Nearly 40 million Americans live in apartments. And because of the COVID-19 pandemic, developers and residents have been forced to rethink apartment living in terms of health, space, and utility.

To capture these thoughts, and to understand the future of multifamily housing, a team at Grimm + Parker Architects, which specializes in affordable and sustainable architecture projects, last summer conducted a fact-based exploration of the challenges and pressures that developers and residents experienced during the health crisis, and how those factors are likely to affect apartment design.

Other design firms have speculated on the impact COVID-19 is likely to have on apartment living, but far fewer have provided solutions as specifically as Grimm + Parker.

The following article is based on the report that came out of that firm’s exploration, titled “The New Normal and the Future of Multifamily Housing,” and created from responses of a dozen developers and 91 residents in the Washington, D.C.–Maryland–Virginia markets. This article also draws from commentary from three Grimm + Parker design architects—Zak Schooley, AIA, LEED AP BD+C, Executive Vice President; Julio Cruz, Architectural Designer; and Lauren Gilmartin, Architectural Designer—whom BD+C interviewed last December.

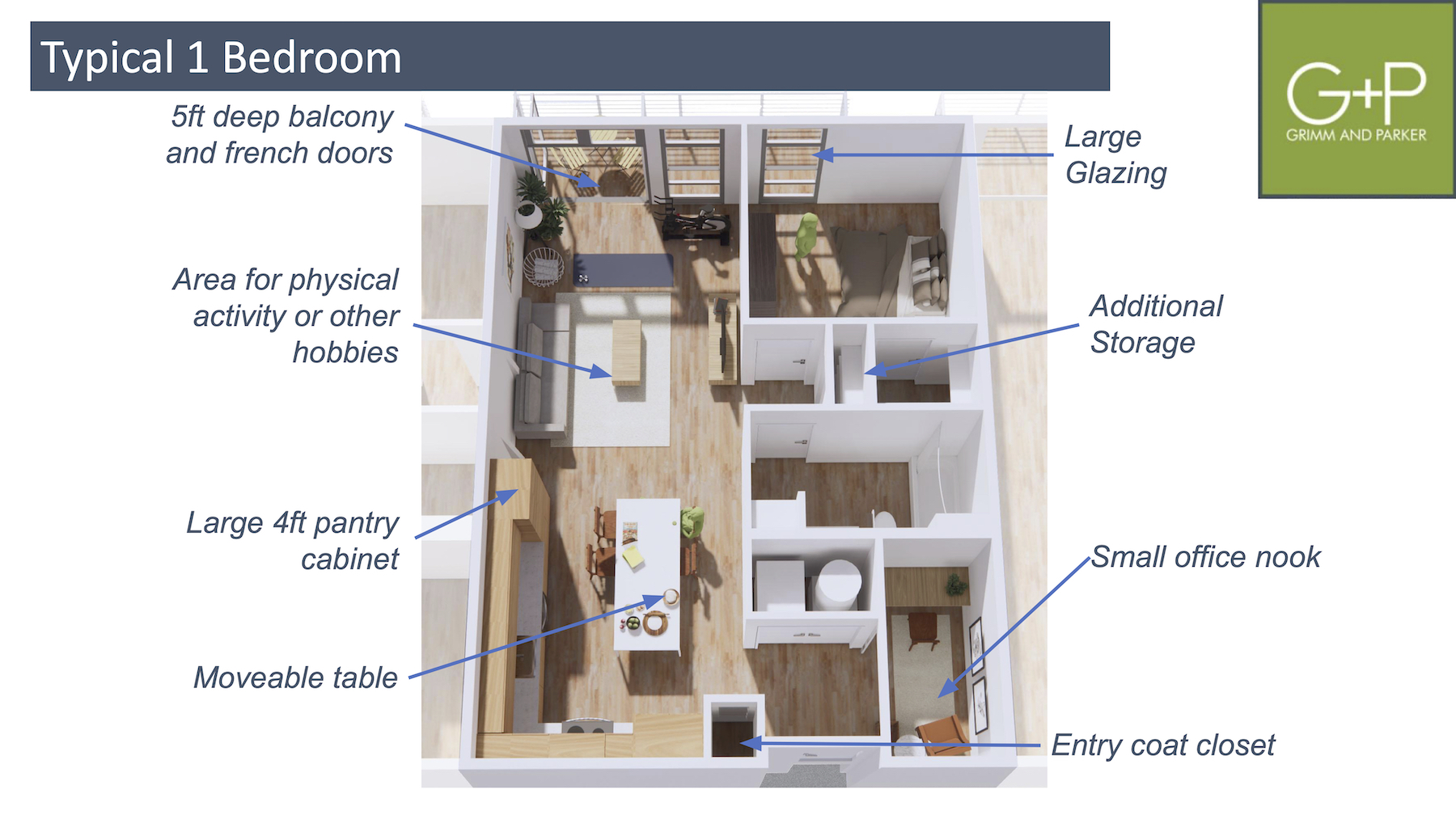

Storage, moveable furniture, and more space for physical activities, both in- and outdoors, could define the apartment of the future. Rendering Grimm + Parker

The vast majority of the survey’s respondents—92%—saw the social and physical implications of COVID-19 as being at least moderate, and in some cases significant. “Quarantine is difficult enough, but the added noise from other residents makes it so much more difficult. I can hear doors slamming, cabinets slamming, constant thuds from neighbors above, dogs barking. It wears on mental sanity,” said one exasperated resident whom the report quoted. Download a PDF recap of the Grimm + Parker multifamily research report, The New Normal & The Future of Multifamily Housing.

Schooley pointed out that there was a lot of concern expressed about health and safety, and the increasing density of apartment projects, which complicated social distancing and the ability of residents to “separate” rooms within apartments for different uses. And 80% of residents indicated a shift in desired residential unit types, which was a disconnect in developer thinking.

Common challenges cited by respondents included the lack of adequate space while sheltering-in-place, to live, work, and exercise. Only 11% of the resident-respondents lived in an apartment with a balcony, so quarantine made access to the outdoors problematic. Conversely, those respondents with balconies were able to adapt that space for, say, fitness or meditation.

The quarantine sometimes required residents to make purchases, like paper goods and cleaning products, in quantities that otherwise might seem extraneous. Many of the survey’s respondents had to come up with makeshift storage solutions by purchasing shelving or creating “contaminated” storage areas for wallets, keys, and bags.

SEEKING SPATIAL FLEXIBILITY IN MULTIFAMILY UNITS

In its report, Grimm + Parker suggested myriad design changes for a typical 733-sf one-bedroom apartment. “With the projected success of the work-from-home business models, residents will need their units to become more versatile and adaptable, to provide users with enhanced technology, spatial flexibility, and separation, as well as provide adequate mental relief through connection to the outdoor environment and fresh air,” the report stated.

The firm highlighted changes that included five-foot-deep balconies and French doors; larger glazing for natural light; physical areas for activities and hobbies; four-foot-deep pantry cabinets; moveable tables; and additional storage.

Schooley noted that tenants also need places where they can “isolate,” even if for a short spell.

BIGGER AMENITIES SPACES FOR APARTMENT BUILDINGS

The report touched on how COVID-19 has altered tenants’ and developers’ perceptions about an apartment building’s amenities. For example, 80% of users said it was a challenge maintaining social distancing while exiting their buildings. More than 30% cited issues with the building’s cramped laundry rooms or package collection areas. And 91% said they’d be changing the way they use amenity spaces in the future.

Two-thirds of the developers who responded to the survey indicated they would like to see amenity spaces adjusted to fit social distancing standards and improved hygiene protocols. Elevators, lobbies, laundry rooms, and grocery pick-up zones were among the most mentioned spaces.

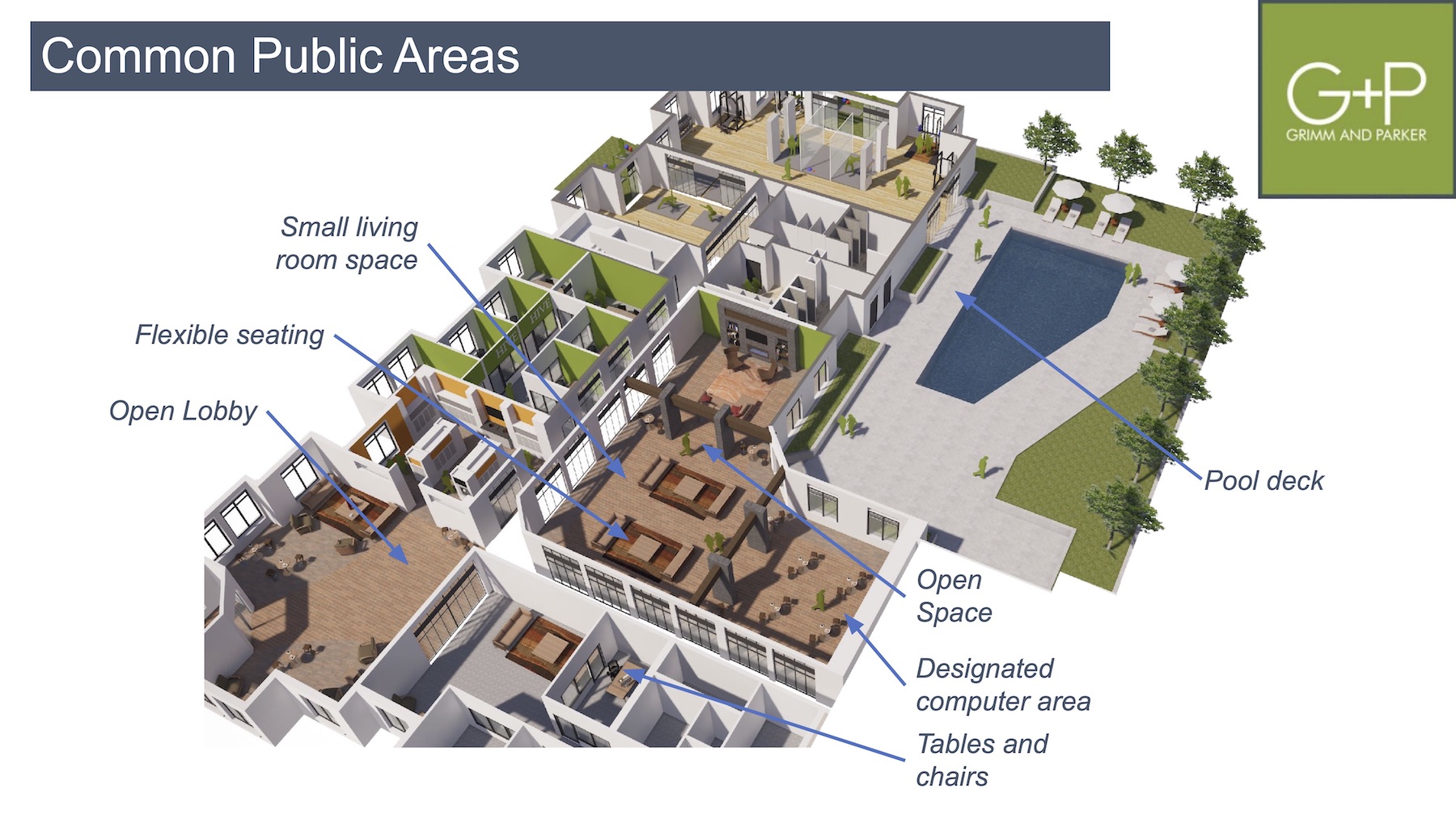

The common public area envisioned by this case study would include more compartmentalization, designated spaces, and flexibility. Rendering Grimm + Parker

Cruz said that Grimm + Parker looked at how residents had been coping with COVID-19 to maintain some semblance of work-life balance, another key tenant concern. With that in mind, changes to common public spaces, said the report, should incorporate more offices and designated computer lounges, flexible seating, an open lobby, a pool deck, and a small living-room space. Common areas should also have operable doors that provide flexibility to size different rooms.

The report singled out how to make fitness rooms safer by enlarging them with an open floor plan. These areas should offer hand-sanitizing stations and designated spaces for individual and group exercise that include outdoor options. Operable doors would introduce more fresh air into the indoor space and allow for flexibility to scale rooms according to usage and need.

ONLINE PURCHASES OVERWHELMED MULTIFAMILY BUILDINGS

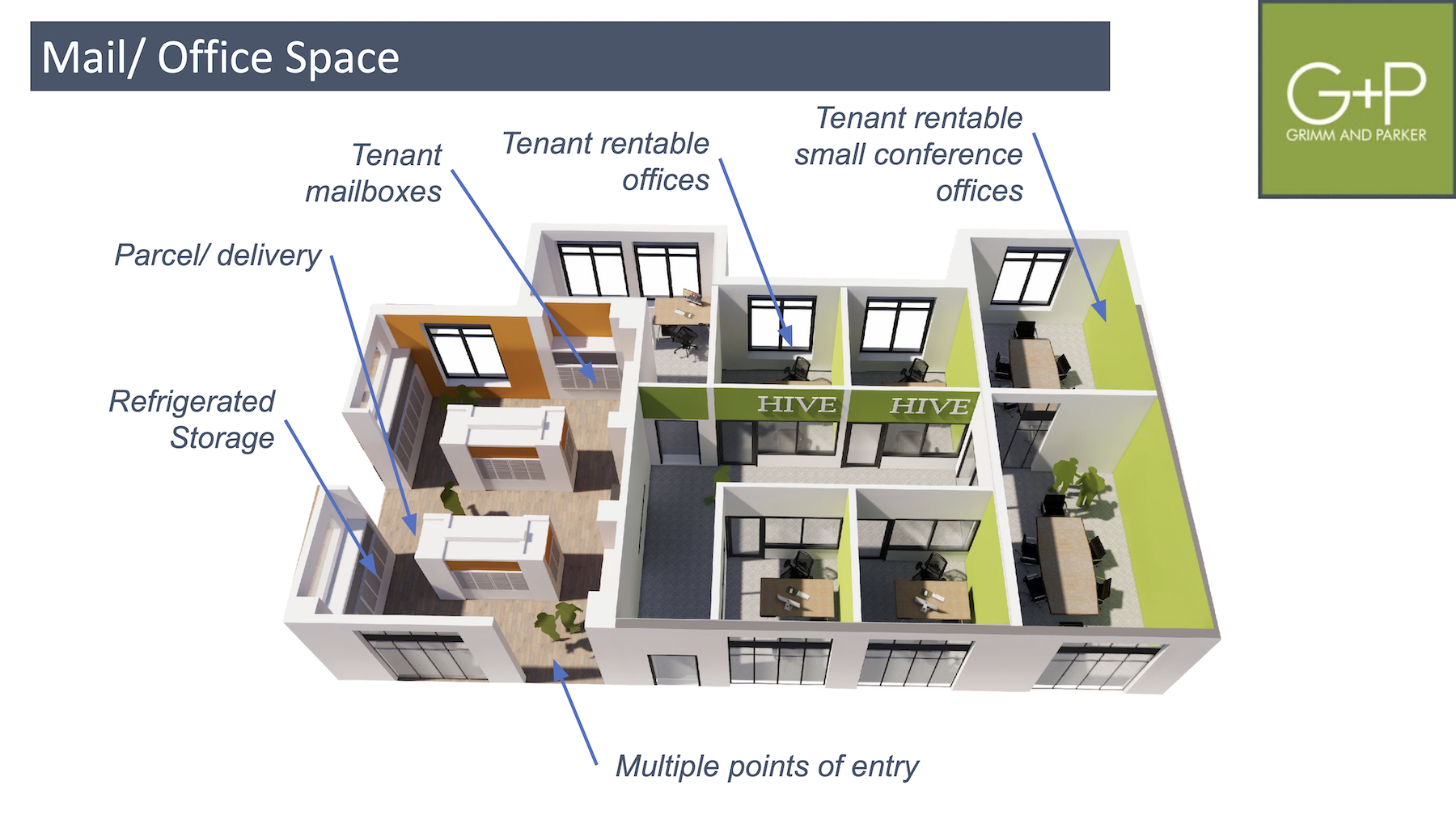

The pandemic exposed the inability of apartment buildings to handle the sheer number of packages they were receiving as a result of their tenants’ online purchases. (Digital Commerce 360 estimates that online spending in the U.S. rose 44% to $861 billion in 2020, and accounted for 21.3% of total retail sales last year.) Gilmartin noted that most buildings’ mail rooms, pre-pandemic, weren’t large enough or equipped to handle big packages or grocery deliveries.

Rendering: Grimm + Parker

Grimm + Parker foresees the multifamily building of the future with electronic refrigerated storage and ample package pickup spaces. The firm also envisions mailrooms with tenant boxes that combine with rentable office and conference room space. The area, in this vision, would have multiple points of entry.

Such an environment might also benefit from individualized mechanicals and airflow zoning for each space.

Schooley says he could imagine tenants renting space just to get out of their apartments for a while to complete a project, or to give their kids cooped up in the apartment because of quarantine a temporary change of scenery.

Related Stories

Sustainability | Nov 20, 2023

8 strategies for multifamily passive house design projects

Stantec's Brett Lambert, Principal of Architecture and Passive House Certified Consultant, uses the Northland Newton Development project to guide designers with eight tips for designing multifamily passive house projects.

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

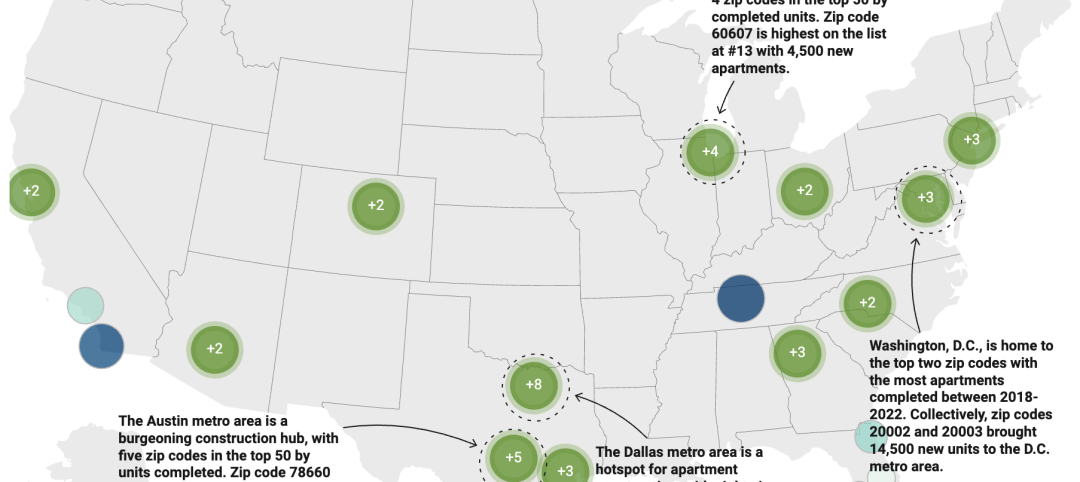

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.