Following President Trump’s signing of the historic Coronavirus Aid, Relief, and Economic Security (CARES) Act, SBA Administrator Jovita Carranza and Treasury Secretary Steven T. Mnuchin announced that the SBA and Treasury Department have initiated a robust mobilization effort of banks and other lending institutions to provide small businesses with the capital they need.

The CARES Act establishes a new $349 billion Paycheck Protection Program. The Program will provide much-needed relief to millions of small businesses so they can sustain their businesses and keep their workers employed.

The new loan program will help small businesses with their payroll and other business operating expenses. It will provide critical capital to businesses without collateral requirements, personal guarantees, or SBA fees – all with a 100% guarantee from SBA. All loan payments will be deferred for six months. Most importantly, the SBA will forgive the portion of the loan proceeds that are used to cover the first eight weeks of payroll costs, rent, utilities, and mortgage interest.

The Paycheck Protection Program is specifically designed to help small businesses keep their workforce employed. Visit http://www.

- The new loan program will be available retroactive from Feb. 15, 2020, so employers can rehire their recently laid-off employees through June 30, 2020.

- Attached are the Payroll Protection Program loan related documents, along with a fact sheet on the program.

Loan Terms & Conditions

- Eligible businesses: All small businesses, including non-profits, Veterans organizations, Tribal concerns, sole proprietorships, self-employed individuals, and independent contractors, with 500 or fewer employees, or no greater than the number of employees set by the SBA as the size standard for certain industries

- Maximum loan amount up to $10 million

- Loan forgiveness if proceeds used for payroll costs and other designated business operating expenses in the 8 weeks following the date of loan origination (due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs)

-

All loans under this program will have the following identical features:

- Interest rate of 0.5%

- Maturity of 2 years

- First payment deferred for six months

- 100% guarantee by SBA

- No collateral

- No personal guarantees

- No borrower or lender fees payable to SBA

SBA’s announcement comes on the heels of a series of steps taken by the Agency since the President’s Emergency Declaration to expeditiously provide capital to financially distressed businesses affected by the Coronavirus (COVID-19) pandemic.

Related Stories

Coronavirus | Apr 2, 2020

COVID-19: HMC Architects using 3D Printers to make face shields for healthcare workers

HMC staff is producing 3D-printed parts from their homes as they self-isolate.

Coronavirus | Apr 2, 2020

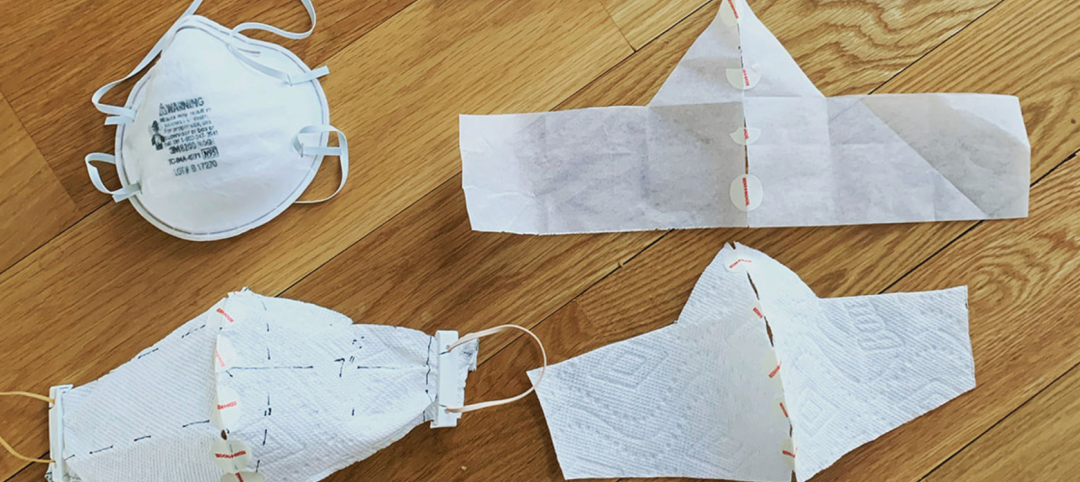

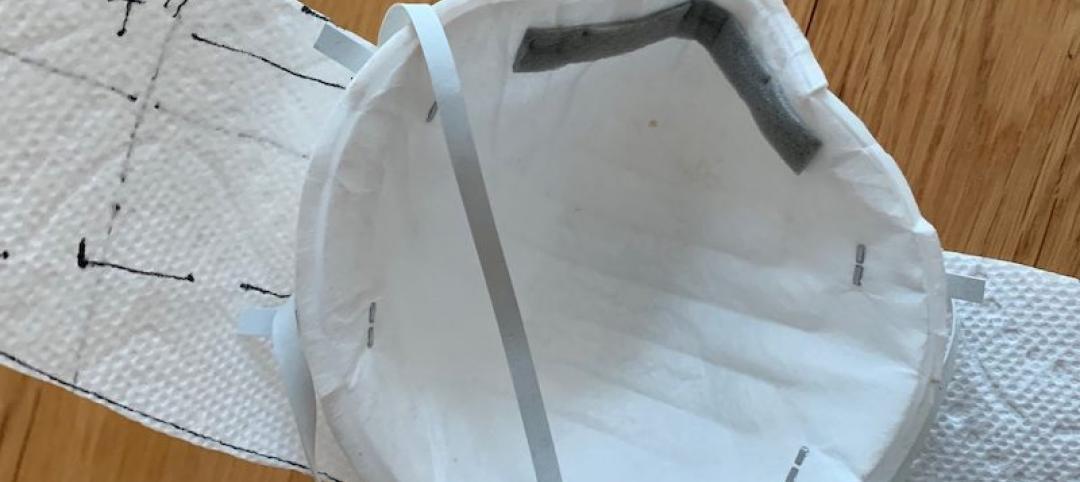

COVID-19: CannonDesign initiates industry coalition to make masks for healthcare providers

Coalition formed to make DIY face masks for healthcare workers in COVID-19 settings.

Coronavirus | Apr 2, 2020

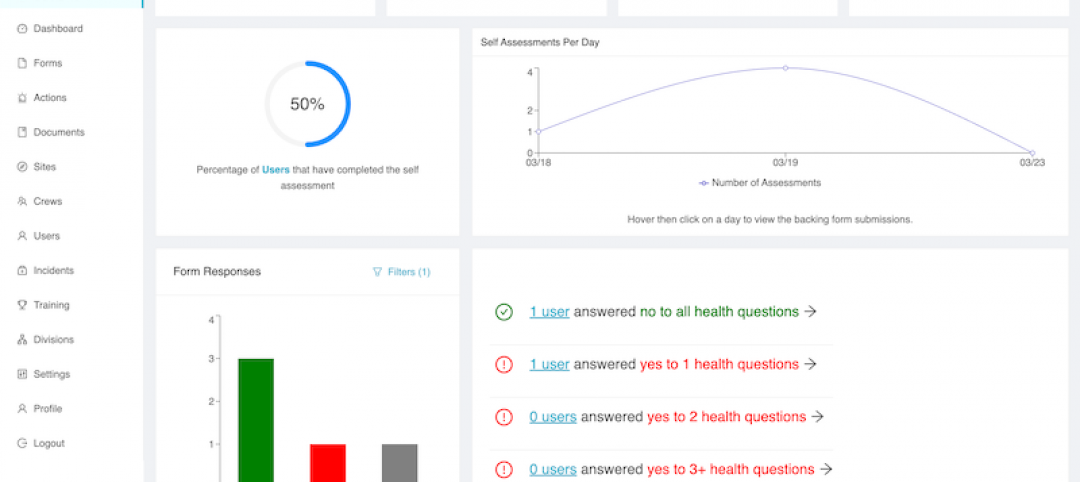

As virus spreads across North America, software providers step up with cost-free offerings

The goal is to keep construction projects moving forward at a time when jobs are being postponed or canceled.

Coronavirus | Apr 2, 2020

New webinar explains how AIA Contract Documents can address business disruptions due to Covid-19

The webinar was recorded March 27.

Coronavirus | Apr 2, 2020

Informed by its latest Crane Index, Rider Levett Bucknall anticipates the effect of coronavirus on the construction industry

While total crane count holds steady, turbulent economic conditions indicate a recession-based drop in construction costs.

Coronavirus | Apr 1, 2020

How is the coronavirus outbreak impacting your firm's projects?

Please take BD+C's three-minute poll on the AEC business impacts from the coronavirus outbreak.

Coronavirus | Apr 1, 2020

Opinion: What can we learn from the coronavirus pandemic?

The coronavirus pandemic will soon end, soon be in the rear-view mirror, but we can still take lessons learned as directions for going forward.

Coronavirus | Apr 1, 2020

Three reasons you should keep sewing face masks (as long as you follow simple best practices)

Here are three reasons to encourage sewists coast to coast to keep their foot on the pedal.

Coronavirus | Apr 1, 2020

TLC’s Michael Sheerin offers guidance on ventilation in COVID-19 healthcare settings

Ventilation engineering guidance for COVID-19 patient rooms

Coronavirus | Apr 1, 2020

February rise in construction outlays contrasts with pandemic-driven collapse in March as owners, government orders shut down projects

Survey finds contractors face shortages of materials and workers, delivery delays and cancellations.