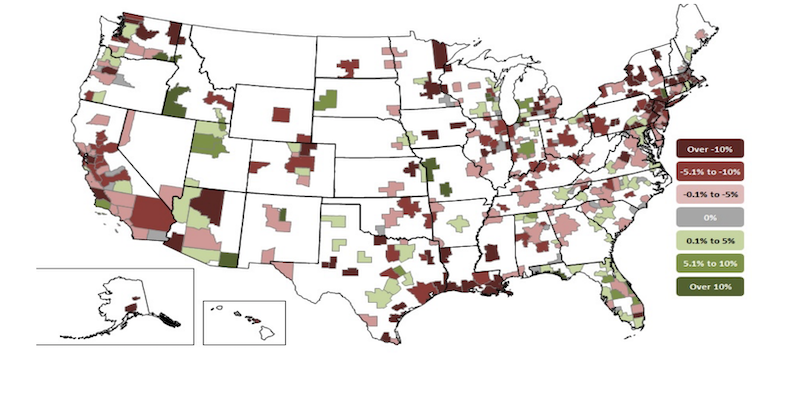

Construction employment decreased in 241, or 67%, out of 358 metro areas between August 2019 and last month, according to an analysis of new government data that the Associated General Contractors of America released today. Association officials urged Congress to pass new coronavirus relief measures before leaving town.

“Although residential construction is picking up in many areas, public and nonresidential construction are shrinking,” said Ken Simonson, the association’s chief economist. “Project cancellations are spreading, and fewer new projects are starting up. That combination makes further employment declines inevitable unless the federal government steps up support for infrastructure.”

Simonson noted that construction employment was stagnant in 29 metro areas and increased in only 88 areas (25%) over the past 12 months. Nineteen metros had all-time lows for August construction employment, while 33 areas had record highs for August, in data going back to 1990 for most areas.

Houston-The Woodlands-Sugar Land, Texas lost the most construction jobs over 12 months (-22,800 jobs, -10%), followed by New York City (-21,700 jobs, -13 percent). Brockton-Bridgewater-Easton, Mass. had the largest percentage decline (-38 percent, -2,200 jobs), followed by Johnstown, Pa. (-34 percent, -1,000 jobs).

Indianapolis-Carmel-Anderson, Ind. added the most construction jobs from August 2019 to August 2020 (4,800 jobs, 9%), followed by Baltimore-Columbia-Towson, Md. (4,300 jobs, 5%). Niles-Benton Harbor, Mich. had the highest percentage increase (16%, 400 jobs), followed by Fond du Lac, Wisc. (15%, 500 jobs) and Walla Walla, Wash. (15%, 100 jobs).

Association officials urged Congressional leaders to not leave town until after the election without passing much-needed new coronavirus relief measures. In particular, the construction officials called on Congress to pass new liability protections for firms that are taking steps to protect workers from the coronavirus. They also urged Congressional leaders to boost investments in infrastructure and pass measures designed to preserve payrolls.

“The coronavirus and efforts to mitigate its spread have left our economy deeply wounded, depressing demand for many types of commercial construction projects,” said Stephen E. Sandherr, the association’s chief executive officer. “Congress can end the downward economic slide and help create needed new construction jobs by passing measures to boost demand and protect honest employers.”

View the metro employment 12-month data, rankings, top 10, and map.

Related Stories

Market Data | Mar 29, 2017

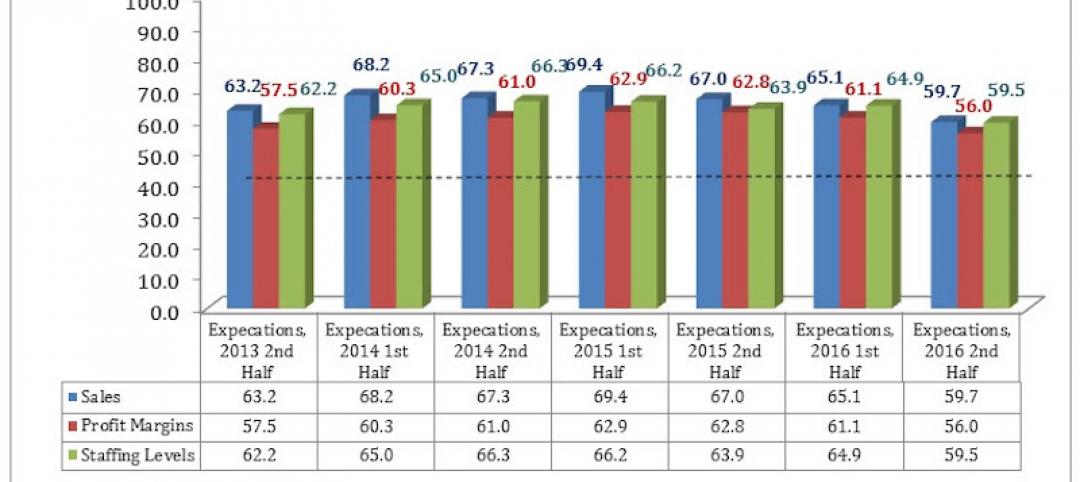

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

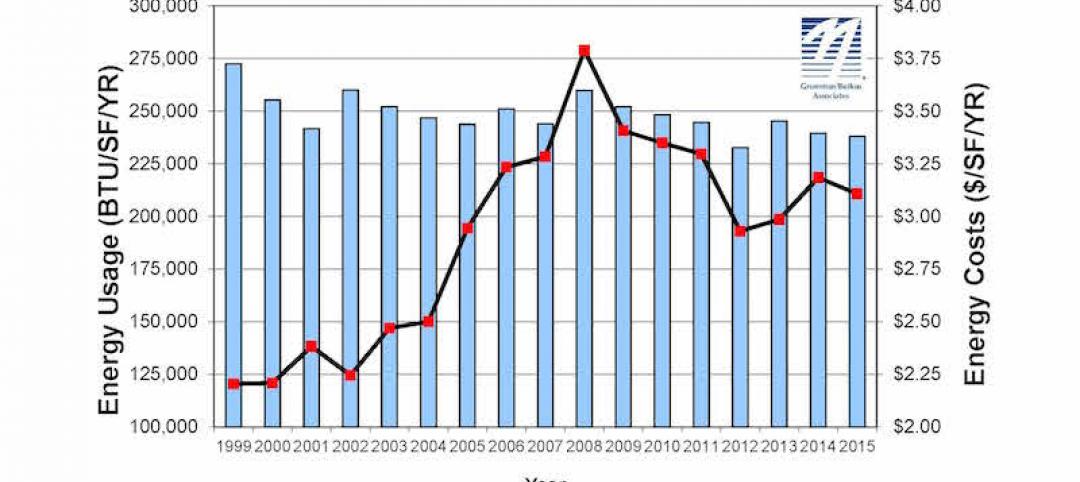

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

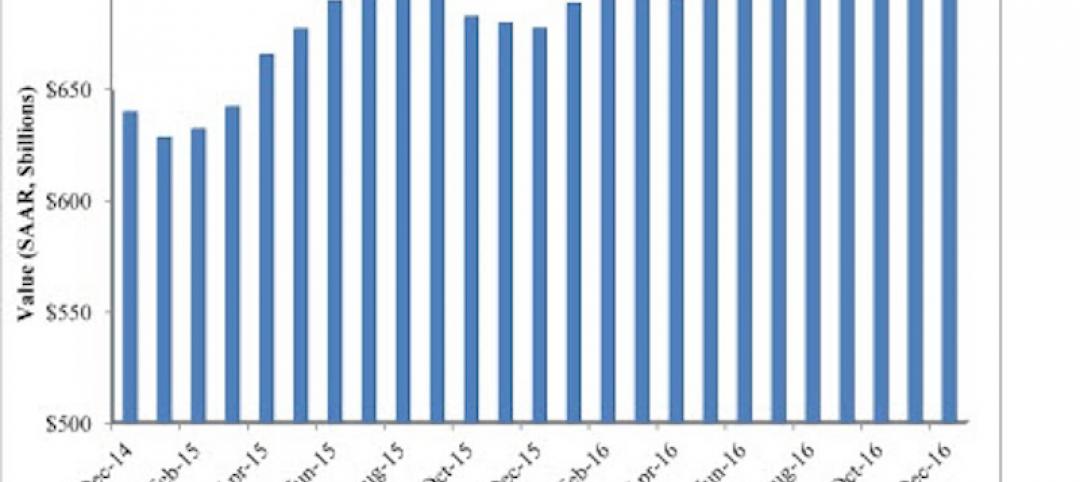

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.