ConstructConnect announced today the release of its Q3 2017 Forecast Quarterly Report. The U.S. grand total construction starts growth projection for 2017 over 2016 in ConstructConnect’s Q3 report has been revised down slightly to +4.5% from +4.8%. 2018 remains about the same at +5.9% year over year (y/y). Earlier, it had been estimated at +6.0%.

“The outlook for U.S. construction starts, as calculated by ConstructConnect, has diminished slightly in the short term,” said to Chief Economist Alex Carrick. “Prospects for some private sector project initiations (e.g., in retail) have stalled, while high hopes for an early launch of a much-needed super-infrastructure program, to be sponsored, promoted and perhaps largely financed by the new administration in Washington, have been deflated.”

The forecast which combines ConstructConnect's proprietary data with macroeconomic factors and Oxford Economics econometric expertise, shows the type-of-structure sub-categories among non-residential building starts that will have banner years in 2017:

- Hotels/motels (+38.2%)

- Warehouses (+16.3%)

- Sports stadiums (+47.3%)

- Courthouses (+110.0%)

The 2017 forecast for non-residential building starts was adjusted to -0.8% y/y, versus a flat (0.0%) performance that was expected in Q2’s forecast report. According to the forecast, non-residential building starts in 2018 will rebound to +3.3%, with private office buildings and industrial/manufacturing doing better with less downward drag being exerted by retail and medical projects. The boom in hotel/motel work will begin to lose steam.

Based on a heightened record of ‘actual’ starts through the first half of this year (+25.2%), civil/engineering starts in 2017 were revised upwards to +16.5% y/y from +8.9% in Q2’s report. 2018 growth in this category has also been raised, to +7.4% (from +5.8%).

The forecast includes a few notable high points in the 2017 y/y engineering sub-categories:

- Airports (+38.0%)

- Roads (+14.0%)

- Bridges (+31.0%)

- Power/oil and gas (+30.8%)

The report states among major sub-sectors, residential construction’s 2017 y/y increase has been scaled down to +4.8% from +8.1%. The robust multi-family market of the last several years has been pulling back of late, as rental rates in many regions soared. Single-family starts also stalled, despite a need for substantial growth activity, since they declined so horrendously in the Great Recession. Also, new family formations, specifically among millennials, point to a tremendous potential that for the moment is not being realized.

Related Stories

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

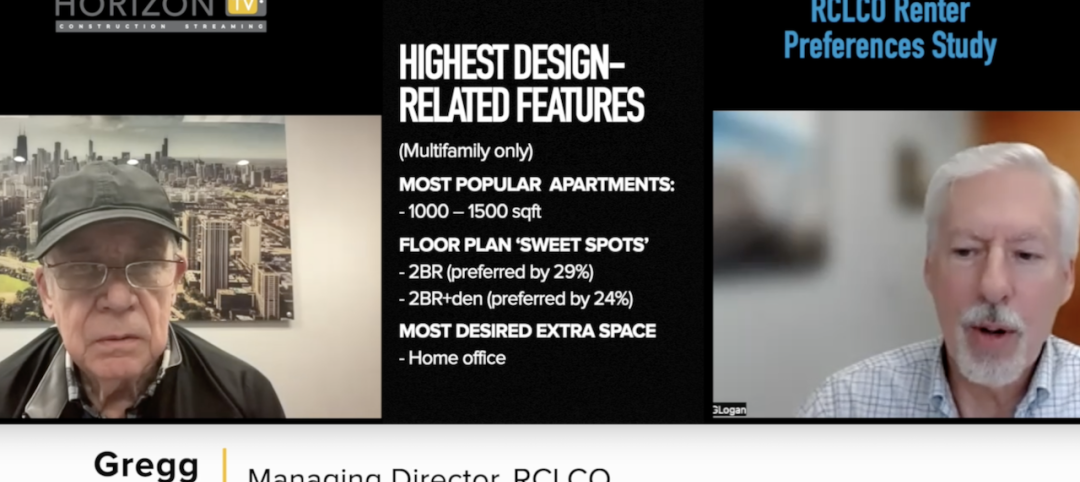

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

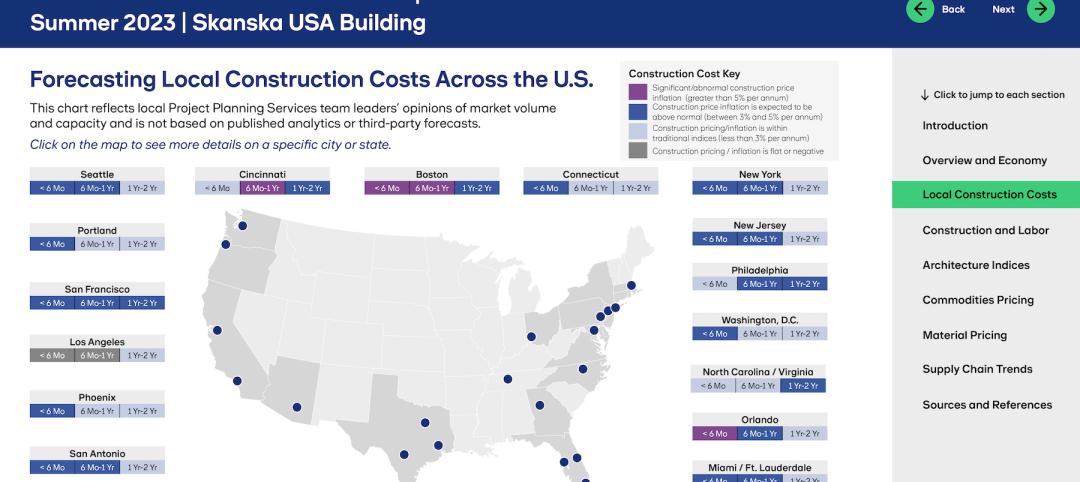

Market Data | Aug 18, 2023

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.