Extreme price increases continued in July for a wide range of goods and services used in construction, according to an analysis by the Associated General Contractors of America of government data released today. Association officials urged President Biden to immediately end tariffs and quotas on steel, aluminum, lumber and other essential construction items to help stave off inflationary pressure in the construction industry.

“July was the sixth-straight month of double-digit price increases for construction inputs,” said Ken Simonson, the association’s chief economist. “In addition, lead times to produce or deliver many items keep lengthening. Many reports since the government collected this price data in mid-July show the trend will continue, at a minimum into the autumn and likely beyond, unless tariffs and quotas are removed.”

The producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—rose 4.4% over the past 12 months. That was a small fraction of the 25.6% increase in the prices that producers and service providers such as distributors and transportation firms charged for construction inputs, Simonson noted.

There were double-digit percentage increases in the selling prices of materials used in every type of construction. The producer price index for steel mill products more than doubled from July 2020 to last month, leaping 108.6%. The index for lumber and plywood jumped 56.8% despite a large drop in mill prices from May to July. The index for copper and brass mill shapes rose 49.0% and the index for aluminum mill shapes increased 33.2%. The index for plastic construction products rose 26.7%. The index for gypsum products such as wallboard climbed 21.6%. The index for insulation materials rose 11.8%, while the index for prepared asphalt and tar roofing and siding products rose 10.9%.

In addition to increases in materials costs, transportation and fuel costs also spiked. The index for truck transportation of freight jumped 13.8%. Fuel costs, which contractors pay directly to operate their own trucks and off-road equipment, as well as through surcharges on freight deliveries, have also jumped.

Association officials urged the president to remove tariffs on key construction materials, including steel and aluminum. They noted that some countries have opted for quotas on steel and aluminum in place of tariffs, making supplies even tighter. They said these government limitations on key materials, if left in place, would undermine some of the benefits of the new infrastructure measure that passed in the Senate

“These tariffs and quotas are artificially inflating the cost of many key materials and doing more damage to the economy than help,” said Stephen E. Sandherr, the association’s chief executive officer. “Leaving these measures in place will undermine the broader benefits of the bipartisan new infrastructure measure the House should be passing.”

View producer price index data. View chart of gap between input costs and bid prices. View the association’s Construction Inflation Alert.

Related Stories

Construction Costs | May 16, 2024

New download: BD+C's May 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Contractors | May 15, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of April 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator increased to 8.4 months in April, according to an ABC member survey conducted April 22 to May 6. The reading is down 0.5 months from April 2023, but expanded 0.2 months from the prior month.

Healthcare Facilities | May 6, 2024

Hospital construction costs for 2024

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Contractors | May 1, 2024

Nonresidential construction spending rises 0.2% in March 2024 to $1.19 trillion

National nonresidential construction spending increased 0.2% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.19 trillion.

AEC Tech | Apr 30, 2024

Lack of organizational readiness is biggest hurdle to artificial intelligence adoption

Managers of companies in the industrial sector, including construction, have bought the hype of artificial intelligence (AI) as a transformative technology, but their organizations are not ready to realize its promise, according to research from IFS, a global cloud enterprise software company. An IFS survey of 1,700 senior decision-makers found that 84% of executives anticipate massive organizational benefits from AI.

Hotel Facilities | Apr 24, 2024

The U.S. hotel construction market sees record highs in the first quarter of 2024

As seen in the Q1 2024 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of the first quarter, there are 6,065 projects with 702,990 rooms in the pipeline. This new all-time high represents a 9% year-over-year (YOY) increase in projects and a 7% YOY increase in rooms compared to last year.

Construction Costs | Apr 18, 2024

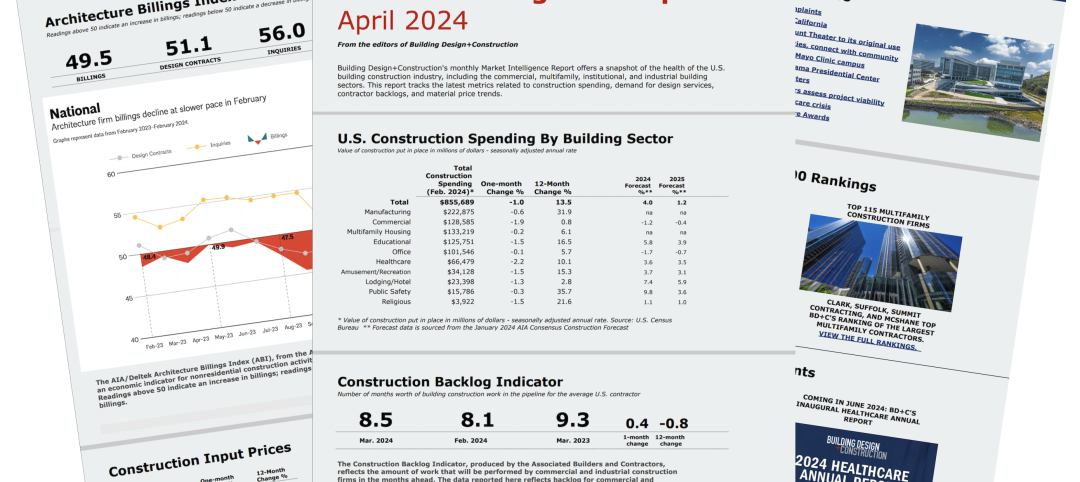

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.