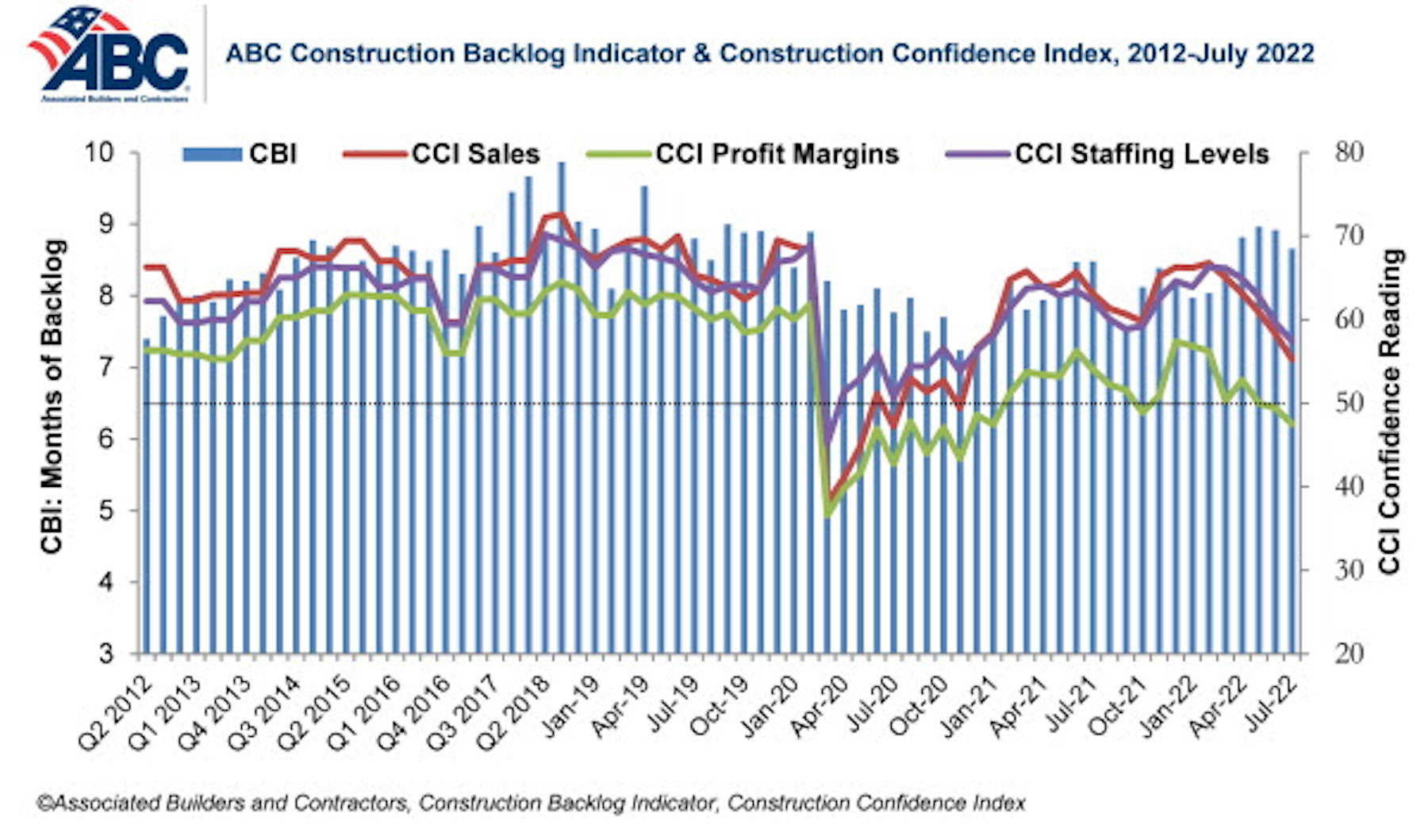

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell 0.2 months in July and stands at 8.7 months, according to an ABC member survey conducted July 20 to Aug. 3. The reading is up 0.2 months from July 2021.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for July 2022.

While backlog is 0.3 months lower than the May 2022 peak, it remains higher than at any point between March 2020 and March 2022. Backlog rose sharply in the south, which continues to be the highest of any region. Notably, backlog decreased by 1.2 months for contractors with less than $30 million in annual revenue.

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels declined in July. The indices for sales and staffing remain above the threshold of 50, indicating expectations of growth over the next six months, while the reading for profit margins remains below the threshold of 50 for the second consecutive month.

“The level of construction activity has begun to fade,” said ABC Chief Economist Anirban Basu. “While the average contractor still expects employment and sales to climb over the next six months, the current pace of expansion is poised to be slower than earlier stages of economic recovery. Higher borrowing costs, weak commercial real estate fundamentals and the reluctance of many project owners to bear the full brunt of higher construction materials prices and rising compensation costs are pushing profit margins lower and driving pessimism higher. The average contractor expects margins to shrink over the next six months.

“A growing number of contractors are preparing for tougher times ahead,” said Basu. “That is nothing new for an industry that has proven itself to be highly resilient and cyclical in recent decades. Nonetheless, for now, many contractors continue to operate at capacity and are actively looking to hire additional workers to expand capacity. It is simply too soon to conclude that the nonresidential construction industry has entered recession despite recent declines in backlog.”