The Trump Administration’s plans for infrastructure investment, regulatory reform, and tax relief have ignited a burst of enthusiasm among U.S. engineering firm leaders, propelling the American Council of Engineering Companies’ Engineering Business Index (EBI) to its largest ever quarterly increase.

The 4th Quarter 2016 (Q4/2016) EBI surged 5.1 points to 66.5, up from the 61.4 score of Q3/2016. The previous largest increase was 1.5 points between the Q1/2014 and Q2/2014 surveys. Any score above 50 signifies that the market is growing The EBI is a leading indicator of America’s economic health based on the business performance and projections of engineering firms responsible for developing the nation’s transportation, water, energy, and industrial infrastructure. The Q4/2016 survey of 317 engineering firm leaders was conducted November 31 to December 20.

Survey results show firm leader market expectations for one year from today rose a hefty 8.8 points to 72.1, the largest quarter-over-quarter increase since the EBI’s inception in January 2014. Expectations for both short- and long-term profitability also climbed. Firm leader optimism for improved profitability over the next six months rose 3.6 points to 69.0; increased to 72.9 for one year from now; and climbed 2.9 points to 70.5 for three years from now.

“We finally have a president who understands business!” says one respondent. “We’re looking forward to some significant tax relief with the new Administration,” says another.

The boost in firm leader optimism extends across almost the entire engineering marketplace. In public markets, transportation showed the strongest increase, up an eye-catching 9.5 points to 73.7.

All other public market sectors rose: Water and Wastewater (up 7.5, to 70.5), Education (up 3.2 to 58.2) Health Care (up 0.3, to 56.1), and Environmental (up 1.1 to 55.4). A new public sector category, Buildings, debuted at 65.2. Among the private client markets, firm leaders were most bullish about the Industrial/Manufacturing sector, which leaped up 12.5 points to 70.7. Four key private sector markets also climbed: Energy and Power (up 8.8, to 69.2), Land Development (up 8.2, to 68.4.), Buildings (up 4.1 to 67.0), and Education (up 5.2, to 58.5).

For the complete Quarter 4, 2016 Engineering Business Index, go to www.acec.org.

Related Stories

K-12 Schools | Mar 18, 2024

New study shows connections between K-12 school modernizations, improved test scores, graduation rates

Conducted by Drexel University in conjunction with Perkins Eastman, the research study reveals K-12 school modernizations significantly impact key educational indicators, including test scores, graduation rates, and enrollment over time.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.

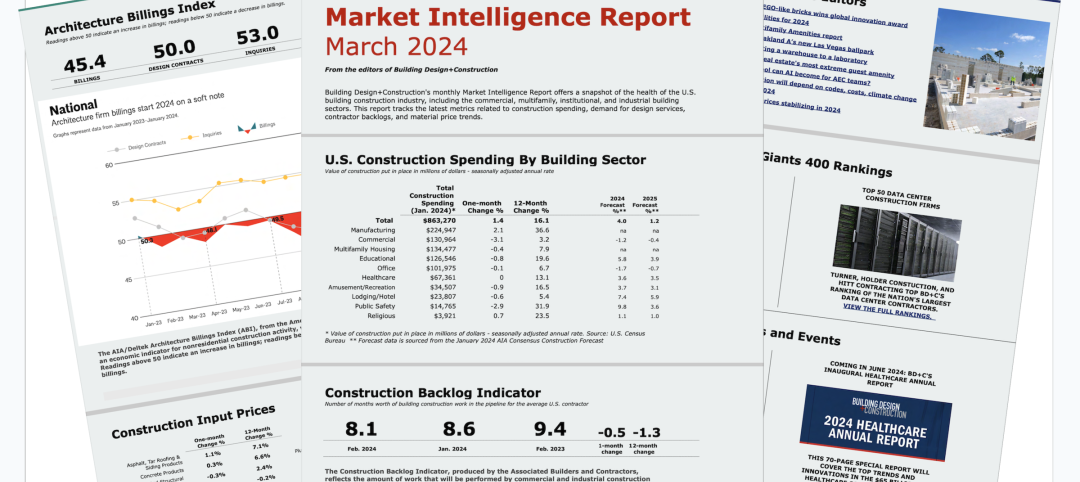

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).

Contractors | Mar 12, 2024

The average U.S. contractor has 8.1 months worth of construction work in the pipeline, as of February 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.1 months in February, according to an ABC member survey conducted Feb. 20 to March 5. The reading is down 1.1 months from February 2023.

Market Data | Mar 6, 2024

Nonresidential construction spending slips 0.4% in January

National nonresidential construction spending decreased 0.4% in January, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.190 trillion.

Multifamily Housing | Mar 4, 2024

Single-family rentals continue to grow in BTR communities

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

MFPRO+ News | Mar 2, 2024

Job gains boost Yardi Matrix National Rent Forecast for 2024

Multifamily asking rents broke the five-month streak of sequential average declines in January, rising 0.07 percent, shows a new special report from Yardi Matrix.

K-12 Schools | Feb 29, 2024

Average age of U.S. school buildings is just under 50 years

The average age of a main instructional school building in the United States is 49 years, according to a survey by the National Center for Education Statistics (NCES). About 38% of schools were built before 1970. Roughly half of the schools surveyed have undergone a major building renovation or addition.

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.