Turner Construction Company has rebranded its supply chain management services as SourceBlue. The company unveiled the new name as part of an extensive strategic initiative to elevate the supply chain planning and procurement experience in the construction industry. The new brand reflects its vision to offer clients a single point of contact for all of their supply chain planning and procurement requirements.

“The evolution of our company is the result of a collaborative process with our clients, suppliers, employees and partner – Turner Construction Company,” said Mark Boyle, senior vice president, chief procurement officer. “Our procurement specialists manage all aspects of buying, expediting, and tracking deliveries, facilitating warranty issues and managing closeouts. It was important to us to create a presence that reflected our vision to revolutionize supply chain management process to enhance the construction experience for everyone involved.”

For more than 20 years, SourceBlue has been providing transformational processes by working with contractors, manufacturers, designers and vendors to provide reliable and efficient procurement experiences in the construction industry.

“When procuring items such as cooling towers, plumbing fixtures, generators, MRIs stone countertops, and the diverse range of building materials and fixtures, the traditional procurement process leads to gaps in the supply chain,” continued Boyle. “Twenty years ago we started this firm so that our clients benefited from greater predictability on these complex supply chains. Now we have expanded our offerings to include turnkey, product solutions. Our global footprint enables clients to benefit from our established relationships with leading international manufacturers leading to opportunities for innovation and collaboration.”

ABOUT SOURCEBLUE

SourceBlue, LLC is a wholly-owned subsidiary of Turner Construction Company, a North America-based, international construction services company. SourceBlue provides planning and supply chain management services. Over the past 20 years, the company has earned recognition for managing complex projects, fostering innovation, embracing emerging technologies and making a difference for their clients, employees and community.

With a staff located throughout the United States, the company offers clients the accessibility and support of a local firm with the stability and resources of a multi-national organization. For more information, visit http://www.turnerconstruction.com.

Related Stories

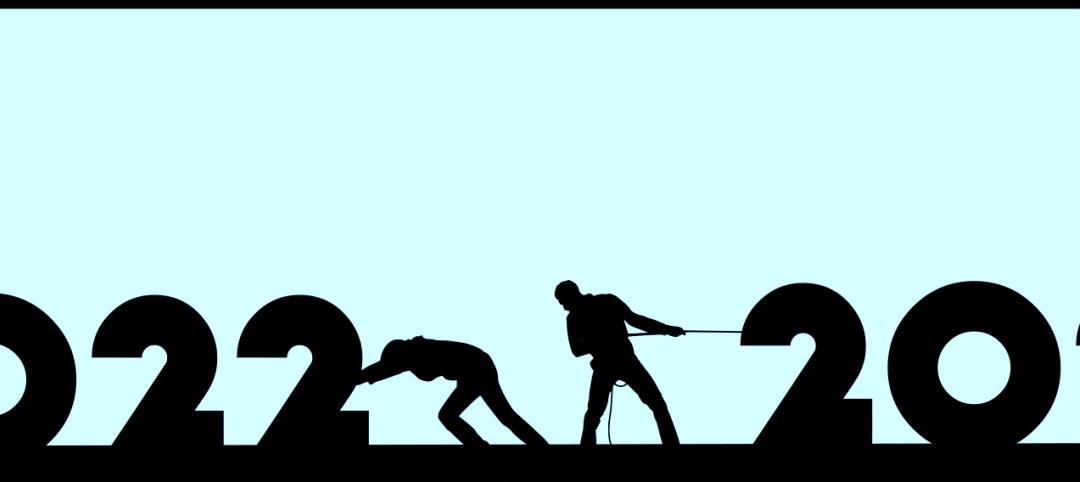

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Market Data | Nov 15, 2022

Construction demand will be a double-edged sword in 2023

Skanska’s latest forecast sees shorter lead times and receding inflation, but the industry isn’t out of the woods yet.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Market Data | Nov 3, 2022

Building material prices have become the calm in America’s economic storm

Linesight’s latest quarterly report predicts stability (mostly) through the first half of 2023

Building Team | Nov 1, 2022

Nonresidential construction spending increases slightly in September, says ABC

National nonresidential construction spending was up by 0.5% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.