The current record-setting expansion in the U.S. economy and its real estate sector, which dates back to the start of this decade, should continue through 2021, but at a moderated pace.

That’s the consensus prediction, based on a recent survey of 41 economists and analysts at 32 leading real estate organizations. Those experts’ opinions about all things real estate—from transaction volumes and pricing to returns on investment and housing development—form the basis of the Urban Land Institute’s Real Estate Economic Forecast, which ULI released last week.

The trends that are likely to drive the pace of that growth are identified in Emerging Trends in Real Estate 2020, which ULI and PwC, the accounting and research firm, released last month. That 92-page report is based on survey responses from 1,450 people working for various real estate-related businesses (nearly 28% of whom are private property owners or developers), and 750 individuals whom the report’s researchers interviewed personally.

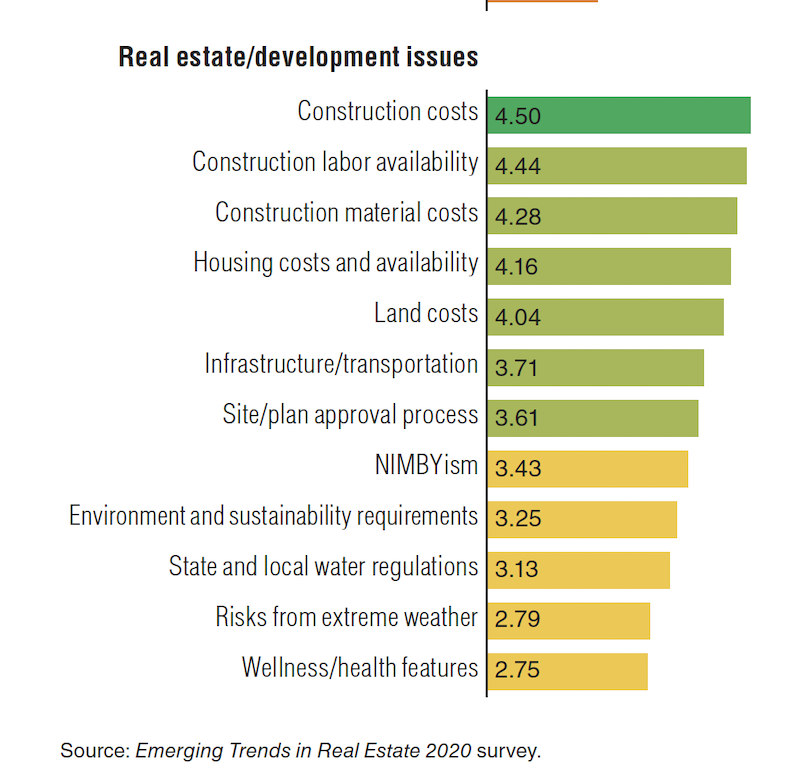

Rising construction costs lead the areas of concern that could stymie real estate growth.

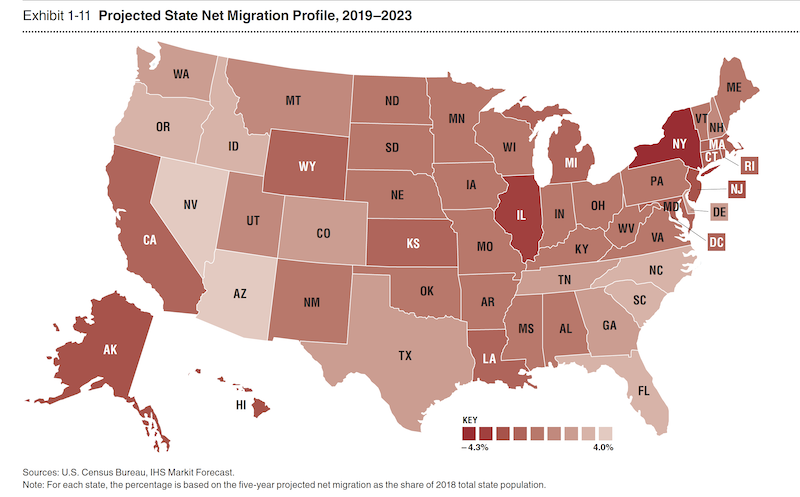

Austin ranks first out of 80 metros in the U.S. for having the greatest potential for real estate for 2020, followed by Raleigh-Durham, N.C., Nashville, Charlotte, and Boston. The Emerging Trends report assesses which markets are worth watching by six criteria that include population projections, homebuilding prospects, investor demand, and redevelopment opportunities.

Manhattan and Chicago will continue to lead the pack as capital magnets for real estate investment. Philadelphia and Long Island, N.Y., are among the metros with sustained track records for capital flow and transaction volume. And Jacksonville, Fla., Salt Lake City, and Columbus, Ohio, are deemed “treasures ripe for discovery.”

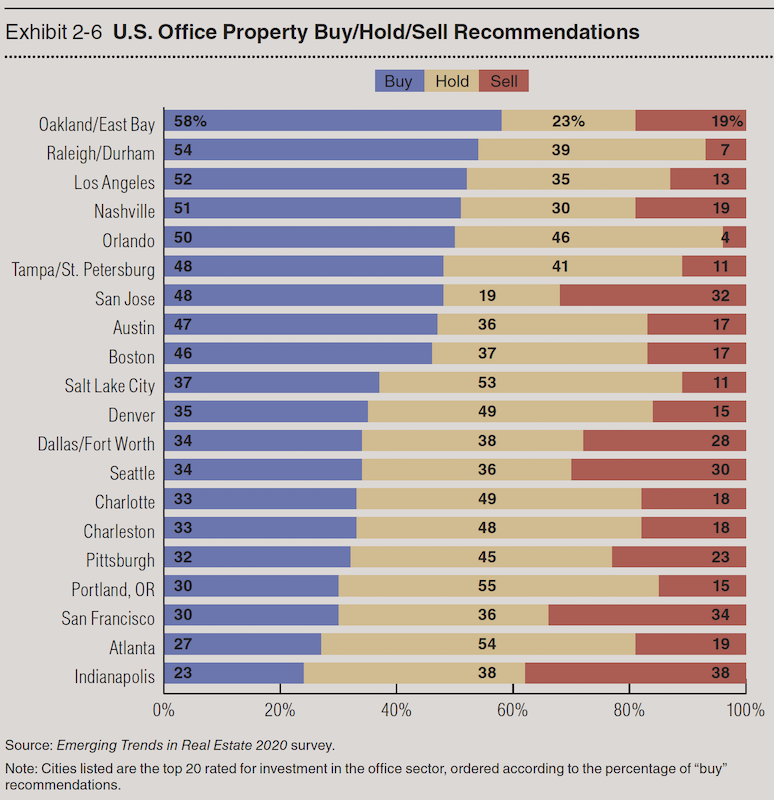

The report makes “buy-hold-sell” recommendations within metros for different building types. For example, nearly three-fifths of respondents gave Oakland/East Bay in California a “buy” recommendation for office properties. Orlando ranked highest for multifamily properties, Nashville for retail, Charleston, S.C., for hotels.

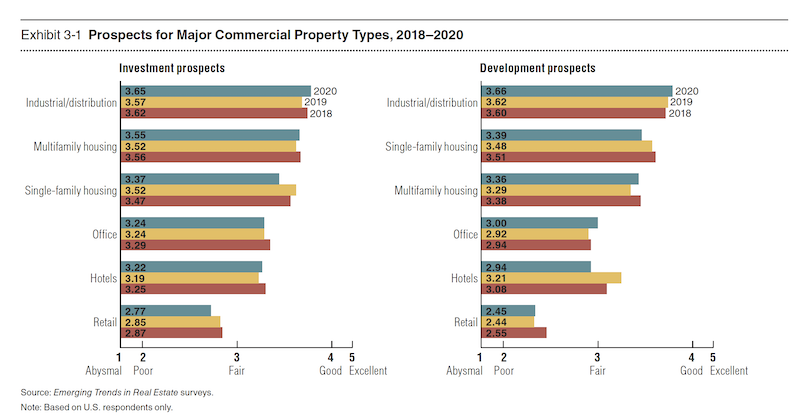

Warehouse distribution, in an era of online shopping, continues to be seen as fertlle for future development.

Nationally, industrial buildings, such as warehouses, have the greatest prospects among commercial real estate property types for 2020 in terms of their return performance and growth outlook, followed by multi- and single-family housing.

This report, though, isn’t all upbeat. Among the trends it spots is an “extended downshifting” in the economy, which is likely to have implications for commercial property demand “in the decades ahead.” The report warns against “a surfeit of capital desperately seeking placement,” which could create a real estate bubble. And the repot sees affordable housing at “a breaking point” of inadequate supply. One attempted solution: the rise in coliving.

The report sees increasing demand for communities that can deliver an authentic sense of place “rather than concocted through prescribed programming and business goals.” It also sees live-work-play districts breaking out of their urban enclaves and expanding to suburban communities to create “hipsturbias.” Real estate development in “hipsturbs” and urban downtowns should benefit from baby boomers’ expectations of staying active as they age.

Infrastructure construction and improvement are more likely to be initiated by state and local, rather than federal, governments that see them as foundations of their cities’ economic growth. And property managers are turning to technology for productivity enhancements and operational efficiencies.

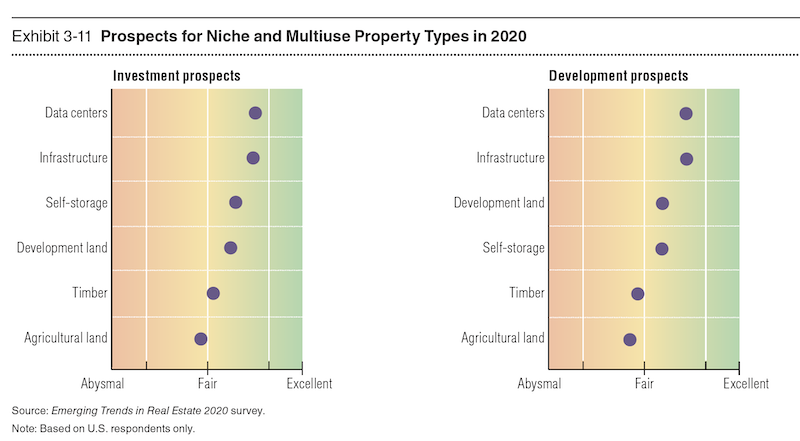

Data centers and infrastructure are two building types where experts foresee better than average growth prospects.

Many of these trends are premised on economic assumptions that ULI lays out in its Real Estate Economic Forecast. It expects the U.S. gross domestic product to increase by 2.3% this year 1.7% next year, and 1.9% in 2021. Net job growth should average 1.7 million per year through 2021. Yields on 10-year U.S. Treasury notes are expected to decline, which ULI states “should be a positive for real estate values.”

Real estate transaction volumes are expected to moderate over the forecast period, from a projected $475 billion this year to $415 billion in 2021. Real estate price growth is also expected to slow, from 5.1% this year to 3.9% in 2021.

The Oakland, Calif., market remains ripe for office development and construction.

Rent growth should be flat for all building types except industrial and hotels, which will see declines. National vacancy rates will rise slightly, predicts economists.

Total real estate returns, as well as equity real estate investment trust returns, are expected to be strong over the next two years. On the flip side, increasing construction costs are tamping down single-family housing, to the point where ULI’s report is forecasting an annual average, through 2021, of between 800,000 and 850,000 units delivered, well below the long-term annual average of 975,000. Home prices, though, should continue to average 3.2% growth per year over the forecast period.

Related Stories

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Market Data | Nov 15, 2022

Construction demand will be a double-edged sword in 2023

Skanska’s latest forecast sees shorter lead times and receding inflation, but the industry isn’t out of the woods yet.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Market Data | Nov 3, 2022

Building material prices have become the calm in America’s economic storm

Linesight’s latest quarterly report predicts stability (mostly) through the first half of 2023

Building Team | Nov 1, 2022

Nonresidential construction spending increases slightly in September, says ABC

National nonresidential construction spending was up by 0.5% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.