the survey also found that talent is most likely to start coveting greener pastures in mid-career, three to five years into their current jobs. Nearly half of AEC employees are on the fence about their companies, neither satisfied nor dissatisfied; however, more than half of AEC workers who had quit in the previous 12 months cited two factors—a poor company culture or frustration with its leadership—among their reasons for bolting.

Feldman observes that many businesses still perceive “culture” as sounding “fluffy.” But, he explains, culture is essentially about how a company gets things done. “That’s the question that talent is asking about companies,” he says, and the answers better be “genuine.”

Show and tell

Feldman says that technology and organizational support are the “great equalizers” in corporate America. “The days of rainmakers are gone,” he believes. That being said, Feldman observes that employees expect their companies to invest in their “brands,” in ways that burnish their reputations and visibility. “Folks who stand out from the ‘beige’ are going to have an edge.”

The problem with the AEC sector, says Feldman, is that it’s still behind the curve using automation tools that can aggregate data to understand what employees expect and want. He wonders, for example, how many AEC firms can describe what their ideal job candidate are? Or how many firms are set up to tutor younger-generation employees who, Feldman says, are eager to learn from mentors?

The survey found that mid-career and leadership employees alike want to feel confident that their voices are being listened to. But on a range of what’s important to them, mid-career workers aren’t keen on wearing too many job hats, whereas leaders require the option and tools to work efficiently from remote locations.

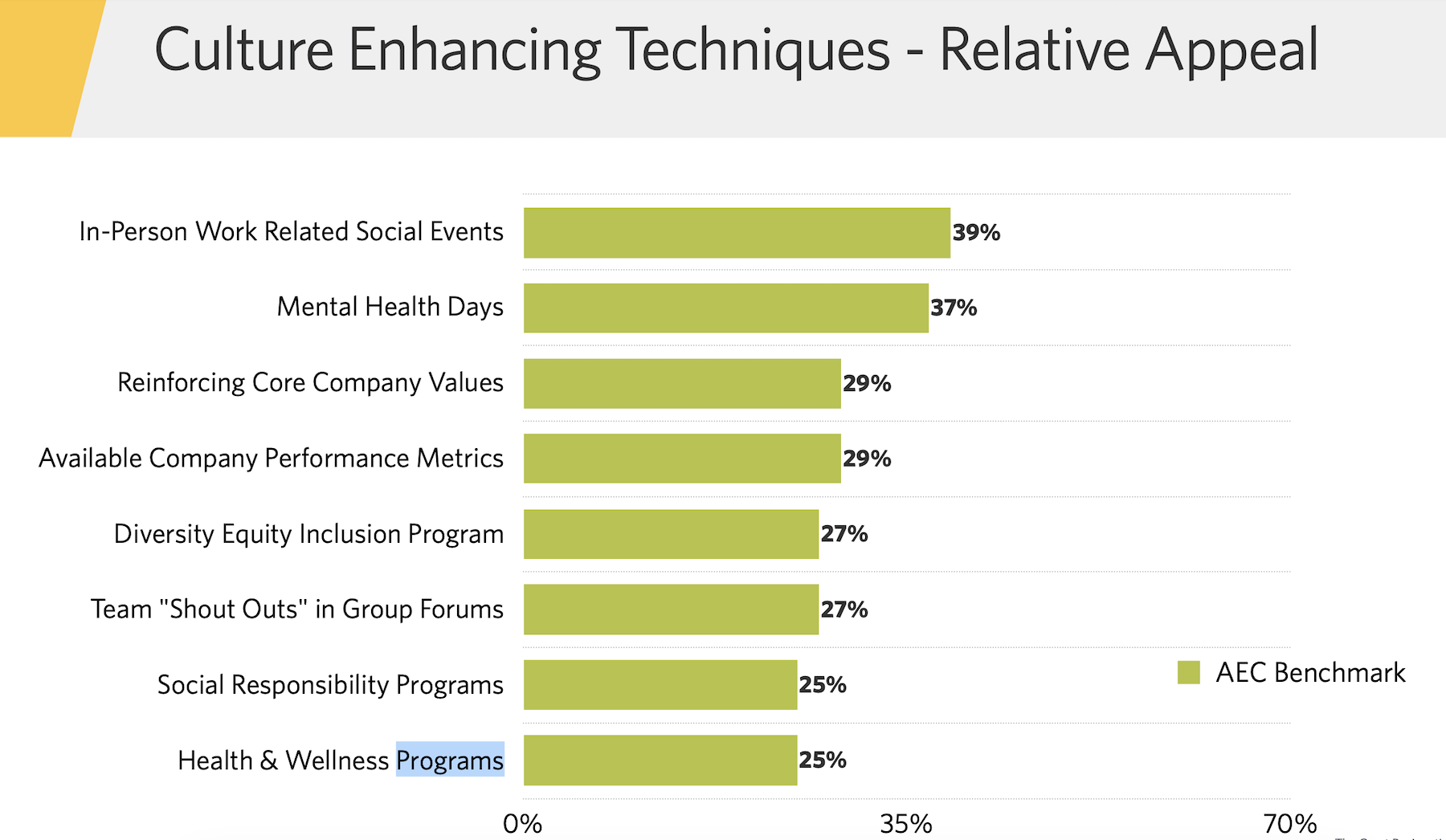

Hinge’s study offers AEC firms six strategies for keeping talent corralled. The first advises them to get to know their employees better at their mid-career levels. Companies should also conduct self-assessments of their brands, “tune” and communicate their cultures, showcase their employees’ expertise, introduce job candidates to their teams, and secure whatever “accelerants” a company needs to retain and expand their talent.

“Mid-level leadership is looking for a good home, but also wants to grow,” says Feldman. What companies need to ask themselves is “will we be more visible and credible” to retain employees they want to keep?